Insight Focus

- Worries over 2023 carbon permit allocation surface as compliance season nears.

- Emissions allowances allocation might be delayed.

- Industry may not be able to use un-issued allocations towards last year’s emissions.

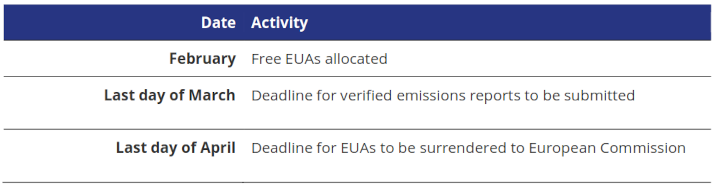

The first quarter of each year is the height of the compliance cycle in Europe’s carbon market, when installations are required to verify their emissions in the previous calendar year and surrender allowances matching those emissions.

Most industrials receive a free allocation of EU emissions allowances (EUAs) each year, to offset the additional costs of carbon compliance and maintain a level playing field with international competitors that aren’t subjected to a price on emissions.

Member state governments are required to issue these free EUAs to industry February each year.

To comply with the EU ETS rules, participants must submit verified emission reports detailing the volume of greenhouse gases emitted by their plants in the previous calendar year, no later than the end of March, and must surrender to the European Commission an equivalent number of EUAs by the end of April.

This timetable means that installations may surrender newly-issued EUAs in respect of their previous year’s emissions, a practice known as “borrowing”, and one that has been often employed by companies looking to conserve cash.

But in 2022 borrowing was substantially hampered by new rules that delayed the handout, and there is an expectation that the process will again drag out long past its nominal deadline.

These delays have potential impacts on industrial firms, and may force many of them into the market far earlier in the year.

Updated regulations for the current phase of the EU ETS (2021-2023) require installations to submit “activity level reports” each year – detailing levels of output at their installations.

If an installation’s output deviates from average over the two previous years by more than 15%, then its allocation of free EUAs is adjusted.

In 2022, the issuance was delayed by months as governments struggled to complete the process of analysing activity level reports and adjusting the allocation.

Commission data show that at the start of December 2022, France had handed out just over 50% of its free EUAs while Ireland had handed out only a handful of allowances. This meant that many installations were unable to “borrow” their 2022 allocation to pay for 2021 compliance.

And though the issuance deadline is more than a month away, analysts are already warning that the process of calculating adjustments to allocations may delay the handout again.

This year’s allocation will be impacted by industrial production levels over 2021 and 2022 – when output was affected by Covid and the start of the conflict in Ukraine, which led to soaring energy costs that in turn forced many companies to cut production.

There is therefore a high likelihood that governments will need to make substantial revisions to their allocations and that this process will take months rather than weeks.

The result is expected to be a surge of buying activity in the carbon market, as industrials are forced to buy EUAs in order to avoid the €108/tonne penalty for non-compliance.

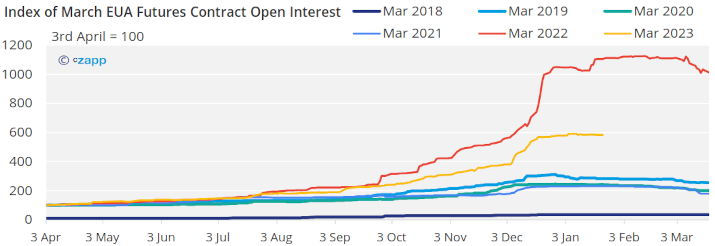

Traders are already positioning themselves for a rise in prices towards the end of the first quarter, with interest in the March futures contract at near record levels.

Traders also suggest that the recent and rapid growth in March EUA futures reflects the rising cost of trading amid higher interest rates.

Where companies may have been willing to hold futures positions in the December contract, and then take delivery of physical EUAs three or four months prior to the compliance deadline, the cost of funding these positions has risen, while exchanges now require substantially higher margins to sustain futures positions.

And as traders and industrials are also increasingly unwilling to hold physical EUAs for months at a time since that ties up capital, this has brought a new emphasis on shorter-term futures positions, sources say.