Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

See a sample of TechCom’s Sugar Technical Review by clicking ‘Download PDF’ above.

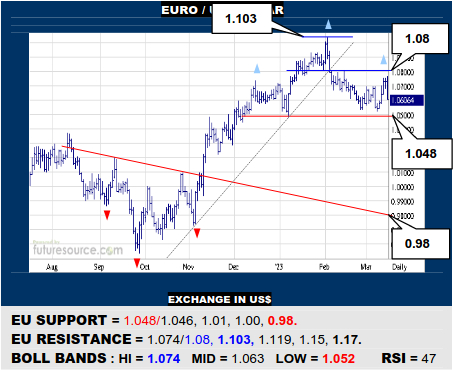

EURO / US DOLLAR

An EU bounce away from 1.048 has flinched via an outside day shy of the 1.08 resistance as the Bank panic grows. Duly back to eying that 1.048 threshold as a trigger for a ragged H&S that could suddenly expose the open air on down to the 1.00 area. Only making it through 1.08 would suggest calming nerves and mitigating risk of the top.

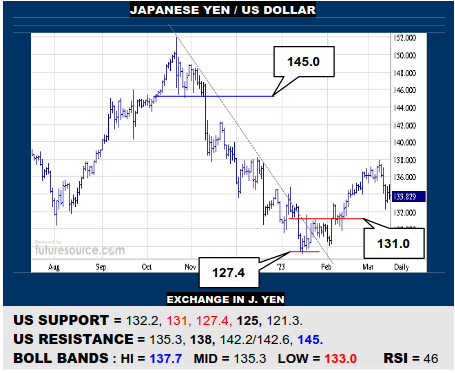

JAPANESE YEN / US DOLLAR

The tentative US recovery faltered at rather arbitrary 138 resistance and it has veered back under its mid band where an initial spell of congestion piques suspicion of a bear flag evolving. Must quickly jolt back over the mid band (135.3) to ease the flag concern whereas breaking the 131 mini-base rim would confirm it and target 127.4.

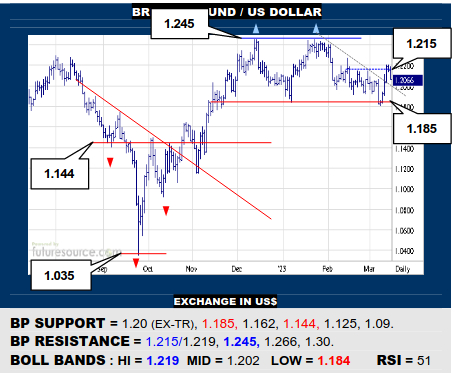

BRITISH POUND / US DOLLAR

The BP dodged a top breakdown at 1.185 but has since been parried by the upper Bollinger band (1.219) to prevent completion of a nearby base. Just minding a small ex-trend at 1.20 to see if it can arrest this flinch but, if not, so 1.185 would be back in the spotlight as the trigger for a broader top still to reveal 1.144 and even a projected 1.125 goal.

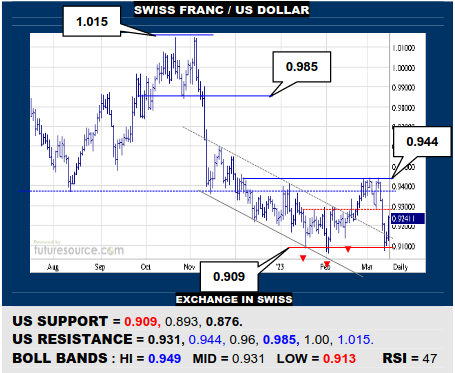

SWISS FRANC / US DOLLAR

Increasingly frantic action but the US has caught another gouge at 0.909 and must now watch the mid band (0.931) to try to gauge the punch of the reply. Popping the mid band would quickly target 0.944 for the chance of building a broader base. Failing at the mid band would instead warn that 0.909 could come under fire once more.

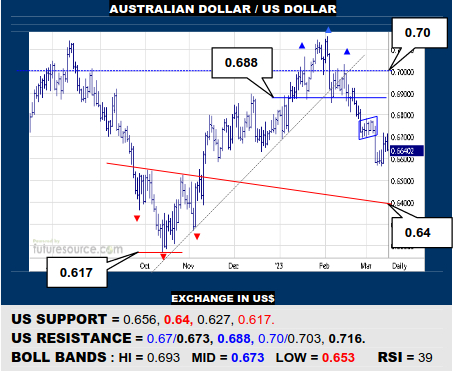

AUSTRALIAN DOLLAR / US DOLLAR

The AD has fought back to tag the underside of the prior bear flag (0.67) but must score a decisive break through here to shake off the recent decline and open passage back to try the 0.688 H&S border. While held at bay by 0.67, beware resuming south again, a break of 0.656 liable to lead on through to a former inverse H&S at 0.64.

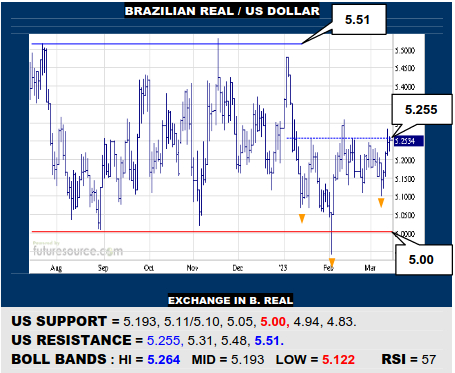

BRAZILIAN REAL / US DOLLAR

Ragged action but the US is still knocking at the 5.255 door in search of completing a Q1 inverse H&S, which could inject more verve to rally to try the 5.51 resistance again, the long term 6.00 high a possibility beyond. Tough to navigate such choppy waters but still minding the mid band (5.193) to warn of stumbling and testing 5.11/5.10 again.

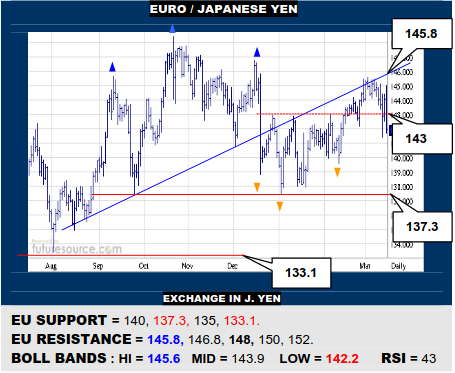

EURO / JAPANESE YEN

The EU couldn’t make any real headway against the neckline of the late ’22 H&S top (145.8) and the more recent base rim at 143 has now started to crumble. If this break entrenched in the next day or so, beware falling away to attack 137.3 to pose a much bigger top threat. Only a surge free of the overhead neckline would really fortify the EU.

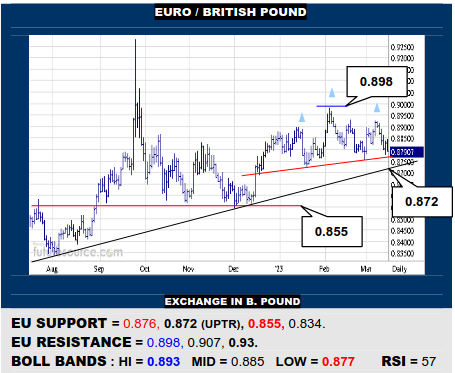

EURO / BRITISH POUND

The 0.89’s continue to foil the EU and it is looming close to a 0.876 neckline to a potential new ’23 H&S pattern, the completion of which could soon snowball into breaking the shallow uptrend (0.872) and returning to the previous 0.855 prop. Must grit the teeth north of 0.876 to hold the BP at bay and at least keep the 0.90’s in sight.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.