Insight Focus

- PTA Futures move lower, breaking December rally, as crude sinks on New Year opening.

- PET export prices remain subdued on low margins despite tighter short-term availability.

- Despite strong Nov/Dec order intake, potential loss of EU order flow poses downside risk in Q2’23.

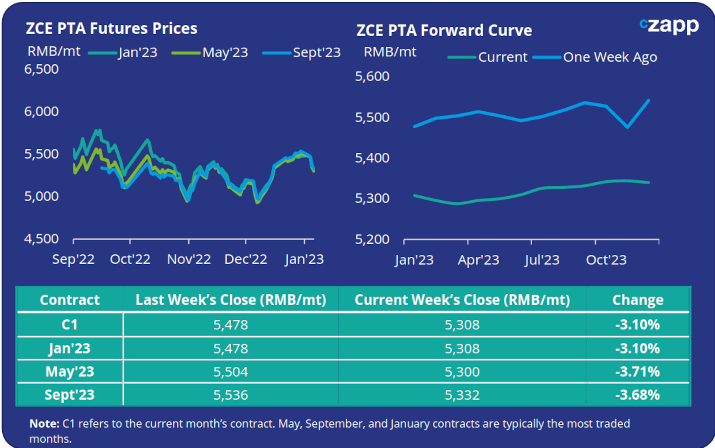

PTA Futures and Forward Curve

- PTA futures ended the first week of the new year on a weaker footing, driven in part by weaker crude markets.

- Oil prices had their worst start to a year in more than 30 years, with Brent crude sinking 9% by Friday, on persistent concerns about the global economy’s immediate future.

- Despite optimism on the Chinese reopening giving the PTA market a boost through December, downstream procurement weakened slightly going into the new year and inventory pressure increased.

- Whilst several bottle-grade PET resin units have restarted following turnarounds, some polyester fibre units remain in maintenance, with overall polyester operating rates expected to keep low.

- The current PTA forward curve is relatively flat through much of 2023, with the May’23 contract effectively trading at a rollover to the Jan’23 level

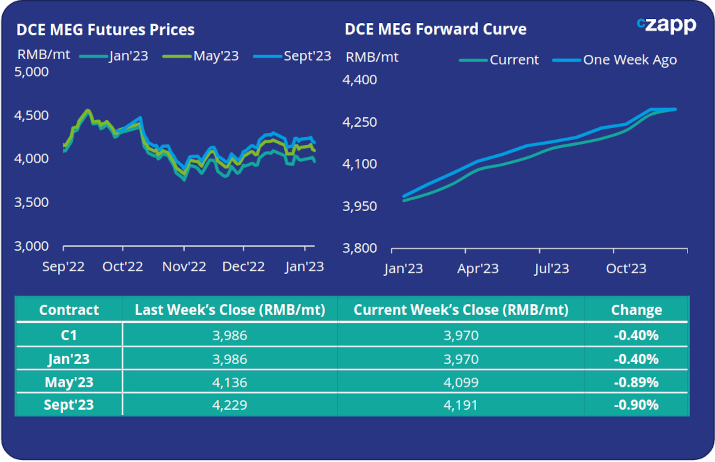

MEG Futures and Forward Curve

- MEG futures ended relatively flat, only slightly down on the previous week’s close, with recent plant shutdowns in the US due to the cold snap continuing to lend price support.

- Whilst East China main port inventories increased around 3.1% from last week, following the previous week’s decline, port congestion delayed any additional inventory build.

- Further inventory increases are expected through Q1’23 before suppliers begin to lower output in Q2’23. Although several new plant start-ups planned in 2023 will continue to add pressure on the supply side

- The MEG futures forward curve remains in contango with the May’23 contract now at a RMB 129/tonne premium to the current Jan’23 contract.

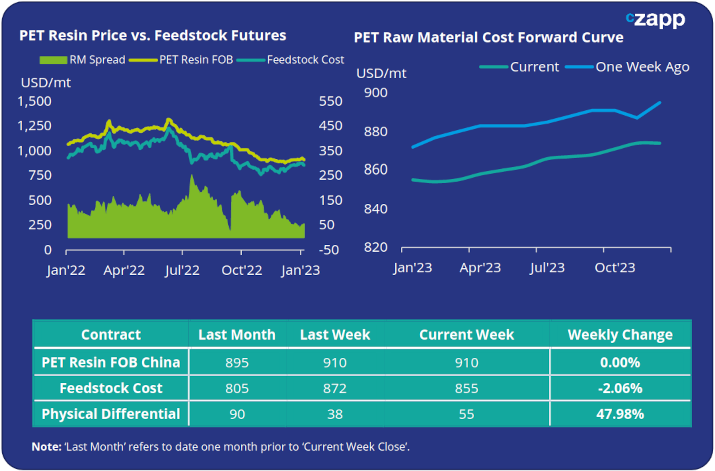

PET Resin Export – Raw Material Spread and Forward Curve

- Having started higher, around USD 925/tonne average at the beginning of the week, Chinese PET resin export prices embedded back down, ending the week at an average price of USD 910/tonne, flat on the previous week’s close.

- The weekly average PET resin physical differential to feedstock costs was flat on last week, averaging USD 53/tonne. By Friday, the daily spread was around USD 55/tonne.

- The PET resin raw material forward curve, whilst remaining relatively flat has begun to exhibit a modest upward slope through Q3’23. At Friday’s close, the May’23 contract was showing a premium of just USD 5/tonne to the Jan’23 contract.

Concluding Thoughts

- Previously reported improving Chinese PET resin export sales were reflected in the latest November PET resin trade data, which set a new monthly record, surpassing last November’s export volume by around 10%.

- December exports are also expected to remain high due to previous shipment delays, and additional bulk orders, including several large European buyers.

- Whilst January shipping schedules may be affected by the Chinese Spring Festival in a few weeks’ time, improved order intake indicates export volumes are expected to rebound strongly after the Spring Festival.

- Although PET resin availability has tightened over the last month this is yet to be reflected in the PET-feedstock differential, indicating potential weakness in the forward demand.

- Chinese exports may face a loss of demand into Europe after Q1’23 due to the threat of potential new trade barriers. Whilst rising COVID infections in China may constrain short-term domestic demand.

- An additional 4.5MMt of new PET resin capacity is also expected to come on-stream in China over the next year.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.