Insight Focus

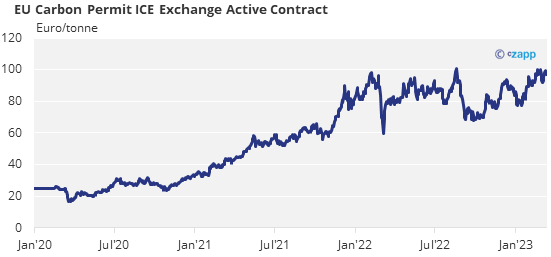

- European carbon allowances fell 2% by midday Monday.

- This follows a flight to safety following Silicon Valley Bank’s failure.

- However, EU carbon allowances remain 17% up year to date.

EU carbon prices stick close to €100 ahead of key trading deadline.

European carbon prices remain elevated even as the market anticipates a drop-off towards the end of March when a key options contract expires and when compliance buyers are likely to have completed the bulk of their purchases towards 2022 compliance.

The benchmark December 2023 EU Allowances (EUA) futures contract was at €97.85 at midday on Monday, a drop of around 2% from its closing level on Friday Mar 10. The contract has risen by around 17% since the start of the year, even while prices for natural gas and electricity have dropped by more than 25%.

Monday’s weakness was a response to the tumult in the US banking sector over the weekend, with investors jettisoning perceive risky assets in a “flight to safety”. Yet carbon prices were seen as holding fairly well, and sources highlight a number of factors that are helping.

Foremost among these is that industrials and utilities are completing their purchases of allowances ahead of the annual compliance deadline.

More than 11,000 installations across Europe must surrender EUAs matching their verified 2022 emissions before the end of April, and the March delivery futures contract represents the last major way-point before that deadline.

Exchange data show that more than 170 million EUAs are set to be delivered on expiry of the March contract, while speculators are also heavily invested in the options market, where there are a significant volume of bets that carbon prices will end March at between €100 and €105/tonne.

Investment funds and other speculative traders are said to have been defending options positions that will pay out with a March futures settlement at above €100, while the high cost of funding has also driven many other participants to move physical EUAs off their books by carrying out short-term “repo” trades – selling prompt and buying March futures.

The short term cash resulting from the physical can then be used to shore up positions in other commodities including gas and power, sources say.

Traders have also noted a significant decline in the volume of positions being held in longer-dated futures, notably the December contract, which has typically been the main focus of trade.

Instead, month contracts are seeing a significant increase in open interest as large traders start to “roll” positions on a monthly basis.

“Many players are willing to pay premia to roll positions month to month, because that’s cheaper in the short term than funding a December position for the whole year,” one trader explained.

Once the March contract expires, the focus of attention will switch to the publication of the verified emissions data for 2022, which will show the extent to which industrial emissions may have fallen last year amid soaring energy costs and the looming economic downturn.

Power sector emissions are widely expected to have risen last year, as skyrocketing natural gas prices forced utilities to switch to burning coal for power generation. Coal emits nearly twice as much CO2 as gas and so the switch is likely to have increased the sector’s emissions.

Data from the Fraunhofer Institute in Germany show for example that gas-fired generation by German power plants fell by 15% in 2021 and 11% in 2022, while coal-fired generation rose by 31% and 19% respectively.

The weaker emissions data for 2022 is likely to result in a correction lower for carbon, many participants believe, while the prospect of additional unbudgeted EUA supply coming to market later this year is also expected to dampen sentiment.

So far relatively few analysts believe prices will average much more than €85 or €90 in 2023, and prices of around €100 are likely to last only to the end of the spring.