Opinion Focus

- The world’s busiest ports, which have seen long running disruption and capacity issues, are now quietening down.

- Shipping rates have plunged as an increase in Chinese demand so far has failed to materialise.

- After a bumper 2021, the pendulum is now swinging in the opposite direction for ports and shippers.

While some macroeconomic indicators are looking positive for the supply chain, the picture isn’t quite as black and white for maritime freight. Prices are dropping and demand is waning. Now, there are new problems to face in 2023.

Prices Drop, Profits in Danger

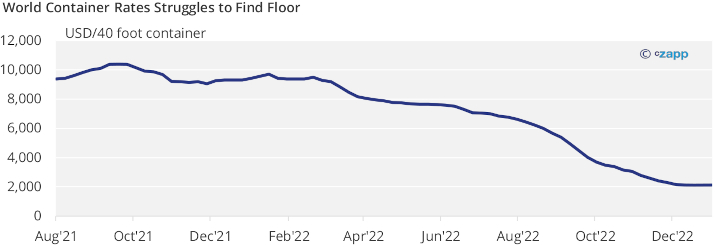

It is no secret that profits are dropping fast for freight forwarders. A lack of consumer demand and a disappointing performance in China have caused rates to go into freefall, desperately seeking a floor.

Source: Drewry World Container Index

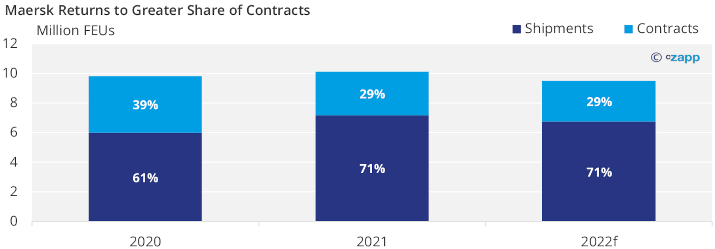

A return to long terms contracts over spot freight rates will provide stability for shipping companies. For Maersk, 2021 and 2022 saw a return to higher numbers of contracts than 2020.

Source: AP Moller-Maersk

But as higher-rate contracts expire in 2023, companies will likely be forced to negotiate new contracts at far lower prices, eating into profitability.

Busiest Ports See More Normalised Traffic

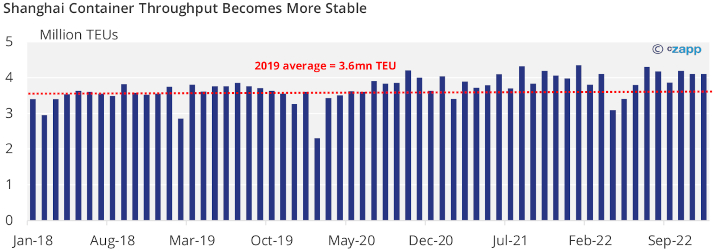

As demand has dropped, predictably ports have been able to get on top of huge backlogs and reduce wait times. Save for some Covid-related issues at the beginning of the year, container throughput at the world’s largest container port in Shanghai remained much more stable throughout 2022.

Source: Shanghai International Port Group

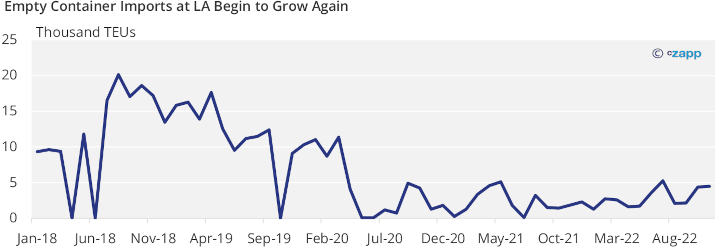

In fact, after 2020 and 2021, when space in a container was at a premium, the number of empty container imports at Los Angeles is slowly increasing. That being said, the port seems to have retained some efficiency in this regard compared with 2018 and 2019.

Source: Port of Los Angeles

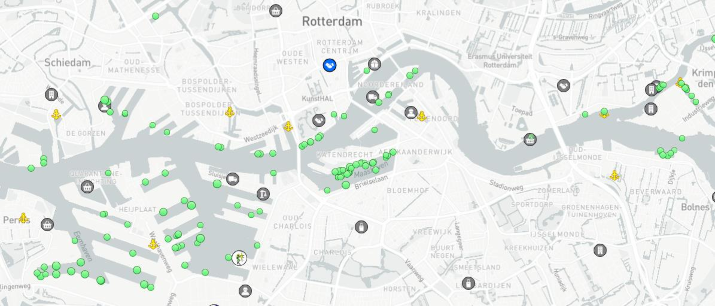

In stark contrast to much of 2021, data from Marine Traffic shows very few queues at the Port of Rotterdam – or any port.

Source: Marine Traffic

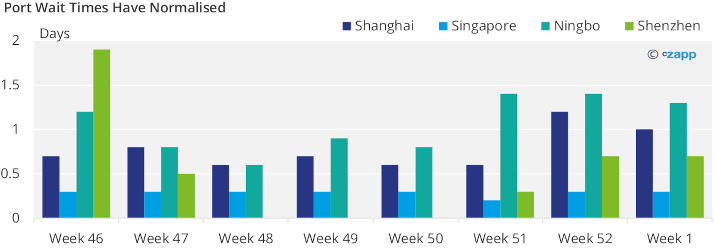

The wait times at the world’s busiest container terminals are also minimal. At the height of the supply chain issues, wait times at ports were into double digits, which had a knock on effect on future voyages.

Source: Marine Traffic

Availability Rises but Logistics Challenges Loom

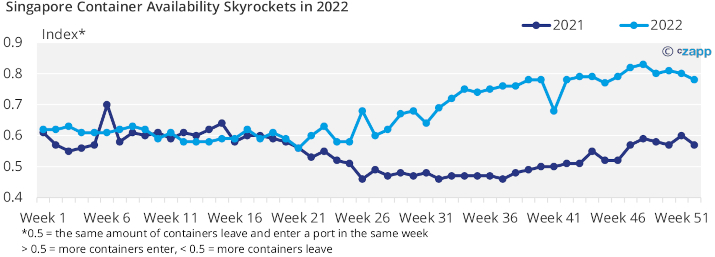

As a result of fewer bottlenecks, availability has risen in the container world. In Singapore, one of the world’s largest container ports, far more containers have been entering than have been leaving.

Source: Container Xchange

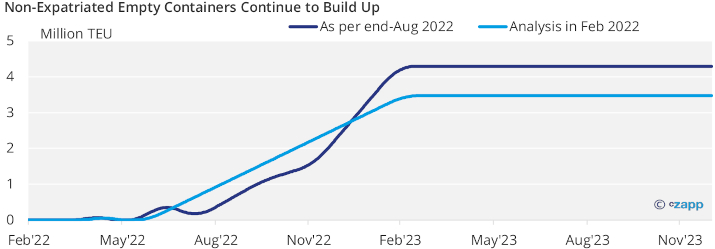

But this presents a logistics issue for the industry and means many more containers are in the wrong locations and need to be moved at the expense of shipping companies. This is likely to put additional pressure on margins.

Source: Sea-Intelligence

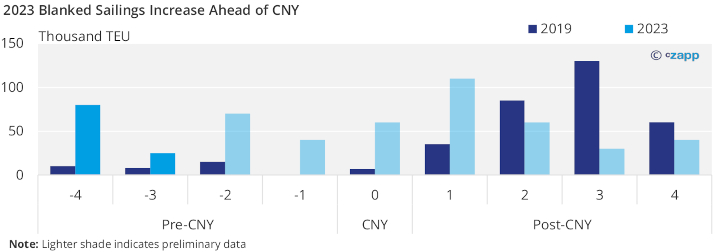

Demand from China also remains spotty, with the normally busy period ahead of Chinese New Year seeing an unusually high number of blanked sailings.

Source: Xeneta

Threat of Strikes Continue to Loom

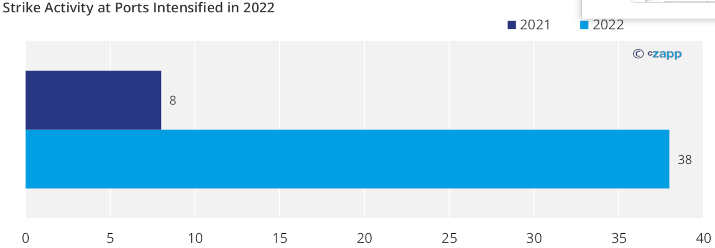

In 2022, ports globally were affected by four times as many labour-related protests than in the prior year, according to data from Crisis24.

Source: Crisis24

Without many agreements in 2022 and as the cost of living continues to rise, strike activity may worsen in 2023. Strikes have also widened to auxiliary sectors such as rail and public service, disrupting deliveries.

Some companies have even taken to rerouting cargoes, particularly away from US West Coast ports. Now they will face the difficult decision of whether to resume normal operations.

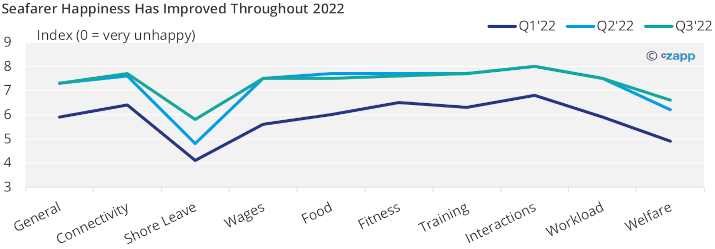

But there is some good news for the industry related to staffing as the 2022 Seafarer Happiness Index noted an improvement in seafarer happiness from the beginning of 2022 to the end.

Source: Seafarer Happiness Index

Weather Events

Weather is perhaps the most unpredictable issue that the shipping industry faces. Last year, devastating floods and landslides hit the region of KwaZulu-Natal in South Africa, severely disrupting operations at the port of Durban. Likewise, Pakistan experienced devastating flooding.

One major change expected to occur this year is the change in weather patterns. La Nina is expected to break down and El Nino should emerge, creating a warmer phase in the tropics that is conducive to higher rainfall.

Concluding Thoughts

- After a bumper few years for the freight industry, the next few years will be muted. · Already, businesses are streamlining with freight forwarder Flexport announcing cuts to 20% of staff.

- For the maritime industry, 2023 will see far more challenges than opportunities.

- Ports and shipping firms should take the opportunity to build efficiencies as a demand trough looms.