Insight Focus

- European PET resin demand remains weak, with producers faced with cheap import arrivals in Q1’23.

- After another long wait November’s PX ECP finally settled, Oxxynova announces closure.

- Potential anti-dumping proposal raises import risk, details remain clouded.

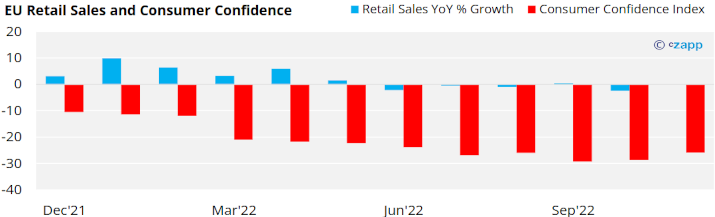

Resin demand remains slow in December, and below typical off-season levels. Although spot deals continue to be concluded, there is a sense of trepidation from both buyers and producers ahead of the new year.

Food and beverage manufacturers are reluctant to commit to new orders on a weaker demand outlook, in turn impacting demand for preforms and packaging.

Instead, buyers continue to clear out stock, reducing the potential overhang going into the new year.

Although some brands have reported that a degree of carryover is inevitable, with excess contracted volumes from 2023 now expected to cover Q1’23 requirements in certain smaller markets.

Latest data from the European Commission showed consumer confidence, whilst remaining low, improved in November bucking trend in recent months.

European producers expect extremely difficult market conditions in Q1 with import arrivals and a continued import price disparity straining contract negotiations.

Reports from current 2023 contract negotiations indicate much lower contract volumes next year, as buyers move more to the spot and import markets.

Whilst many converters prefer to source resin domestically, due to supply security and prompt delivery, many are also afraid of losing competitive advantage if they fail to buy the current import disparity.

However, many European converters are also limited to specific PET resin producers, due to approval processes, constraining their ability to switch sources readily.

European Producers Face Q1 Import Threat and Expect Reduced Rates

Several European PET resin producers are already running with a line down, almost all others continue to run at reduced rates.

With a weak demand environment, lower contract volumes, and the threat from imports, means production cuts are expected to remain through Q1.

Some producers have already decided to keep lines down for the entirety of 2023.

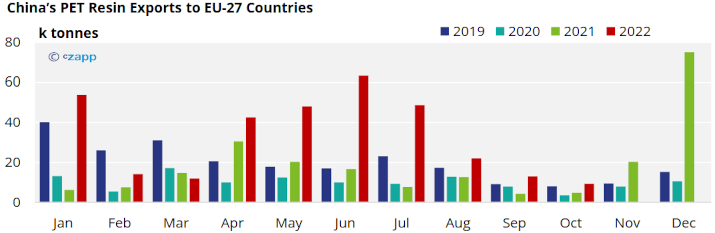

Chinese PET resin export volumes to EU27 countries have followed the typical off-season trend, falling to an October low.

However, Q4 export order intake has been much slower than in 2021, indicating a potential delayed uptick in Q1’23 volumes.

Export orders are also likely to be impacted by the Christmas period, and Chinese Spring Festival at the end of January.

Therefore, any surge in shipments is likely to be focused post-Chinese New Year, meaning Q1 may see a steady flow of imports rather than a tidal wave, which may be concentrated in early Q2.

Dysfunctional PX ECP Settlement Hurting European PET Market

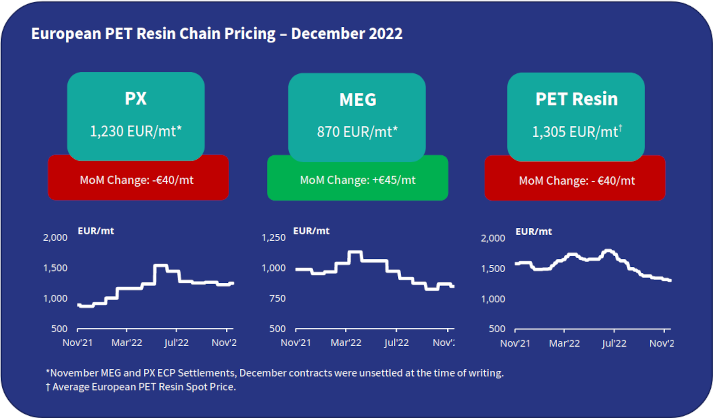

November’s PX European Contract Price (ECP) finally settled split, with agreements of EUR 1210 and 1250/tonne, averaging EUR 40/tonne lower than the October settlement.

Since June, the PET resin market has been hostage to volatile PX pricing with considerable delays on settlements.

Oxxynova, one of the main partners in the PX ECP system, has frequently been out of kilter with Indorama, resulting in repeated split settlements.

Whilst most domestic PET resin contracts are no longer on a ‘raw material plus’ structure, a dysfunctional PX ECP settlement means that producers lack full clarity on feedstock costs, hampering their ability to price more competitively on the spot market.

And its this lack of competition with imports that has driven buyers to consider increasing import volumes to the detriment of European producers.

The recent announcement that Oxxynova will stop production by year end, effectively closing their site in Lower Saxony, Germany, will throw another curveball into the PX ECP settlement.

Another partner will likely be needed to take Oxxynova’s place in the PX ECP settlement.

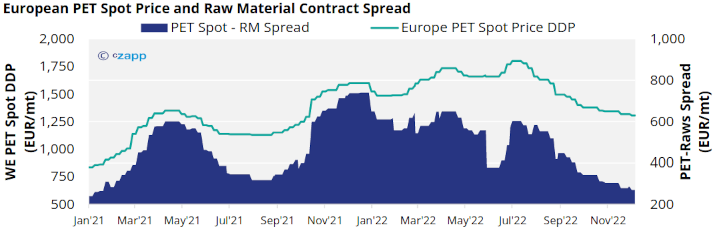

European PET Spot Prices Continue to Tumble

European spot prices continued to ebb downwards through December, typically ranging between EUR 1280 to EUR 1330/tonne, averaging down around EUR 40/tonne for the month.

Prices were also heard either side of this range, depending on location and individual producer.

Higher prices up to EUR 1350/tonne were reported. However, these were considered niche purchases and not representative of a broader market indication at the present time.

Equally on the lower end, spot deals were concluded at as low as EUR 1250/tonne, for local delivery within the Benelux region.

Some buyers are now anticipating prices to move down to EUR 1200-1230/tonne by the end of December/beginning of January. Although this will be highly dependent on future feedstock costs.

Is it cheaper to import?

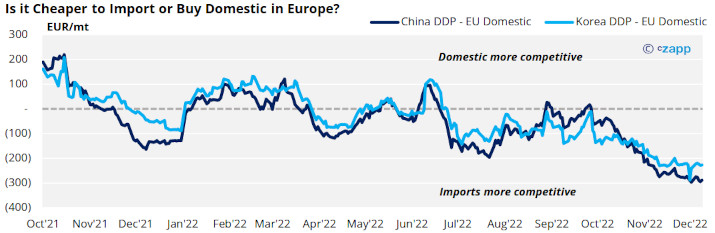

At the time of writing, daily China PET resin export prices averaged around USD 895/tonne, down around USD 20/tonne over the past month.

Import prices of USD 935-950/tonne CFR, equating to EUR 1020-1035/tonne DDP, are now available based on average daily Chinese export prices.

Whilst the collapse in ocean freight rates has enabled such competitive offers, the strengthening of the Euro versus the US Dollar has also played against domestic PET producers.

The current delta between Chinese imports and domestic European resin is around EUR 290 /tonne on a delivered, duty paid basis.

Potential Anti-Dumping Proposal Raises Import Risk

According to several major PET resin producers, an anti-dumping proposal against certain PET imports was submitted to the European Commission.

However, until the proposal has undergone review and an investigation is launched, there is unlikely to be any formal confirmation of the submission.

Despite the lack of transparency, a potential timeframe can be sketched out.

European producers are anticipating that the investigation with be opened in March/April 2023; timing for an investigation is then expected to be 8-9 months.

Crucially any decision may be applied retrospectively, meaning arrivals later than March/April, could be at risk of unknown import tariffs.

Some buyers are already pushing through advanced purchases for March Arrival, with few willing to take the risk on imports after Q1’23. However, until there is a formal notification nothing is officially confirmed.

Market Outlook & Concluding Thoughts

- The main question now is, can European producers close the import parity gap?

- Both energy and raw material costs need to come down in tandem to close the gap on imports.

- PX is expected to steadily decline on lower MX, and reduced demand from PTA and PET production cuts. However, energy cost disparity between Europe and Asia will make it difficult for European PET producers to fully bridge the import price gap.

- European producers seem to be willing to write-off Q1’23 in the hope that a potential anti-dumping investigation will add protection against imports through peak season.

- However, Europe receives PET resin from a diverse range of origins, shutting the door to just one may only result in a rebalancing from another supplier.

- With Asian export prices reaching a bottom in the raw material forward curve, buyers need to be looking at diversifying suppliers, and fast-tracking approvals, for future supply and cost security.