Opinions Focus

- December is normally a quiet month in the grain and oilseed markets.

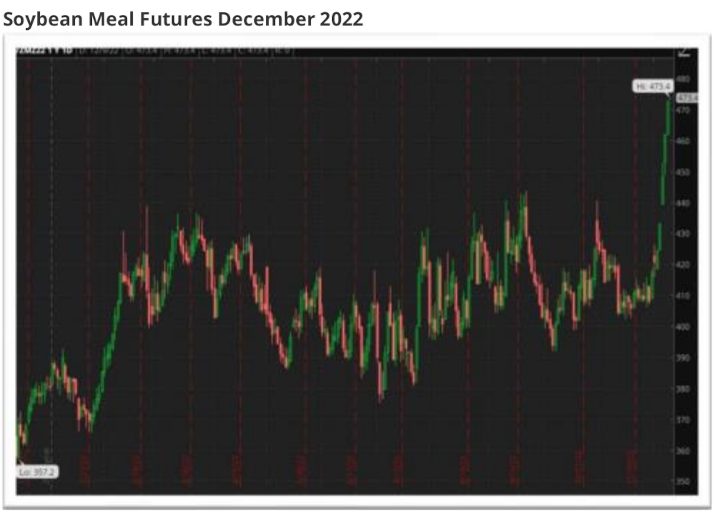

- Soybean meal has strengthened 7% in December to date.

- What is the EPA’s policy on biofuels going to be?

Traditionally December is a quiet period for the global grain and oilseed trade. The North American corn and soybean harvest is normally completed and crops stored away for marketing into the next year. The bulge of harvest grain movement from last half September through first half December has peaked and the Mississippi River transportation and grain trading system begins to adjust to winter closures from Quincy, Illinois north to the top of the system. The meat industry begins to wind down its feed demand as the holiday turkeys, pork loins, and beef tenderloins get delivered into retail markets and New Year’s resolutions will feature short lived diets (for the Americans) but will still cause a dip in meat demand.

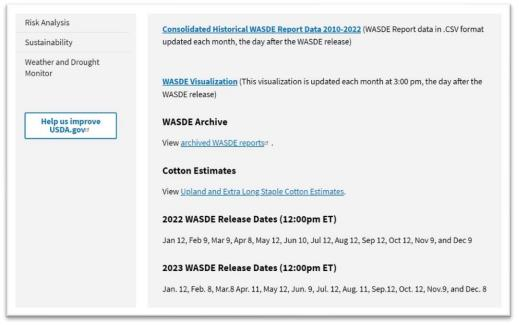

Amidst all this winding down toward the holidays and the New Year the chief economist at the US Department of Agriculture issues a World Agriculture Supply and Demand Estimate (WASDE) that is quite a waste of paper. Why? The trade knows the December report is incomplete and during the second week of the following January the chief economist will issue an all-encompassing, completed 2022 crop report, a year ending grain stocks stored in all positions report, and a WASDE adjusted for all this “final look at the crop” information.

So from the third week of December until the second week of January we keep an eye on the weather in South America (not yet yield determinant but potentially a yield drag or a yield add), we look at the weekly US export sales and loading statistics, we eat endless boxes of Harry and David goodies that the brokers send, and we get out the door by 4 PM because we got out the door at 8 PM during most of harvest. A nice, quiet end to the year.

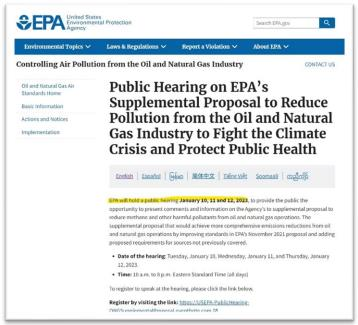

UNFORTUNATELY, this year, Environmental Protection Agency (EPA) bureaucrats did not get the above “quiet December” memo and decided to make this quiet period a bit livelier (which I covered in this post: https://tinyurl.com/2n53d5bd).

The EPA’s proposed limited biofuel production forced the global protein meal consumer, already a bit nervous about Argentine weather, to fully panic about future soybean meal supplies should the EPA not support the growth of renewable diesel (RD) which supports the growth of US soy processing capacity:

Source: Refinitiv Eikon

And soybean oil prices, sharply inverted (the spot price higher than deferred prices; backwardated for the Houston readers) and busy rationing demand, collapsed and flattened the entire price structure.

Source: Refinitiv Eikon

January looms large for the grain and oilseed trade. The EPA’s Renewable Volume Obligation proposal has set the stage for a very market moving environment start to the year. 1) There are the EPA hearings:

2) The aforementioned USDA crop report:

3) Earnings calls for publicly listed companies building out RD infrastructure (billions of dollars at risk) and soybean processing infrastructure (billions of dollars at risk) to supply feedstock for RD. Analysts and investors will question management with “where do we go now?” and “do you believe the EPA’s proposal is for real?” type questions.

One involved CEO got out ahead of the crowd and threw down his (Bunge’s really) gauntlet during an industry “fireside chat”:

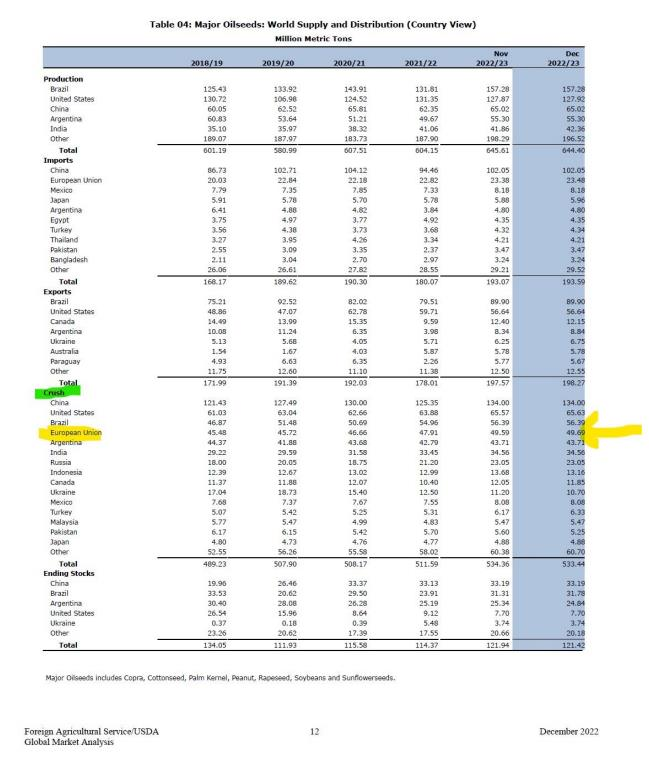

In addition to the above we have a crisis in Europe, both in the Ukraine, but also in Western Europe and I continue to monitor it closely. How will Europe fare during the winter is a question on lots of minds. On the next page is a data table from the USDA’s December Oilseeds, World Markets and Trade, in which I highlight, every month, the USDA’s economists’ views of European oilseed crush rates. To date, the economists have stood fast on their view: no problem here. In the coming months we shall see.

Here is a hint for the New Year: look at the country just below the yellow European highlights: I will be posting a lot about it next year (ummm…they may be facing their own energy crisis).

All the best for holidays and Happy New Year. I am done for 2022 (unless I think of something!)

https://www.fas.usda.gov/data/oilseeds-world-markets-and-trade