Insight Focus

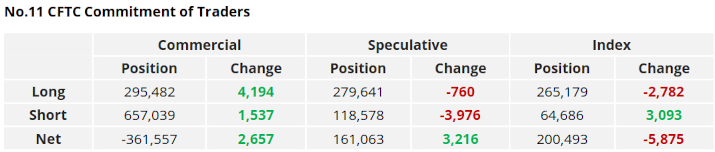

- Raw and refined sugar prices have traded in a narrow sideways range so far in December.

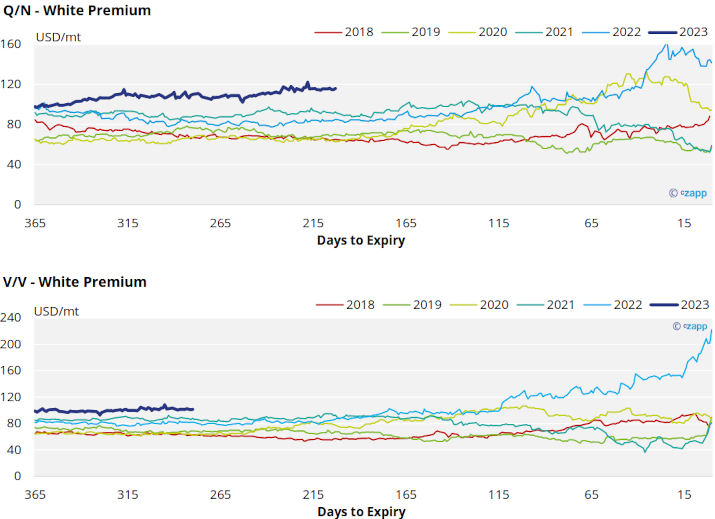

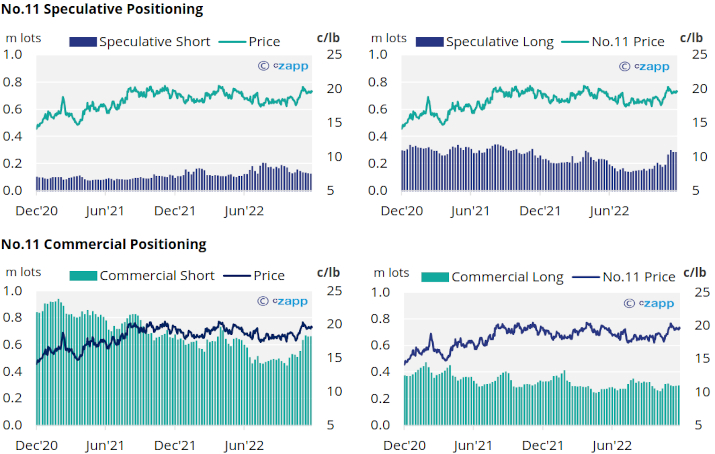

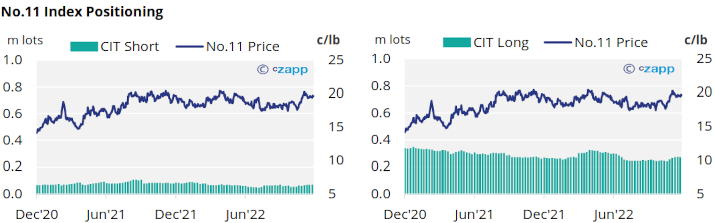

- Speculators have closed more short positions, willing to hold on to long positions.

- Raw sugar consumers add new hedges despite relative market strength.

New York No.11 (Raw Sugar)

The No.11 raw sugar futures continue to trade sideways, reluctant to break too far higher or lower than 19.5c/lb.

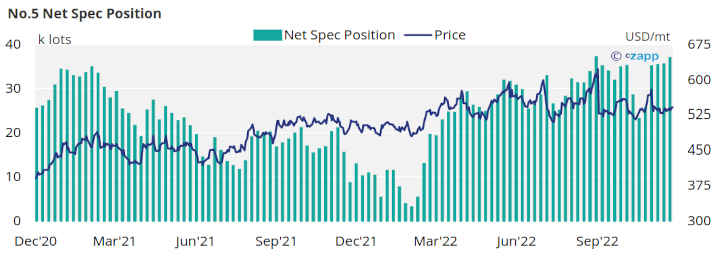

Speculators still appear to remain committed to many of the long positions opened when the market rallied toward 20.5c/lb in early November, despite the market now trading 100 points down on these highs.

Fewer than 1k lots of spec long positions have been closed in the week to the 6th of December, far fewer than in the week before. This could imply that many of the long positions built when the market was above 20c/lb have now been closed, with the remaining positions still sustainable at current prices.

A larger withdrawal of short positions (4k lots) means that the net spec position has extended slightly, now back above 160k lots long.

Both raw sugar producers and consumers were able to add new hedges, with commercial positions extending by 4k and 1.5k lots respectively by the 6th December.

With the No.11 fluctuating very little for the last few weeks, consumers may have been forced to add new cover at a higher price than they have done so far in 2022 (generally we have seen consumer hedging with the market closer to 18c/lb).

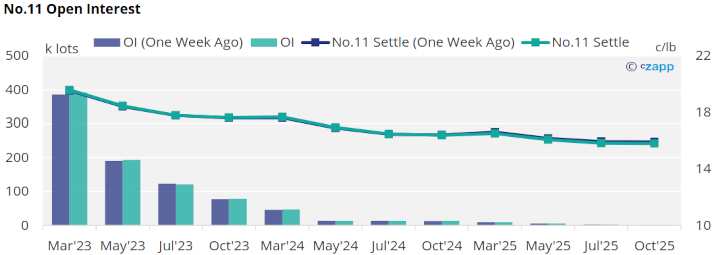

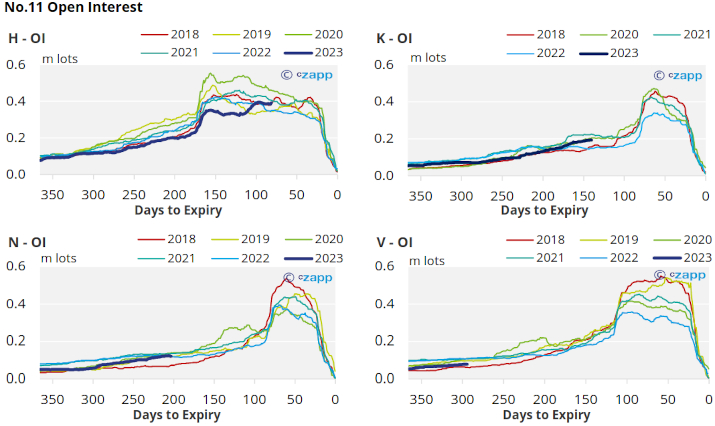

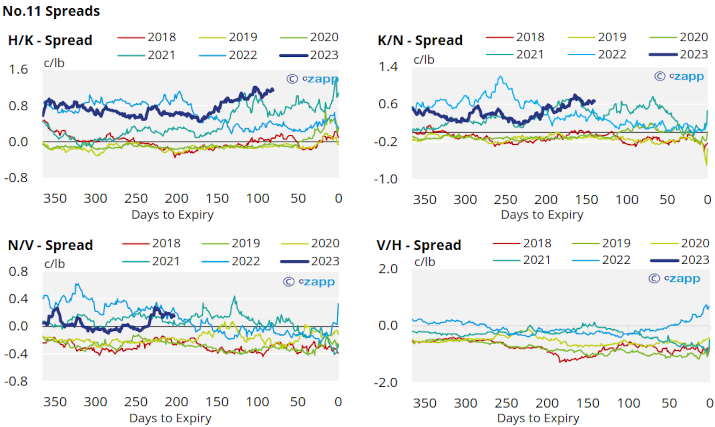

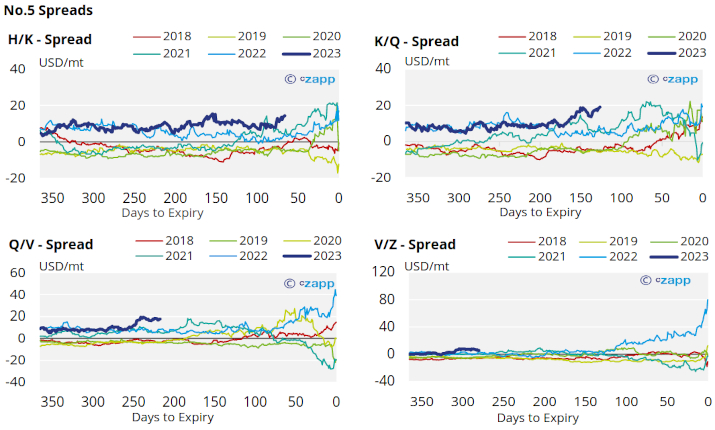

The No.11 forward curve remains inverted until the end of 2024.

London No.5 (Refined Sugar)

No.5 refined sugar futures have also traded sideways in a very narrow range for the last few weeks, closing just above 540USD/mt by Friday last week.

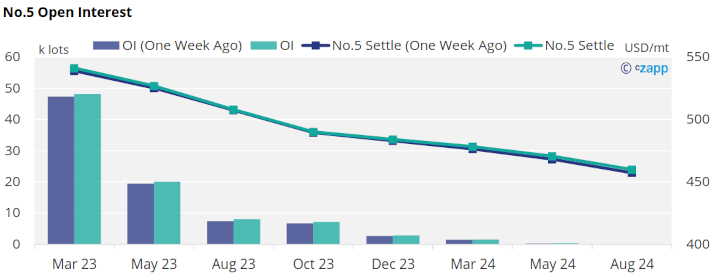

Despite this, by the 6th of December refined sugar speculators extended the net spec position by 1.5k lots, broadly through closing existing short positions.

This brings the net spec position very close to the 2-year high reached back in September, around 37k lots long.

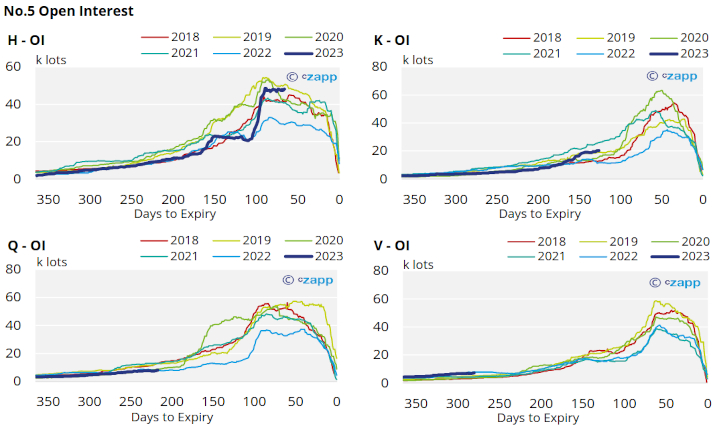

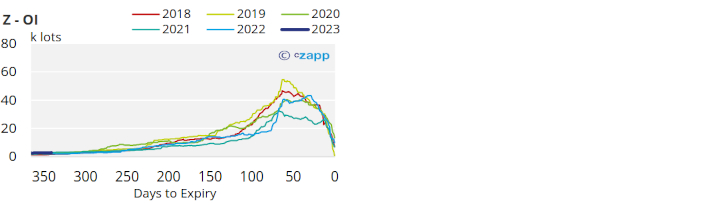

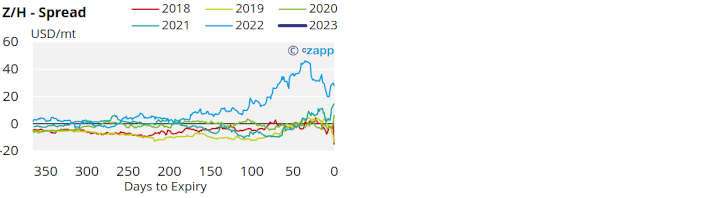

The No.5 forward curve remains strongly backwardated as far ahead as Aug’24, suggesting a slowly easing market tightness over the next few years.

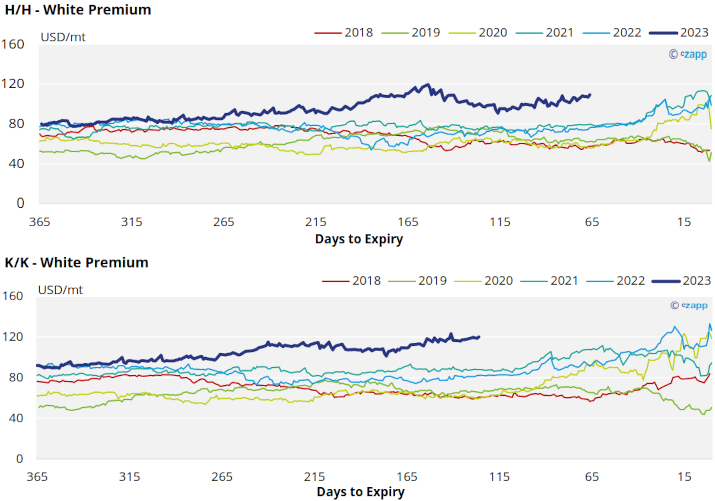

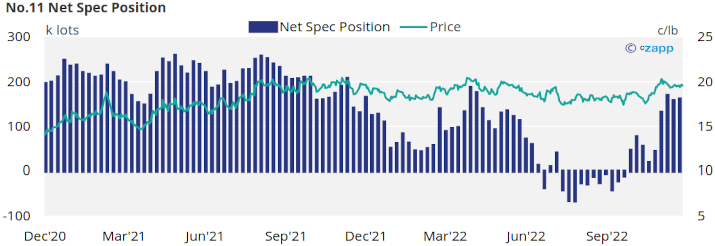

White Premium (Arbitrage)

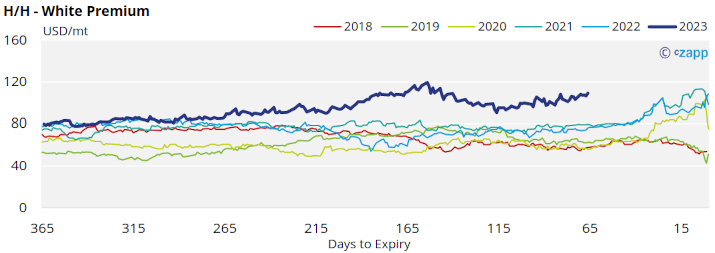

The H/H sugar white premium has strengthened slightly, now approaches 110USD/mt.

We think re-exports refiners need around 120-130USD/mt above the No.11 to profitably produce refined sugar, therefore physical values should still be necessary to bridge this gap.

The refined sugar market is likely to be slightly undersupplied for the majority of 2023 and this is reflected in comparatively strong K/K and Q/N white premiums which have also been rising and now approach 120USD/mt.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix