Insight Focus

- The European carbon market faces a tricky year.

- A recession in the EU and high energy prices might be negative for carbon prices.

- But coal generation is increasing in the bloc once more.

Europe’s carbon market faces uncertain 2023 amid macro headwinds and supply volatility

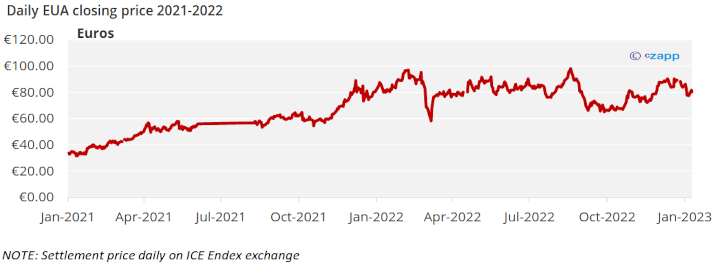

Benchmark EU carbon prices ended 2022 at €83.97/tonne, a gain of 4.1% from a year earlier. This followed months of extreme volatility, triggered by Russia’s invasion of Ukraine and European nations’ determination to deliver on the bloc’s climate agenda.

Prices for EU carbon allowances (EUAs) fluctuated in a wide range, falling to a low of €55.00/tonne in the days immediately following the Russian invasion, but climbing to a high of €99.22 just five months later as traders anticipated an ambitious outcome from discussions among policymakers on wide-ranging reforms to the carbon market.

The market now faces an uncertain 2023 with the threat of recession looming over the EU, as industrial output has declined due to high energy costs and inflation has soared to around 10%.

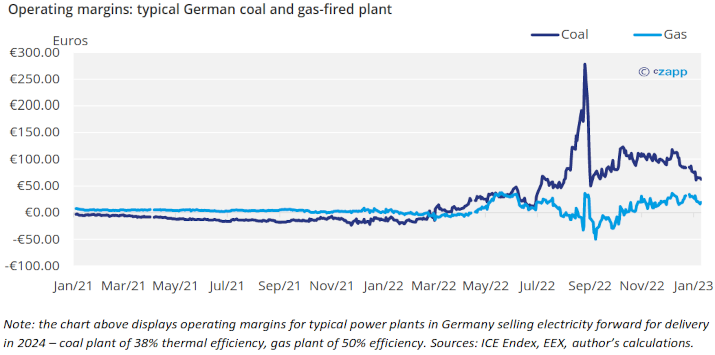

Falling demand for EUAs from industrial plants across the bloc due to lower output in 2022 was offset by an increase in the use of coal to generate electricity, as natural gas prices rose too high for profitable power generation, data show.

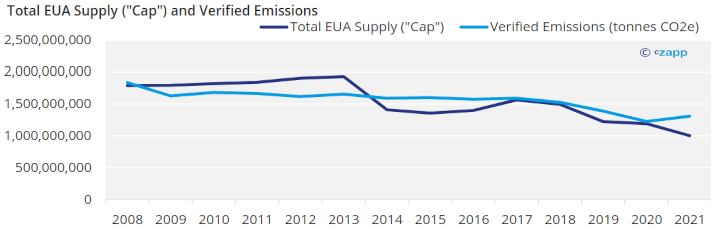

As a result many analysts believe verified emissions for 2022 will increase relative to 2021’s total of 1.307 billion tonnes (see chart), further depleting the historical surplus that built up between 2008 and 2013.

Source: European Environment Agency

Allowance supply in 2023 will increase after the EU passed legislation in December to raise funds to speed up the region’s transition away from fossil fuels.

This plan, known as REPowerEU, requires the monetisation of €20 billion worth of EUAs – estimated at upward of 250 million allowances – which will be taken out of the market stability reserve and from member state auctions in 2027-2030 and sold at daily auctions in 2023-2025.

This addition to short term supply will be offset by a reduction in member state auction sales later in the decade, tightening the market just as other reforms – in particular the gradual elimination of free allocations of allowances for industry – begin to bite.

Carbon permit price expectations are mixed for 2023, with the balance of opinion appearing to lean towards a largely stable market over the next 12 months. EU authorities are yet to publish details of the additional auction supply, and until that data is released traders are taking a cautious view.

Other changes will take effect later in the decade, but include the extension of the EU ETS to cover maritime emissions and a one-off lowering of the overall cap on emissions and a steeper annual cut thereafter.

The introduction of a Carbon Border Adjustment Mechanism (CBAM) has the potential to tighten the European market and increase competition for carbon allowances.

A levy on imported materials like steel and cement, based on their implied carbon emissions, will allow the EU to gradually eliminate free handouts of EUAs to trade-exposed industries in Europe, forcing these companies into the market, some of them potentially for the first time since the market launched in 2005.

The CBM might also encourage importers to hedge their financial exposure to the EU levy by acquiring EU carbon permits adding another source of demand to the market.

To be clear though, the CBAM levy cannot be paid in EUAs, and so any financial hedging using EUAs would be a risk management strategy rather than a compliance one.

The CBAM is making waves elsewhere in the world. Under the new regulations, imports from countries with an equivalent carbon price could be exempt from CBAM costs, and this may encourage more countries to implement carbon prices.

According to the World Bank emissions trading systems are being eyed in countries including Thailand, Pakistan, Brazil, Malaysia and Morocco.