Insight Focus

- Mexican cane yields have been hit by poor weather.

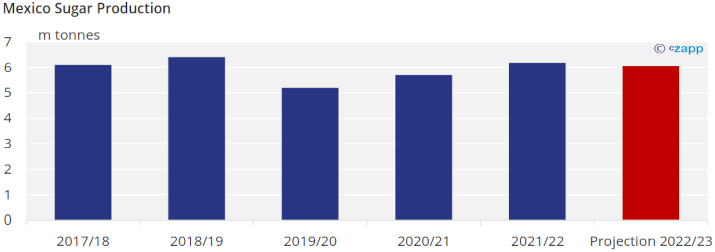

- We forecast 6.05m tonnes sugar production with downside risk.

- Production below 6m tonnes could mean no world market sugar exports.

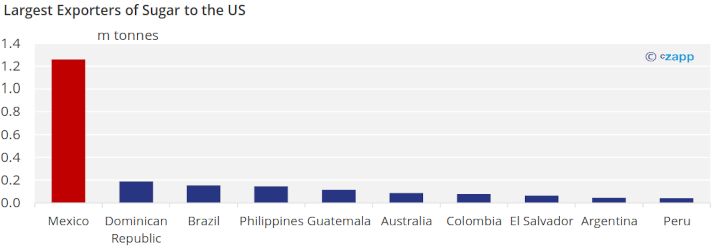

Mexico is a major cane growing country. It’s also co-joined to the American sugar market under the US, Mexico, Canada Agreement (USMCA), which facilitates trade between the nations. This means that most of Mexico’s surplus sugar flows into the US duty-free, with American corn syrups going the other way.

In 2022/23, America believes it will need 1.26m tonnes of Mexican sugar to arrive. However, this year’s Mexican cane harvest is proving tricky.

Problems With Mexico’s Cane Harvest

We think Mexico will make around 6.05m tonnes of sugar this year. However, there is downside risk to this forecast.

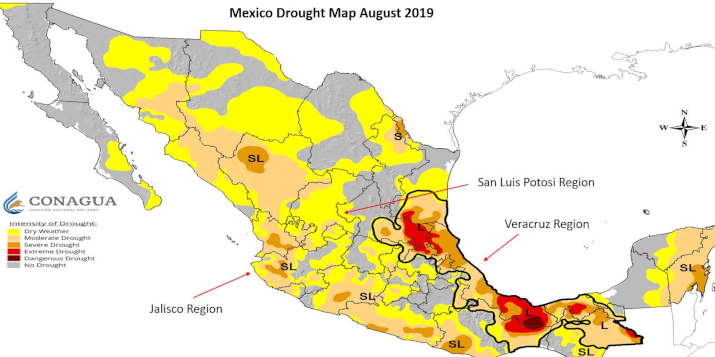

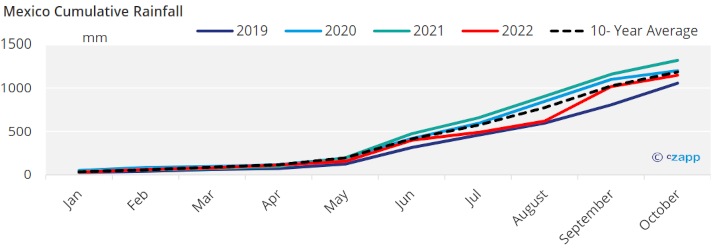

Weather was dry in the Mexican cane regions of Veracruz and San Luis Potosi through the middle of 2022, which limited cane development.

Source: CONAGUA

Around 60% of the cane isn’t irrigated and so was exposed to the full force of the dry weather.

The last time this happened was in 2019/20, when sugar production fell from 6.4m tonnes the year before to just 5.2m tonnes.

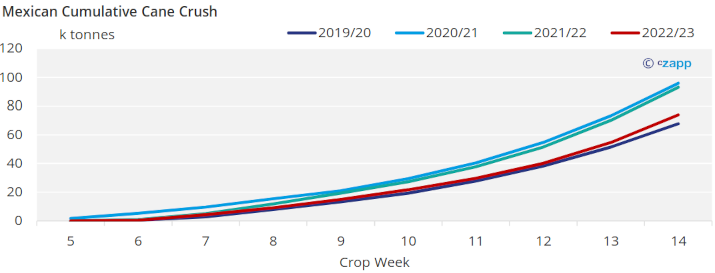

During the first 14 weeks of the cane harvest, less cane has been crushed at mills than usual. Ironically, this is partly because of wet weather in October which delayed the start of the harvest.

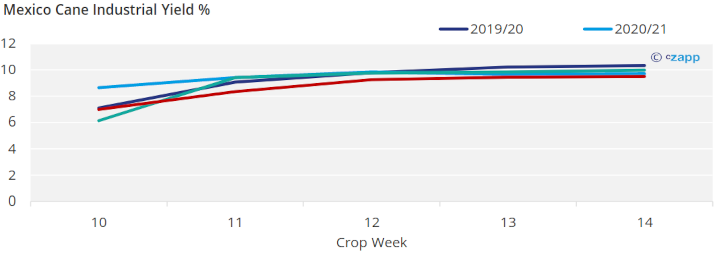

But we fear it’s also partly because cane yields are lower than hoped. We are also concerned about the sucrose yield, which is the lowest of the past four seasons. Again, this is thanks to the wet weather at the start of the harvest.

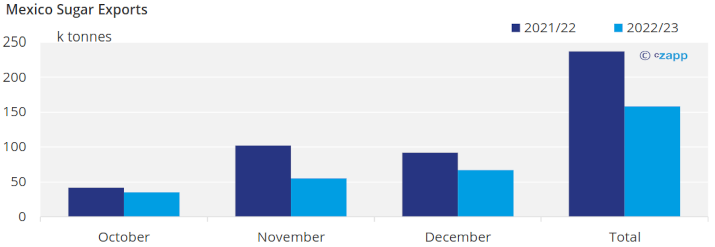

Now that the rain has stopped we’d expect this sucrose yields to rise. However, the low yields risk affecting overall sugar production. Already we have seen the effect on exports. Mexico exported less sugar year-on-year every month in Q4’22; the majority of this sugar goes to the USA.

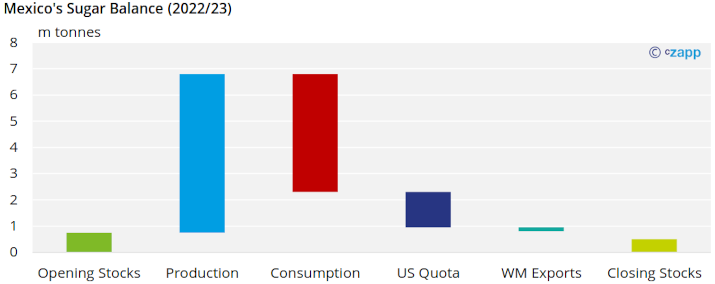

If Mexico makes 6.05m tonnes of sugar this year, we expect 4.5m tonnes to be used domestically and 1.35m tonnes to be exported to the USA. This would leave around 150k tonnes surplus sugar which could be exported to the world market.

Any shortfall in sugar production would reduce the amount of sugar available to the world market in the first instance. If Mexico produces less than 5.9m tonnes of sugar, it will struggle to supply 1.25m tonnes to America.

In this event, the US would probably need to increase raw sugar quotas for other trading partners, potentially benefitting Central American sugar producers.