Opinions Focus

- Considering the consequences of the extraordinary wheat market of 2022

- Weather extremes combined with an ongoing and unexpected war

- Interesting prospects for 2023

Introduction

We have, over the past 12 months, witnessed arguably the most extraordinary year in living memory for the world of wheat and its global markets.

Supply forecasts have proved difficult, as weather records have been broken time and again around the world.

Demand estimates have suffered great uncertainty. Entire populations of the poorest wheat importing nations across North Africa have struggled with record high prices and logistical disruptions to their top suppliers from the Black Sea.

Markets have seen volatility on an astonishing level giving cause for concern to all participants, both buyers and sellers.

With 2022 firmly confined to history, looking at lessons learned and prospects for the year ahead in 2023 are taking centre stage.

Wheat Markets of 2022

As new year 2022 arrived most wheat participants were considering the harvest outlooks for the coming 12 months.

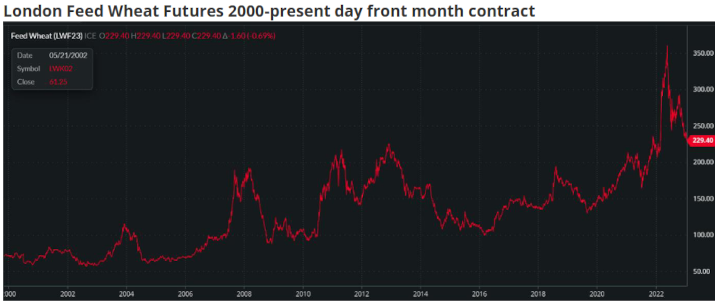

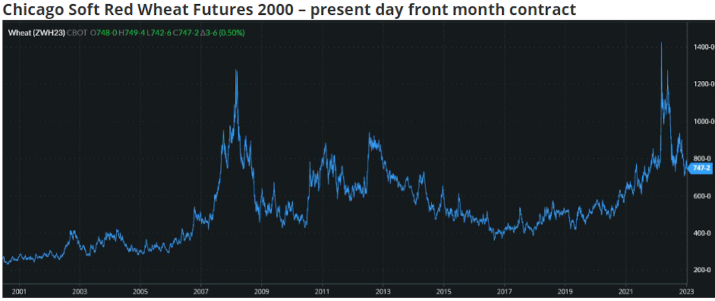

The charts below (source Barchart Commodityview) show the incredible year that followed, with context from the last 20 years or so demonstrating how extreme price movements were in 2022.

Source: Barchart Commodityview

Source: Barchart Commodityview

Source: Barchart Commodityview

Source: Barchart Commodityview

Source: Barchart Commodityview

Source: Barchart Commodityview

January ‘22

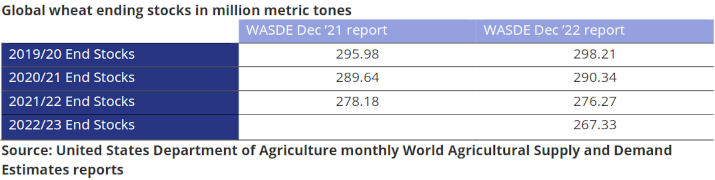

The latter stages of ‘21 saw firming wheat markets due to concern for year on year diminishing wheat stocks (see below table).

February to Mid-May ‘22

The reality of Russian President Putin’s invasion of Ukraine on 24th Feb ’22 sent not only wheat markets, but financial, energy and commodity indices worldwide, on a roller coaster ride of volatility.

Record wheat values were posted across major markets between the start of March and mid-May ’22.

A focal-point of discussion during this period was the part Russia and Ukraine played in the wheat export trade and the reliance of the world’s largest importers in North Africa on this food from the Black Sea region where fighting raged.

Russia has become the number 1 global wheat exporter in recent years with exports of 35-40mmt annually.

Ukraine meanwhile, sat in 4th place with 15-20mmt per annum.

This of a circa 200mmt worldwide export trade made both countries fundamentally important to the smooth supply chain that had become the norm; now plunged into disarray and uncertainty.

Mid-May to Mid-August ‘22

Ultimately prices can only go up so far before there is inevitably a degree of demand erosion as buyers simply cannot afford the values on offer.

Concern about the ability, or inability, to export wheat from Ukraine’s Black Sea ports began to be replaced by simple affordability. Putin’s war was not going to be over in the near future and the impact on the global economy suggested prices needed to ease.

The economic unpredictability, coupled with Turkey and UN brokered discussions between Russia and Ukraine to open up a Black Sea Grain Corridor to allow food shipments from Ukrainian ports, helped the cooling of wheat values.

Turkey and the UN initiated talks in April and an agreement was finally signed by both Ukraine and Russia in Istanbul on 22 July ’22, allowing grain exports for a period of 120 days from Ukrainian ports, previously blockaded by the Russian navy.

Mid-August to Mid-October ‘22

This third quarter of the calendar year brought unprecedented extreme weather on many continents with record heatwaves, drought, floods and more to add further disruption to wheat values.

As combines rolled throughout the Northern Hemisphere concern for the continually dwindling global stocks was fundamental news.

A period of firmer prices ensued with war in Ukraine having less impact.

Mid-October to the year-end ‘22

Vessels had continued to ship wheat from the Black Sea to supply the needs of North Africa and further afield countries.

Despite a few days of disruption at the end of October, the Black Sea Grain Corridor Agreement prevailed and a continuation for 120 days was signed on 17 November ’22.

Wheat prices were driven by the bears as values eased over the latter months of ’22.

Stock levels continued to be news worthy and prices remained elevated in relation to historical values. This particularly applied to the European markets, in part due to their proximity to Ukraine and Russia.

Prospects for 2023

Although weather woes played their part in ‘22, it does look like there is some optimism on the horizon for wheat supply in ‘23.

Large producing areas in North America, Europe and India have seen an abundance of wheat acres planted for the ‘23 harvests.

It will be many months before grains are safely in store from the ’23 harvests, but replenishing some of the depleting global wheat stocks is a realistic possibility.

Wheat prices remain high, but mirrored by many of the input costs for tractors, machinery, buildings, fertiliser, fuel, energy and virtually all other costs related to producing a crop.

The ongoing war in Ukraine will doubtless have its bearing on the wheat market ups and downs. Any ability to bring about peace is likely to calm the general economic climate in ’23.

Conclusions

The extraordinary year of ’22 is now history.

We may yet see more weather records broken in ’23, but it is difficult to see the high wheat price records of ‘22 being challenged.

Climate change and sustainability discussions will likely be regular news, with reflection and planning for agriculture in the years ahead never far from our thoughts.

Optimism for some replenishing of global wheat stocks will be welcomed by many of the poorer importing nations.

A wish for peace to the people of Ukraine is paramount on a human level. The by-product of which, if achieved, would no doubt be more market stability for all.

Another interesting year ahead in ’23 with weather, economics, politics and conflict all with cards to play.

Happy New Year and wishing a prosperous and peaceful ’23 to all.