Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

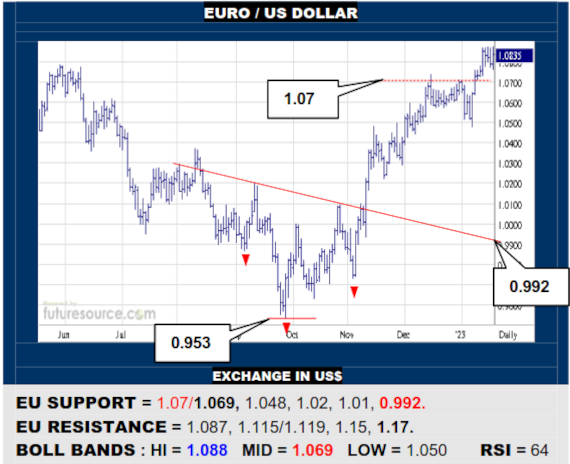

EURO / US DOLLAR

Defeat of 1.07 has been reassured by the $ Index falling from the 103’s and the EU has since managed some flaggish congestion so a clean break of 1.087 would project up to 1.115 as the path to 1.17 expanded. Still mindful of divergent RSI though so watch 1.07/1.069 mid band support as a swivel point to trip a deeper setback.

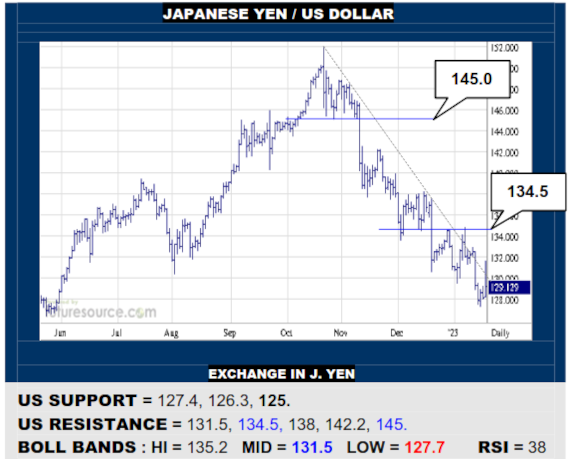

JAPANESE YEN / US DOLLAR

Some fraying of the Q4 downtrend in Jan has failed to translate into any enduring reaction and the US must at least pop its mid band (131.5) to suggest better grip, then lifting sights to 134.5. Meantime the downward stepping continues and must cater for this reaching 125 before much sturdier support should be encountered.

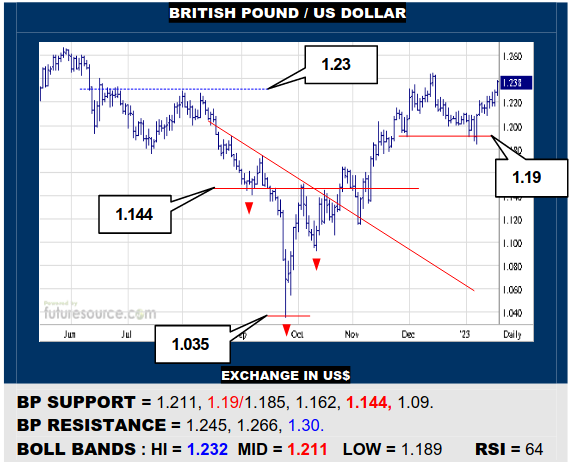

BRITISH POUND / US DOLLAR

An early Jan outside day bounce from 1.19 appeared to end a Dec correction and conquest of 1.245 would underscore the BP’s new rally to pave the way on up towards 1.30. Only another failure in the low 1.24’s and reversal through the mid band (1.211) would raise concern of a double top instead, returning focus to the 1.19/1.185 area.

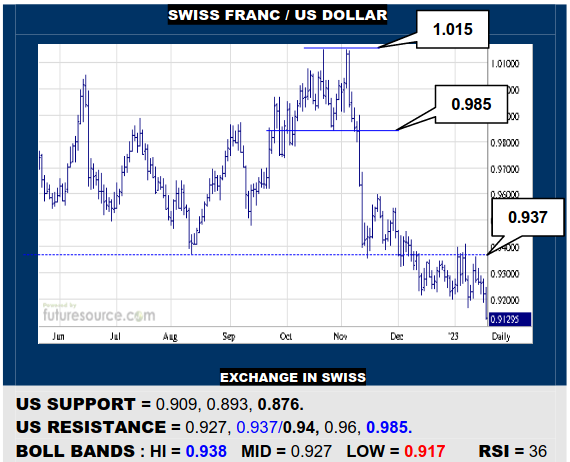

SWISS FRANC / US DOLLAR

Intraday prods back over 0.937 early in Jan failed to grip and thus left the large ’22 double top intact and the US is now beginning to extend the breakdown. Mindful of one other 0.909 ledge but otherwise there is little else to prevent a return to the early ’21 low at 0.876. Only re-surfacing in the 0.94’s would make for a marked turn of the tide.

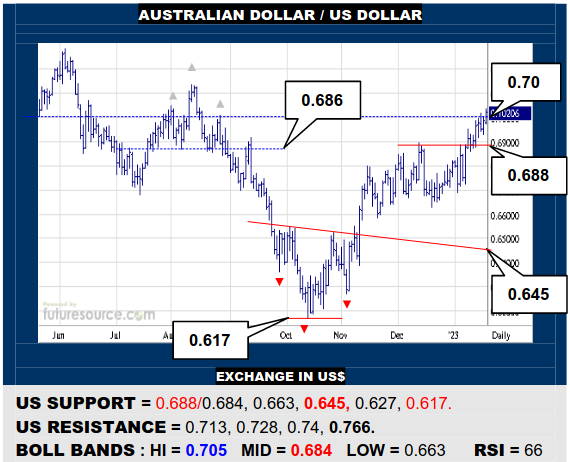

AUSTRALIAN DOLLAR / US DOLLAR

Defeat of the Q3 H&S rim at 0.686 has led on to the AD starting to make some headway through the broader 0.70 top frontier. Could just use a bit more push here to jog RSI to a 70’s reading to reassure the effort and so point on towards 0.74. Only a swerve back below 0.688 and the oncoming mid band (0.684) would undercut this advance.

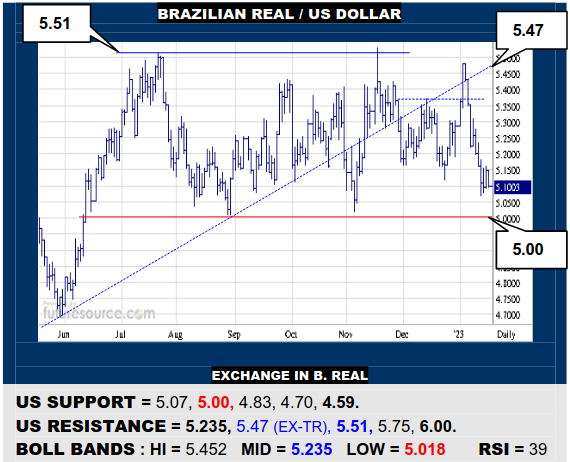

BRAZILIAN REAL / US DOLLAR

A sharp backlash from the mid 5’s has been reined in during recent days but resulting congestion is far from persuasive as a precursor to a turn, instead giving hints of a bear flag forming. The US would thus have to hop back over its mid band (5.235) to regain stability while loss of 5.07 would call the flag and threaten a major break of 5.00.

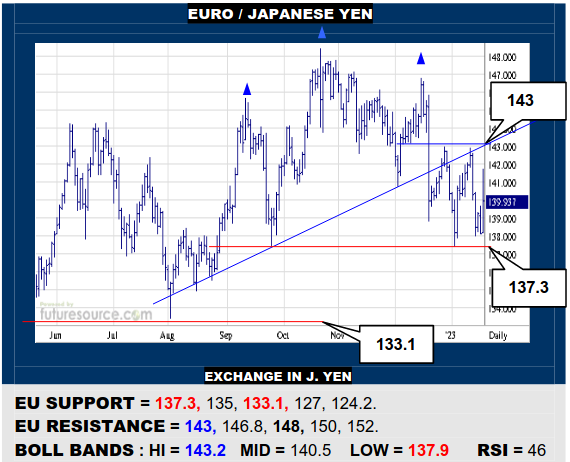

EURO / JAPANESE YEN

Successive denials at 143 have kept the second half ’22 H&S intact thus far and so the EU must rely on its 137.3 support to try to prevent a more serious breakdown that could then crack 133 and press into the 123 ballpark. Plainly needing that 143 crossing to make genuine repairs that would also situate a new base to reach for 148 again.

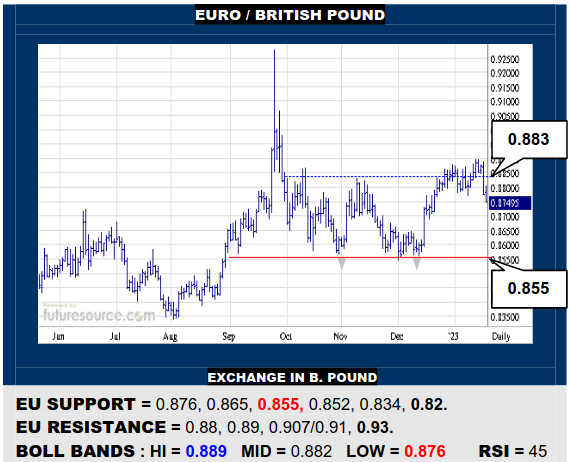

EURO / BRITISH POUND

Jittery action in the 0.88’s failed to secure a Q4 double bottom effort and the EU has provisionally dropped away through its 0.877 pivot to imply a small new top resolving instead. If the lower Bollinger duly started to veer south, beware falling back to 0.855. Only rapid return to the 0.88’s would suggest the lower band helping to gather up.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2017 Technical Commentary.