Insight Focus

- Federal tax exemption for gasoline and ethanol is extended until March.

- This decision will limit the upside for ethanol prices during the offseason.

- Even when it the exemption ends, mills will prioritise sugar, not ethanol.

One of the first decisions made by the new Brazilian government was to extend the federal tax (PIS/COFINS and Cide) exemption for fuels. The deadline established by the former president was 31st December, and now the new president Lula has moved the deadline for more 60 days – a decision made by fear of having fuel prices rise at the pumps, which would be unpopular with consumers.

In short, by March, federal taxes for gasoline and ethanol are set to come back in full.

But how is this relevant for ethanol prices, and consequently, for sugar?

Delaying Ethanol Upside By 60 Days

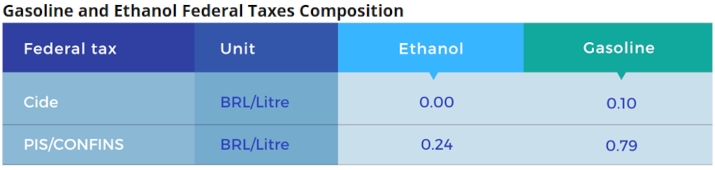

Gasoline has a higher tax burden than ethanol, as seen in the table above. This means that in order for ethanol to keep its competitiveness, its price must come down.

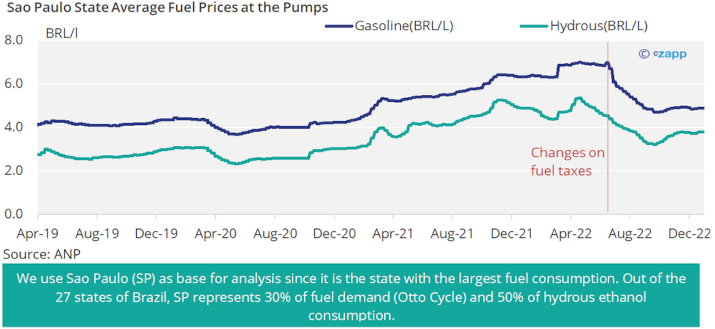

When the federal tax exemption was announced along with ICMS tax reduction (more on that below), in 30 days gasoline prices fell by 19% and ethanol by 13% at the gas stations.

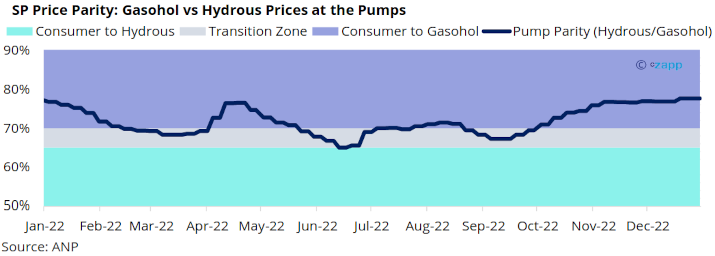

Over the same time, ex-works ethanol prices fell by 5% resulting in a downside of 115 points on a No.11 basis. And since then, the biofuel has presented a gasoline ethanol parity of over 70%, and so has lost market share.

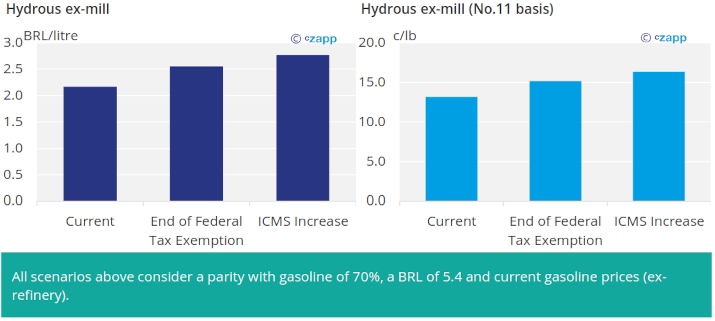

Therefore, a return of gasoline taxes would be positive for ethanol. Based on a 70% theoretical parity (and a BRL of 5.35), ethanol could climb by 200 points to over 15c/lb (on a No.11 basis).

Given where sugar prices are today, it would hardly represent a threat for the max sugar vision for the 2023/24 crop – for that to happen, ethanol would need to be above BRL3/litre (ex-works, net of taxes). But still, it would improve mills returns. Now, they will need to wait until March…

ICMS Tax Comeback – Only in 2024 for Sao Paulo

The cap on ICMS tax was extremely controversial. Being a state tax, it meant a significant loss of revenue.

In short, the law was changed to consider fuel a basic needs product, and as such would be subjected to a maximum 17 or 18% cap on ICMS (depending on the state). Last December, some states increased the cap by up to 4 percentage points.

However, this is not the case for Sao Paulo (SP). Since the state failed to pass a proposal last year, any increase in ICMS would only be valid in 2024.

Even if we assume that SP could increase ICMS tax on gasoline from 18% to 22%, the upside is not enough to bring parity between sugar and ethanol. Ethanol upside would rise around 300 points to 16.3c/lb, still far below sugar present returns.

The upside is that ethanol average price at BRL2.77/litre would be above cost of production, a reality that may not be the case for upcoming 2023/24 season…

One Last Thing to Consider

However, all of this could be offset with a change in Petrobras’s gasoline price policy. The government has nominated Jean Paul Prates as new president of the company. He is notoriously against the existing policy where gasoline prices are benchmarked against international prices.

There is a chance that Petrobras reduces gasoline prices to a point that any increase in taxes would keep pump prices at the same level. Then, all the upside scenarios above will be scrapped and the sugar and ethanol sector in Brazil could be once again in a position of low ethanol prices and a difficulty in reducing its debt.