Insight Focus

- The world is producing excess sugar.

- Yet raw sugar futures recently traded to a 6-year high.

- The sugar that’s being made is not always the right quality at the right time.

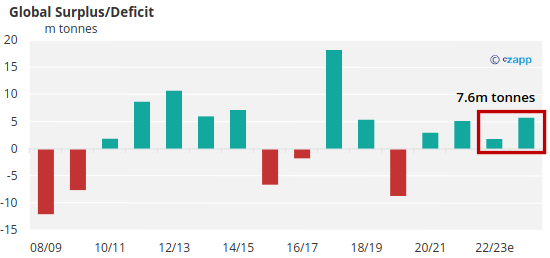

The world will produce more sugar than it consumes in 2022/23 and 2023/24. Over the 2 seasons, we think this surplus production could be as high 7.6m tonnes, with the majority of this surplus coming in 2023/24.

This follows the 2 seasons prior where production also exceeded consumption.

The world is therefore making enough sugar each year to meet consumption. Yet sugar futures have recently traded to 6-year highs near 22c/lb. What’s going on?

So Why Does The Sugar Market Feel So Tight?

One key reason is production and consumption statistics do not show how what type of sugar is available to the market, nor when it’s available. Nor does it take into account what buyers want.

This distinction matters because raw and white sugar futures prices are FOB (free on board) contracts. They represent the value of sugar which can be traded and moved from sellers who are oversupplied to buyers who are undersupplied.

A production surplus may not be immediately available to buyers. For example, whilst CS Brazil’s next crop (2023/24) will be the second largest on record, only a limited amount of this sugar is available to export each month due to logistics constraints. Grains exports will take priority at ports until later in 2023. In other cases, sugar may be held as government security stocks (China, Russia, India) or prohibitive tariffs can limit which countries can trade viably.

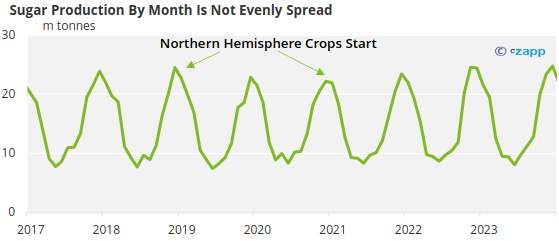

Time is another huge factor. Each region has its own season when sugar is produced, and beet and cane crops have differing growth and harvesting cycles. Sugar production tends to peak towards the end of the year when cane and beet harvests in the Northern Hemisphere (E.g. Europe, Russia India, Thailand, US and China) is in full swing.

Consumption of sugar is also not evenly spread with more sugar being consumed around key festivals or holidays. The weather and seasons also affect the products consumers tend to buy (more ice cream and soft drinks in the summer) which equally affects consumption. On top of this, major sugar buyers don’t always need to be consistent offtakers: they can choose to build or run down stocks.

To answer all these questions, we turn to our Trade Flow analysis. Each month we publish our detailed findings on Czapp for premium subscribers, with the likely implications for price and risk management. Look out for next update coming soon.

If you would like to find out more about this service and how it can help you manage your sugar price risk, please talk to Connor McGrath (cmcgrath@czarnikow.com).