Insight Focus

- PTA and MEG futures decline on weaker than expected demand following CNY.

- PET value chain continues to see new capacities suppress margins.

- PET resin export price outlook flat, producers offer forward prices on par with current spot values.

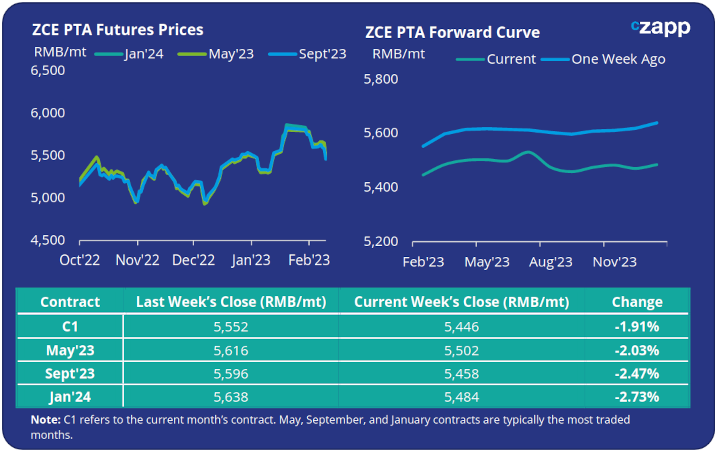

PTA Futures and Forward Curve

- Despite upward movement in crude oil prices, PTA futures continued to retrace downwards through last week on ample availability and slow downstream polyester demand.

- Whilst polymerisation rates have improved since the New Year, PTA supply continues to outstrip demand leading to a build-up in inventory and a narrowing of the PX-PTA spread.

- With margins compressed, PTA prices will continue to be driven largely by upstream costs.

- Although restocking from polyester may remain slow, domestic bottle-resin demand is expected to accelerate in preparation for peak season, which in turn may provide some support to margins.

- The current PTA forward curve is relatively flat with a small forward premium through to May; the May’23 contract closed the week trading at a RMB 56/tonne premium to the current month’s contract.

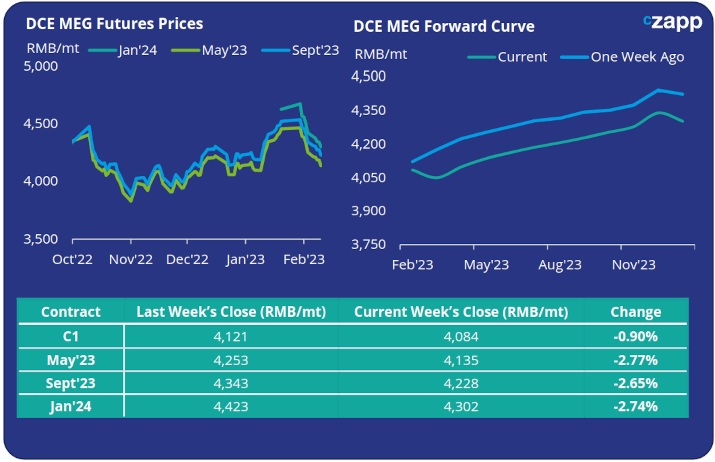

MEG Futures and Forward Curve

- MEG Futures also fell sharply, with most main forward contract months down around 2.7% on the week.

- The decline in MEG futures was largely driven by a weaker than anticipated pick-up in downstream demand following the Chinese New Year, and upcoming new capacity additions.

- Imminent start-up of Sinopec Hainan Refining & Chemical’s new 800k tonne/year MEG unit is also leading to a destocking by traders, subsequent additional plants will also continue to add pressure on the supply side.

- At the same time, East China main port inventories fell by around 2.8%, following the previous week’s surge, as polyester and downstream textile factories returned to business.

- The MEG futures forward curve remains in contango, although flatter versus previous weeks, with the May’23 contract now at a RMB 51/tonne premium to the current month’s contract.

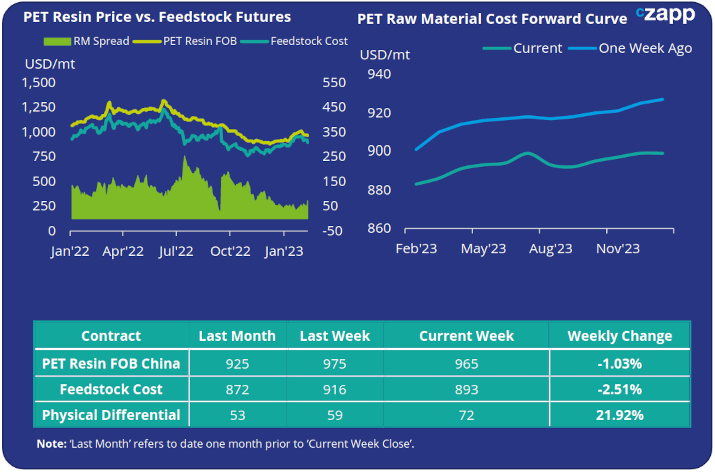

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices continued to weaken through last week, following raw materials lower and closing the week at an average price of USD 965/tonne, down USD 10/tonne on the previous week.

- The weekly average PET resin physical differential to feedstock costs improved very marginally versus last week, averaging around USD 55/tonne. By Friday, though the daily spread had increased to USD 72/tonne.

- The PET resin raw material forward curve continued to present a slight upward slope. At Friday’s close, the May’23 contract was showing a premium of USD 10/tonne to the current month’s contract.

Concluding Thoughts

- China’s reopening has yet to drive a step-change in restocking activities, following the industry’s return from Chinese New Year.

- Whilst undoubtedly setting a floor for Chinese consumer demand, domestic demand from polyester textiles and bottle-grade resin is slower than expected.

- At the same time, new capacity additions on both the raw material and PET bottle-grade resin are compressing margins through the value chain.

- Whilst modest improvement in the physical differential between raw materials and the PET resin export price is expected as we enter pre-season and domestic demand improves, further price gains may be constrained by new PET resin capacity additions.

- As a result, the upside to any forward premium for PET resin export prices is expected to be limited, with some forward offers for H2’23 already on par with current sport levels.

- Sanfame is expected to add its first 750kta PET resin line by early April, with the second 750kta lone due early July 2023.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.