Opinions Focus

- Brazil’s new president will help set the tone for global vegoil markets.

- Agricultural energy markets (renewable diesel, sugarcane ethanol) might have a good year.

- Commodity nationalism/stocking could continue.

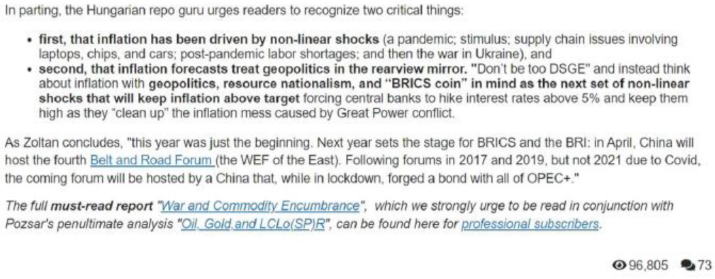

I am pretty sure many of the readers of this weekly summary are regular readers of the Zero Hedge website. During the end of the year the editors at Zero Hedge featured a review of Zolton Pozsar’s War and Commodity Encumbrance which outlines the impending rise of the BRICS alliance and the emergence of the BRICS economic hegemony (Pozsar’s works are dense and thoughtful and his macro views are extremely popular and until he is proven wrong a few times his essays are a MUST read for many traders).

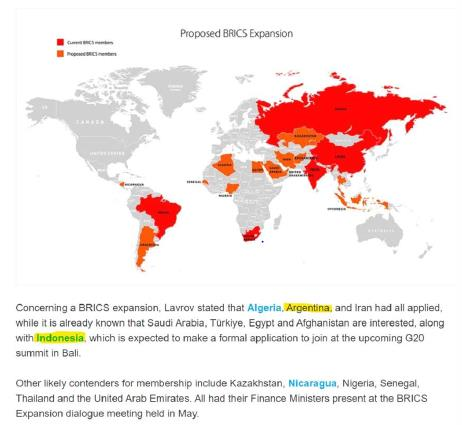

Two of the ascendant BRICS members are global leaders in soybean and palm oil production respectively.

Will the expanding BRICS alliance fix broken countries? The country at the bottom of the below 2022 list needs to be fixed, while the second from the top country has a changed political regime that could potentially alter development that has led to tremendous agricultural growth (dominance?).

Best and Worst Emerging Markets Currencies in 2022

Source: Bloomberg

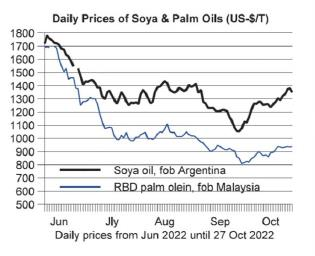

Pozsar’s recent writings also feature an ongoing subtext, the battle by producers for commodity control or commodity leverage over consumers. Recently Indonesia has tried to leverage her dominance in palm oil production via an export embargo that failed (see below price chart). The Indonesians no doubt maintain a keen eye on US renewable diesel policy and understand that the US itself will “domesticate” its soybean production (the soybeans and soybean oil stay home but the meal gets exported).

Brazil has been a roll toward global soybean dominance, especially relative to Argentina, but the regime change will be watched closely by the global oilseed trade and by China, Brazil’s BRIC’s partner and potential singular soybean lifeline as the US withdraws from global soybean trade, a first ever in US soy history, and Argentina wanes.

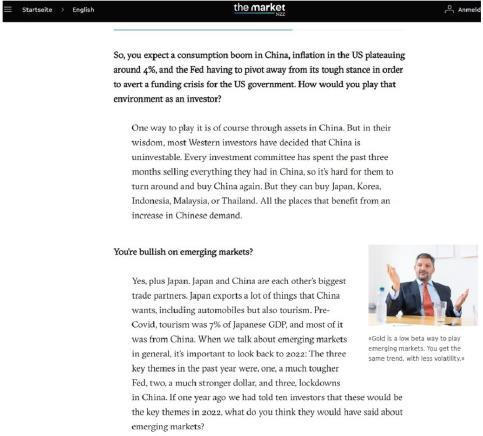

This was a great read this weekend. Gavekal Research forecasts a Chinese BOOM as policy makers rescind the Covid shutdown of the country which leads ultimately to a Southeast Asian markets boom.

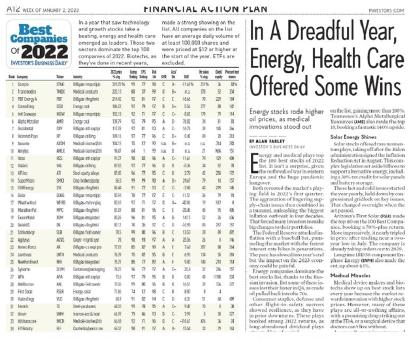

If global energy production has peaked then “agricultural” energy may have a bright new day in the US (remember that a primary component for the formation of domestic biofuels policy was national security of motor fuels supply). Agriculture energy producers did not make IBD’s top 100 list. Huh?

Over the last 5 years ethanol has outperformed big energy…

Especially relative to global oilseed processing and renewable diesel feedstock production…

But integrated agricultural (with feed technology) and oilseed processing and keeping a “FOR SALE” sign out in front of ethanol plants has far outperformed big energy…and takes the win!

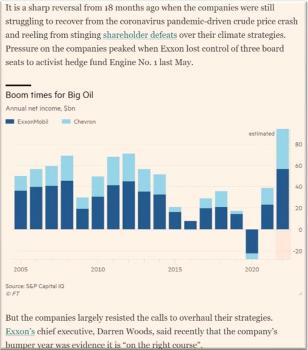

Maybe the good energy times return, especially for those who have not dismantled their pre-ESG business model. XOM’s CEO says the company is on the right course (and the ESG peanut gallery has gone quiet).

For those who did dismantle, it sort of has left a mark.

Sell your coal stake for $101 million, it makes $2 billion in EBITDA in the next 6 months. Ouch!

So back to Zolton Pozsar and the impending commodity nationalism (and producers’ leverage over EV builders?).

It will be an interesting year to watch for BRICS commodity adjusted trade flows and potential realignments of consumers/suppliers in the commodity space. This one should get unloaded this week.

While all the financial news featured endless stories about the implosion at FTX, it is amazing how little analysis I have seen on the damage done to investors by this year’s tech rout.

We kick 2023 off with a very busy first half of January:

- EPA’s hearings January 10, 11, and 12 on their proposal to add eRINS to the RVO

- USDA’s all-encompassing January 12 WASDE and Stocks in All Positions Report and Final 2022 Crop Report

- And of course WINTER in Europe and its impact on Europe’s ability to keep the lights on and the apartment warm.

Happy New Year to all!