Insight Focus

- The energy crisis has severely impacted the PET value chain in Europe.

- Lack of price competitiveness with imports has led to lower sales and production cuts.

- Can European production now move past survival mode and back into profitability?

European PET Resin is in Disarray

After facing a series of challenging years, the ramifications of Russia’s war in Ukraine threatens to upend the European PET resin industry.

The war in Ukraine has unleashed an energy crisis and economic storm impacting the entire PET resin value chain.

Spikes in energy prices created volatility and a lack of reliability in European raw material contract price settlements, with large delays at times.

For PET resin producers reliant on domestic PTA supply and pricing, the failure of the contract settlement mechanism also created a lack of clarity around production costs.

Throughout 2022, higher energy costs and increased raw material price volatility meant that European PET resin producers were unable to price PET resin competitively versus imports. And respond quick enough to changes in import pricing to defend market share.

A cost-of-living crisis has also spread across Europe threating to crush downstream consumer demand. Disposable incomes are being swallowed up by rocketing food prices and energy costs, as well as higher borrowing costs as central banks rapidly raise rates.

The repercussions of the energy crisis have been felt from upstream raw materials, right through to the individual retail consumer, and have left the European PET resin industry teetering on the edge.

With gas prices falling sharply in recent months, can the European PET resin industry now stage a recovery in 2023?

Timeline of the European Energy Crisis

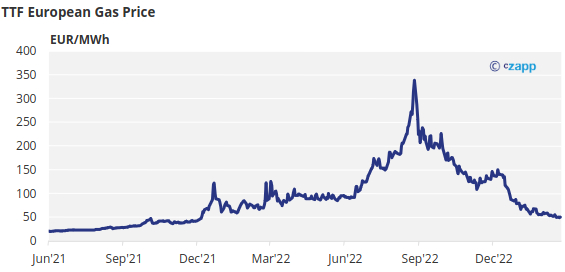

Looking at the origins of the energy crisis, whilst Russia’s invasion of Ukraine was a critical juncture, disruption was already being felt months before the invasion itself.

From mid-2021, European gas prices began to rise sharply as Russia cut supplies and political tensions increased.

By October’21, with energy costs rising sharply, some European PET and PTA producers decided to impose contract surcharges, a situation never previously seen in Europe.

Following the Russian invasion of Ukraine in February’22 gas prices surged once more. And through the early part of the summer Europe scrambled to replace Russian energy imports, amid supply cuts.

European gas prices finally peaked in September’22, following the sabotaging of the Nord stream pipeline.

Since then, gas prices have fallen sharply, helped by massive LNG imports and a relatively mild winter.

European Production Uncompetitive on Higher Costs

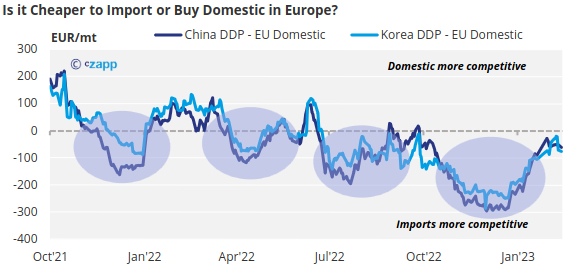

Each of these events along this timeline defined PET resin pricing and competitiveness over the last year, and ultimately set the scene for what was to become a record year for European PET resin imports.

As energy prices in Europe surged, European and Asian PET resin and raw materials pricing disconnected. European production was then challenged by cheaper imports at key buying points in the year (highlighted).

Firstly, in Q4’21, European producers lacked competitiveness against imports in a key period for the following year’s contract negotiations, this in addition to disruptive surcharges pushed buyers towards imports.

Again, in the pre-season buying period between Feb-Apr’22, as Russia invaded Ukraine, domestic producers failed to respond price wise to imports. Then through the peak summer months, as energy prices spiked, and raw material pricing deteriorated the arbitrage remained open favouring imports.

Despite energy prices now easing substantially, a sharp decline in Asian PET export prices through Q4’22 and the collapse in ocean freight rates created an even larger price disparity with imports.

By Mid-Nov, this delta had increased to over EUR275/mt, with the import arb fully open through the entirety of the final quarter of last year, again just in time critical annual contract negotiations.

Closing the Gap on Imports

Unfortunately for European PET resin producers the rollercoaster has continued into 2023.

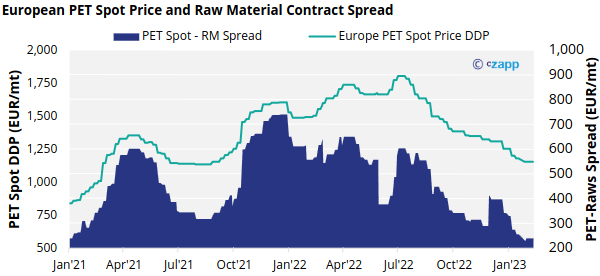

Domestic PET resin prices have continued to tumble, with PET resin spot prices declining EUR 120/tonne, around 10% since the beginning of the year.

Producers have also struggled to secure 2023 contracts, with volumes agreed for 2023 much lower than in previous years. Buyers instead have moved to a larger share of spot and imported resin.

Lack of price competitiveness, and concerns on supply security, through Q4’22 has also meant yet another wave of imports is currently arriving at Europe.

Deterioration in demand for domestic resin has led to producers lashing operating rates and shutting lines entirely. At present, we estimate that around 977k tonnes of European PET resin capacity is offline, equivalent to 29% of total European production; average operating rate across all assets is currently estimated to be just 51%.

European producers are now becoming more aggressive in attempting to close the price gap on imports and boost domestic sales going into Q2’23. Intra-regional spot competition has also increased.

On average, the gap to import parity has narrowed to around EUR 50/tonne, less than half of what it was in January.

European producers are now hoping that whilst demand for domestic resin is expected to remain weak through Q1’23, having moved closer to import price parity they can claw back market share going into Q2’23.

The risk from future anti-dumping proposals against Chinese resin entering the EU may also move some demand towards domestic production. Although no formal investigation has been announced, and Chinese producers have not received any notification to date.

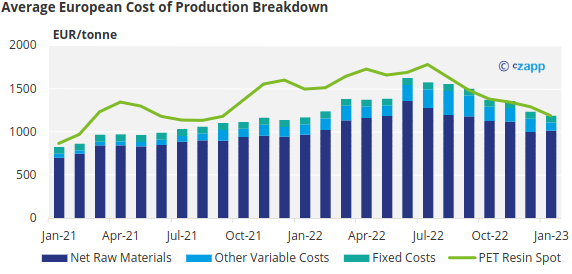

European PET Resin Production Cost Breakdown

Whilst increased price competitiveness with imports is likely to see demand for European resin improve, closing the gap on imports has come with a cost.

Whilst energy costs have fallen sharply, European PET producers have been at breakeven, or making losses since September last year; the recent drop in energy and raw material costs just hasn’t been enough to return to profitability.

Significant new Chinese PET resin capacity is expected to keep a cap on Asian PET export prices in 2023, with an additional 4.5MMt of capacity announced for start-up this year.

Therefore, only lower energy and raw material costs will enable European PET producers to retain parity with import price levels and return profitability to the industry.

However, with the war in Ukraine likely to continue through 2023 and beyond, European gas prices are almost certainly going to remain elevated. Many with the industry are now openly talking about the rationalisation of European assets.

Whilst rationalisation is always a potential last resort, many European PET resin producers exist in complex arrangements, either co-located with raw material suppliers or integrated within larger corporate groups. Therefore, closing production, even one that is loss making is likely a decision that will be pushed much further down the line.

This potentially sets up an extended period of low margins for European PET resin producers through 2023.

What’s the Outlook for European Gas Prices?

So far Europe looks to have avoided the worst this winter, thanks to massive LNG imports and the construction of additional LNG import terminals.

However, there has also been a degree of luck, with a milder winter combining with depressed demand in China due to last year’s lockdowns.

With future European PET resin profitability in lockstep with regional gas prices, the threat of potential gas shortages in Europe next winter is of concern.

According to the IEA, with China’s reopening expect to stimulate a recovery in demand, “there may not be enough gas to import and therefore it will not be easy this coming winter for Europe”.

Even though Europe has made it through this winter ending with record high levels of gas in storage, meaning less will be required next winter, a large proportion of Europe’s gas reserves still came from Russia, a source that will not be available this year.

With Russian volumes needing to be replaced and China likely to absorb a greater share of global supply, European gas prices could rise sharply again next winter.

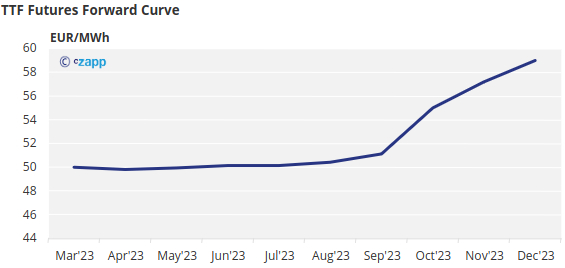

Although having retreated from last year’s highs, the current TTF forward curve shows European gas prices remaining elevated above historical levels through 2023 and increasing to levels comparable with Q4’21 through the coming winter (2023/2024).

Further pressure on European PET production costs, and continue disparity with Asia, would likely result in producers being unable to price competitively with imports through the later part of this year.

A scenario such as this could set up a continuation in some of the trends seen over the last 12-months.

Many will be keeping a sharp eye on the thermometer come October.