Insight Focus

- India sugar supply to decrease.

- Thailand production to stay the same.

- Long Term Outlook: Higher Prices, Investment Needed.

We recently attended the International Sugar Colloquium in La Quinta, California. We shared our views on the world sugar market this year and beyond. Here are the key takeaways.

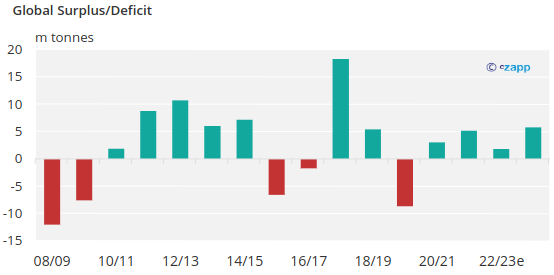

Global Balance Sheet

Firstly, let’s look at our global balance sheet. We are predicting a small surplus this crop (2022/23) and a larger surplus in 23/24 just over 5m tonnes. This might seem like a significant surplus, especially following 4 years in which the market has been somewhat balanced, but we do not believe this means prices need to fall.

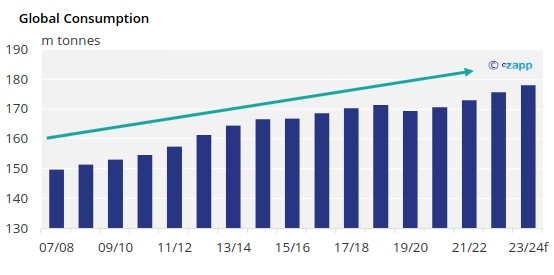

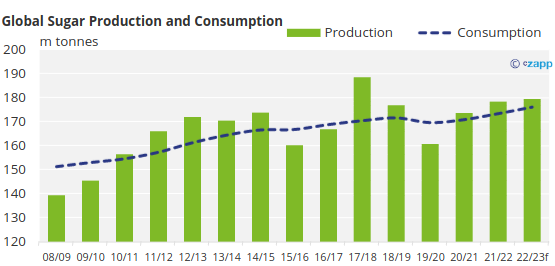

Global Consumption and Production

Between 2007/08 and 23/24, we have seen consumption grow every year except for 2020, when the covid pandemic shut down much of the world for a while. We now think consumption is growing at about 1.5% per year, slightly faster than population growth, driven by growth from developing countries in Africa and Asia.

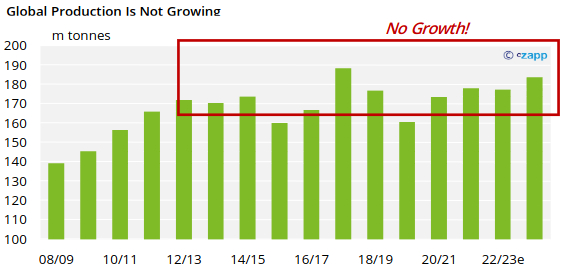

Production on the other hand has been more stagnant since 2012/13. We have seen some years with global production surging, and others that were much more disappointing. This is starting to look like a trend.

India Production: Good So Far, Trouble Ahead?

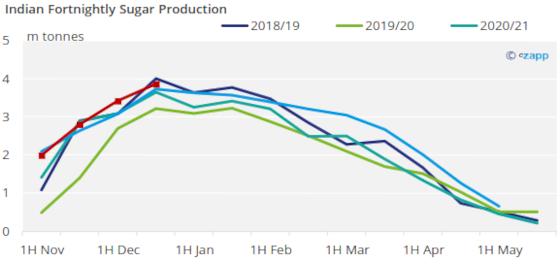

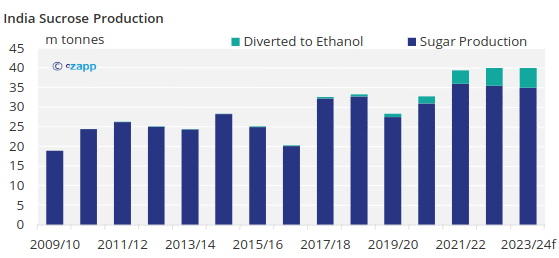

Maybe the most important driver in production in recent years has been India, who now compete with CS Brazil to be the largest producer of sugar each season. This season we now think they will produce 34m tonnes. We have seen a strong start to the crop but there are rumours of lower yields later on in the season. The current data does not show this but we do believe there is downside risk.

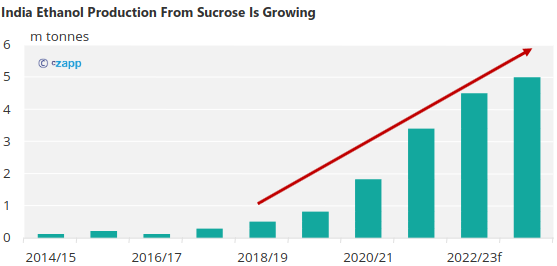

Market rumours vary between an India crop reaching 36m tonnes and some as low as 31m tonnes. This is a huge swing and could quickly wipe out much of the surplus we saw in our global balance sheet earlier. It is also important to note the steady diversion of sugar production to Ethanol. Since the 2017/18 crop a lot of infrastructure in India has been put in place to permit ethanol production to grow, and this is a trend we will come back to later.

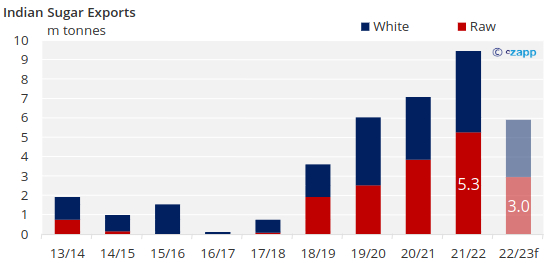

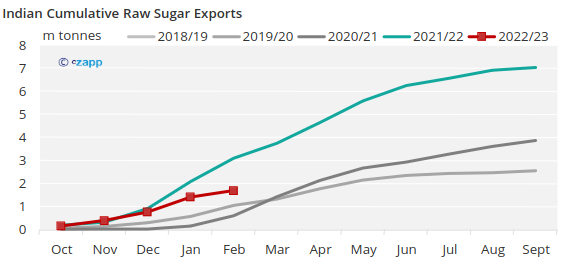

A fall in the Indian crop would also impact supply to the global market. So far the Indian government has permitted exports for 6m tonnes of sugar, and if the crop does not perform as expected, it is likely they could halt further exports past 6m tonnes.

Sugar export rates have already shown market uncertainty after a strong start. You can see the slow down in nominations and shipments of sugar clearly from this chart. Many were expecting availability to be a non-issue but that is no longer the case.

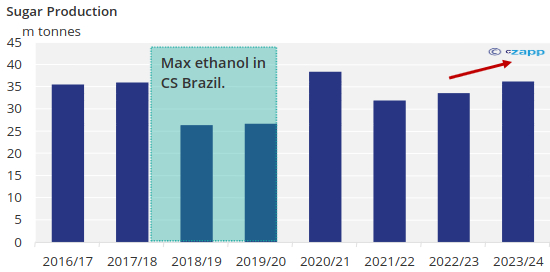

Brazil Sugar: Max Sugar 2023/24

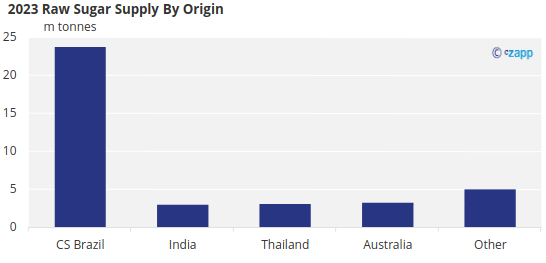

CS Brazil is likely to regain its crown as the world’s largest producer in 2023/24 and still supplies over 60 % of the world’s raw sugar.

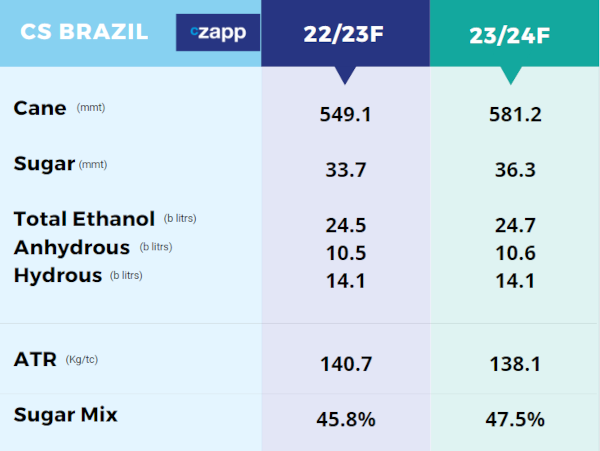

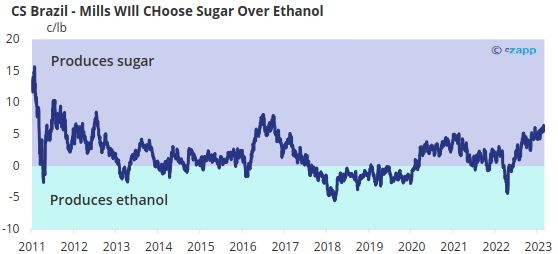

The crop in 22/23 reached 33.7m tonnes and in the coming season we expect the crop reach 36.3m tonnes. This is off the back of a max sugar production in the country as ethanol returns do not match the current price of sugar. Any downside in the crop however would also impact sugar supply directly.

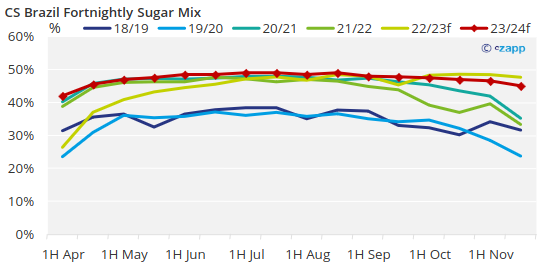

Here is our estimates for the 2023/24 season: the sugar mix will be higher than in 2022/23 as mills will focus on sugar production from the start of the season because returns from sugar are much more attractive than ethanol.

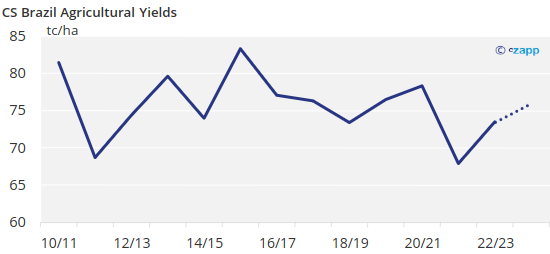

The 21/22 crop was affected by drought, but we are seeing recovery year on year back to average Ag yields.

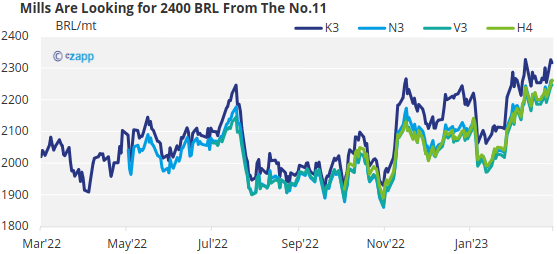

No.11 Order Flow: Brazil Mills Looking for Higher Returns?

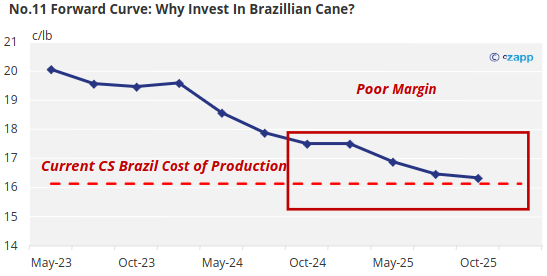

When it comes to prices, mills are targeting 2,400Brl per tonne – 21c/lb or thereabouts on the No.11. If the BRL weakens, we could see this come down a little in No.11 terms, but at present returns are not quite there for 2H’23.

Brazil Ethanol: Not Competitive with Sugar

As I mentioned, Ethanol is unlikely to play a disrupting roll in the 2023/24 crop. Prices are low for ethanol at the present and during the season they tend to weaken as supply from the crop reaches the market. Any large disruptions in the oil market could change this, but keep in mind the market does need Brazilian sugar and cannot afford to let prices slip to parity, especially if India does indeed produce less than expected.

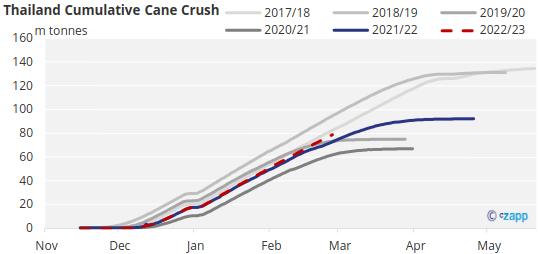

Thailand: Crush Similar to Last Season so Far

Thailand is another producing country of note, as it continues to rebound from a poor season in 2020/21. We expect yields and cane availability to match that of last season.

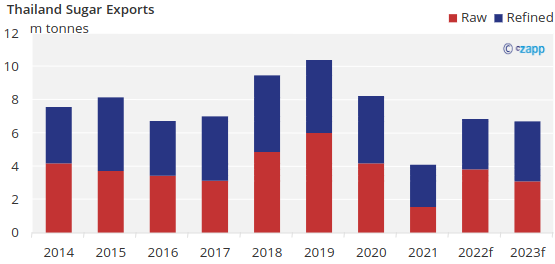

That would mean Thailand will produce 10.6m tonnes and continue to provide sugar to the world market as it did last year. Total exports should reach 6.5m tonnes, in line with the 2022 crop. Beyond the current crop, we don’t expect significant growth in cane area as competing crops continue to provide good returns (cassava/tapioca for example).

Market Dynamics: Changing Production Trends in the World

However, as we look at 2023 it is important to look at how dynamics are changing across the market. Whilst things may appear to be somewhat balanced and almost “as usual” we believe that there are some significant changes that will mould the market prices and dynamics.

Going back to Thailand, even though we saw the crop rebound after a very difficult year in 2021, the market remains incredibly tight for Thai sugar. This is including the regional supply coming from India. We have seen in the past certain Thai crops lead to a regional surplus and it would be easy to assume we are headed back there, but with the competing crop not allowing for acreage growth, this will not be the case.

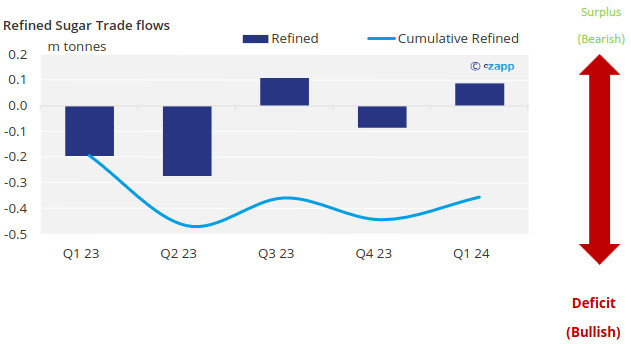

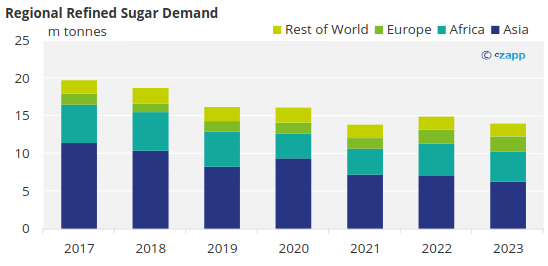

Refined Sugar Demand: Falling?

Another trend we are seeing is falling refined sugar demand. By refined we mean quality of 45 Icumsa sugar or lower colour. This is sugar often required by industrial users but due to certain years of scarcity, and high production costs, demand in various regions is falling such as in Asia in particular. There are certainly various factors at play, but one is high prices on the London No.5 market (above 525$) per metric tonne, and the other is a strong supply of lower quality white sugar.

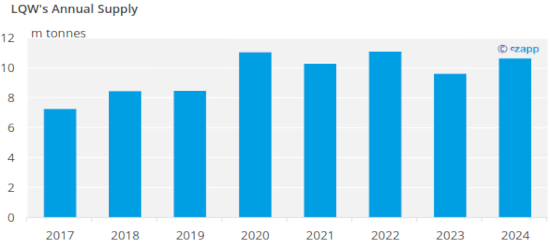

Lower Quality White Supply Growing

Whilst production growth of LQW sugar has not been linear, it is certainly noticeable. With Indian exports often being in the form of 150-300 Icumsa sugar, the market has seen an influx of this sugar type. Many mills in the Americas have switched to low quality white sugar instead of bulk raw sugar exports. These sugars are less expensive than refined sugar, and with prices high, many buyers find that they can switch to this quality instead of refined sugar. These are not necessarily industrial users but domestic use. How this plays out for refined sugar prices is unclear, as a market remains for traditional refined 45 Icumsa sugar, but we are certainly seeing some disruption.

Long Term Outlook: Higher Prices, Investment Needed

I also want to come back to my first two slides. We mentioned consumption is steadily growing, but this is being copied by production. The usual suspect to increase production are the two largest producers, India and Brazil.

India will not be meeting this growth in demand, and in fact will be reducing supply to the world market. The increase in Ethanol production is through government mandate to reduce imports and use of oil domestically and the growth in production has really ramped up since 2018/19. in 2023/24 we expect nearly 5m tonnes of sugar production to be replaced with Ethanol production. Going forward this should increase as population growth drives higher gasoline demands domestically and India finally solves its domestic Sugar surplus problem. How quickly this will happen is hard to tell, but it does seem clear it will happen. Brazil then may then have to play the role of saviour to long term market supply, but at current prices we don’t think it will.

Brazil: Why Would you Invest Long Term?

Long term market prices are down compared to the spot market. We mentioned the pricing target around 21c/lb, current prices for 2024 are around 17c/lb. With these prices as references for investment and crop regeneration, there is little incentive for mills in Brazil to invest large amounts into the current cane crops. Brazilian yields are already coming back to the norm, and maximising sugar production whenever possible… there does not appear to a clear avenue for increased crop growth in Brazil. With India expected to reduce production of sugar gradually every year, and Brazil not being pushed to plant more cane, solutions may need to come from elsewhere.

So Who Else Could Step Up?

Brazil and India currently make up around 65% of global exported sugar. Even if we were to see 10% growth from Thailand, Australia, and Central America, we would not be near filling the void left by India’s decrease in sugar production. To make matters worse, sugar production have decreased in Europe due to poor farmer returns and high processing costs.

Long term this means the market needs to push the market to prices in which we can see a steady growth in production, and Brazil would not be able to fill this void alone. Other producers would also need to find a way to increase production of sugar production, but it is hard to imagine where this could come from.