Opinions Focus

- The Environmental Protection Agency has sought comments on the viability of domestic renewable diesel refiners.

- It’s also questioned how to support novel fuels such as sustainable aviation fuel.

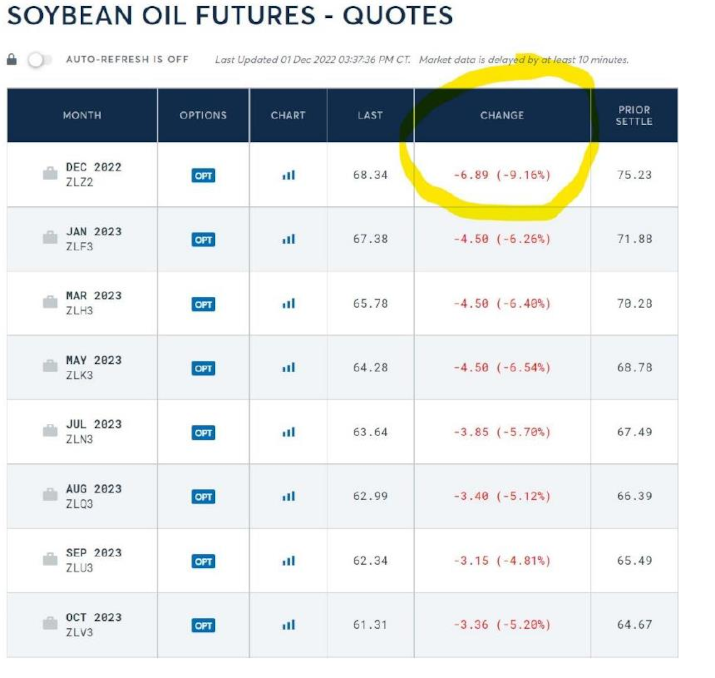

- Its press release has unnerved soybean oil futures, down 9% on 1st December.

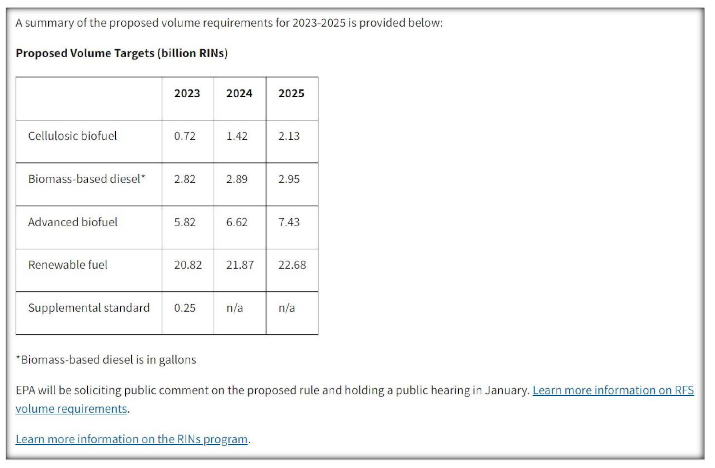

The US government’s request for commentary on its 2023-2025 proposed biofuel inclusion rates for the nation’s fuel supply touched off quite a “risk off” response in publicly traded equities of companies that produce feedstocks for renewable diesel (RD), soybean oil futures, and soybean crush margin derivatives traded on the Chicago Mercantile Exchange (CME).

What happened?

Markets are delicate machines and can be thrown out of whack by subtle inputs, ESPECIALLY when the input comes from a government regulatory agency, in this case the EPA, for a business that is driven by policy, in this case the usage of biofuels to extend or replace the US petroleum fuel supply.

The following highlighted items from the EPA’s press release, in my very humble opinion, contributed to the risk off actions of investors and traders:

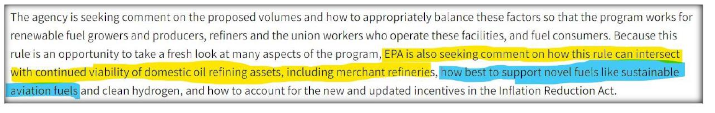

The yellow highlight features the unnerving language of discussing the death of domestic refining assets as the EPA wonders how new policy rules “can intersect with continued viability of domestic oil refining assets, including merchant refineries.” In other words, the EPA is wondering out loud if policy for biofuels should also consider the impending death (remember this is for the period of 2023-2025) of the refining industry so it needs to help keep them alive. Huh? Tough to blend RD feedstocks (soybean oil, used cooking oil, tallow) into a dead refinery to produce RD.

The blue highlight features the equally unnerving language on whether the EPA may give some, limited, or full support to sustainable aviation fuel as it wants public input on “how best to support novel fuels like sustainable aviation fuel.” Umm, that is not what I would call a full endorsement that support is coming for the development of sustainable aviation fuel; rather it features hesitancy and doubt.

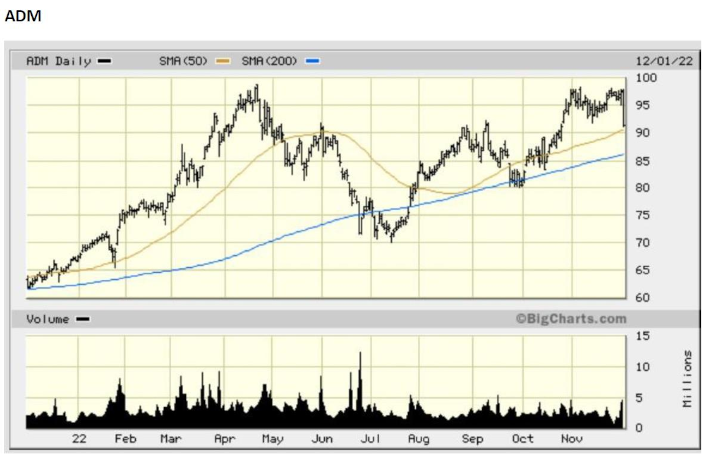

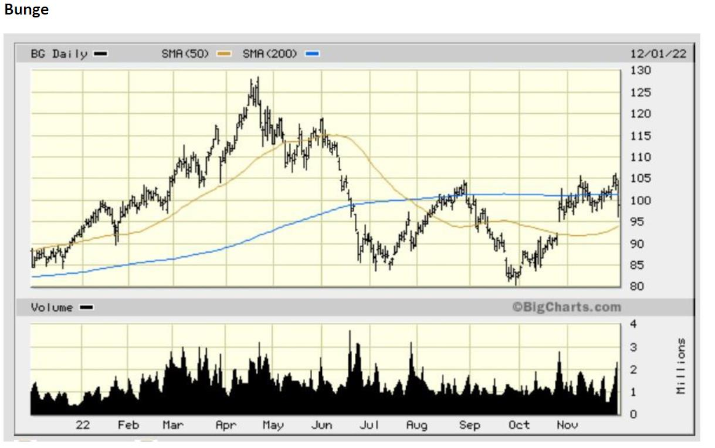

Many market participants ran for the biofuels exit in the public equity of companies that produce the feedstock for biofuels (see the volume increase at the bottom of each chart):

Soybean oil futures traded down to their permissible lowest level for a single trading day, the proverbial limit down, while the spot contract in its physical delivery cycle, the December 2022 contract which has no trading limits, traded down over 9%.

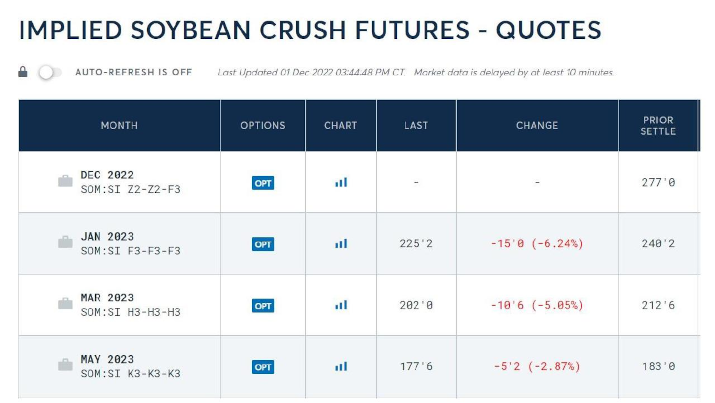

Nearby January soybean crush margins lost over 6% while March soybean crush margins lost 5%.

All in all today featured a very significant market response to a press release that sounded “iffy” about PUBLIC COMMENT ON EPA PROPOSALS NOT FIXED POLICY.

In the aftermath of the “every doubter for the exit” I would assert the following:

- Per many prior posts I have made the case that the availability of US domestic vegetable oil feedstock supply to meet all the demands from the renewable diesel industry remains woefully inadequate; post the EPA’s blend proposal (next page for the policy wonks) the inadequacy remains and the function of the market is to ration supply.

- Another function of the market in the coming 3 to 5 years also remains the same: encourage consumers toward global palm oil consumption via sharply lower relative palm oil prices to US soybean oil prices, check, happening, and sharply lower non-US soybean oil prices (Argentine and Brazilian), check, happening, to insure adequate soybean oil supplies for food and RD consumers in the US, i.e. keep US soybean oil prices at a significant premium to other global vegetable oil prices.

- US soybean crushing capacity growth must occur as it produces the only viable feedstock from a volumetric perspective, soybean oil, and without that growth the RD industry cannot achieve its ambitions and the EPA proposed blending rates will not occur.

Nonetheless the EPA’s rather odd choice of words in today’s request for public comment sowed some policy sustainability doubt from the investor and trader classes who necessarily pay close attention to policy and policy pronouncements. A recovery in prices likely begins once the “shaking the doubters out” has concluded and investors and traders return to focus on the above three key drivers.