Insight Focus

- PTA and MEG futures followed crude higher, despite gloomy fundamentals.

- PET producers report strong export demand with buyers activated by market bottom.

- Uncertainty around future of zero-COVID still a major risk for domestic PET resin demand.

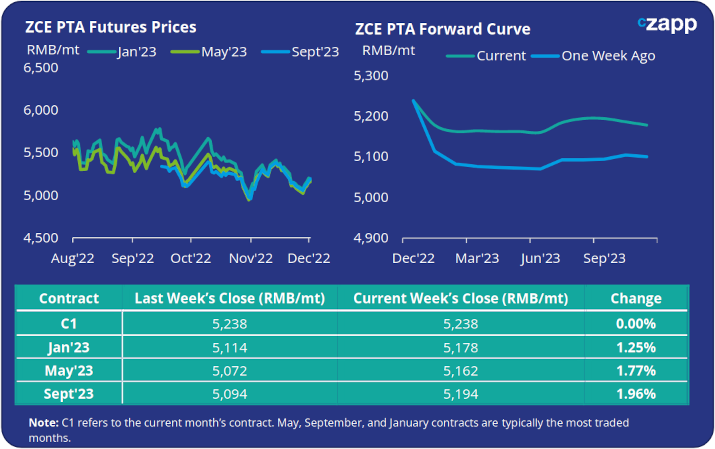

PTA Futures and Forward Curve

- PTA futures recovered ground as oil prices posted their biggest weekly gain from nearly two-months.

- Following weeks of declining polyester operating rates, the easing of COVID restrictions in certain regions of China may stimulate some short-term PTA demand, although operating rates remain low.

- Whilst PTA inventories at futures warehouse remain low, constrained by tight PX supply, new PX and PTA production is expected to see inventories grow outpacing slower polyester demand.

- The current PTA forward curve is now only partially backwardated into the new year, with the Jan’23 contract trading at a small discount of 60RMB/mt to the current month, representing a market bottom.

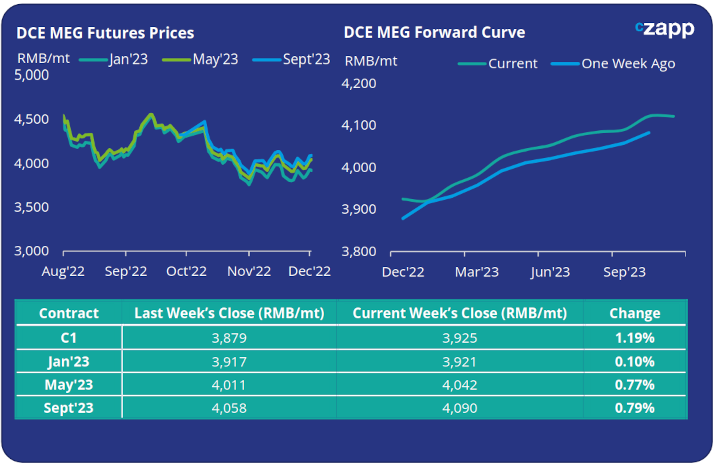

MEG Futures and Forward Curve

- MEG futures rose off-the-back of higher crude and a weaker US dollar. However, buyers remained cautious with expectations of continued weak downstream demand.

- Port inventories posted another weekly increase, up around 2.8%, with supply cuts being outpaced by the demand slowdown.

- Following recent turnarounds from Asian and Middle Eastern producers, imports are expected to increase towards year end, keeping MEG fundamentals bearish and the market in oversupply.

- The Jan’23 contract closed last week at a RMB 4/tonne discount to the current month. Whilst the forward curve is in contango, the market faces continued oversupply through Dec/Jan.

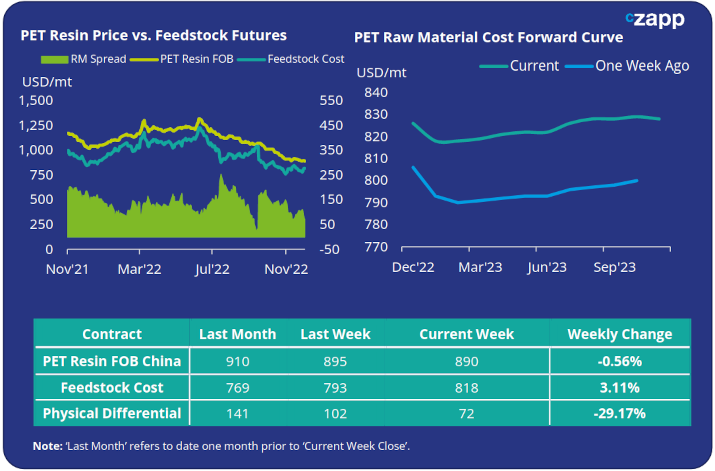

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices decreased marginally on last week’s close, moving down to an average price of USD 890/tonne by Friday.

- Last week saw strong export demand as prices reached a potential market bottom and buyers looked to secure volume ahead of the Christmas period in key export markets.

- Inventory levels also declined with major Chinese producers now reporting reduced availability for Dec/Jan shipment.

- The weekly average PET resin physical differential to feedstock costs fell on rising raw materials, down USD 13/tonne last week, to USD 90tonne. By Friday, the daily spread had narrowed to USD 72/tonne.

- The PET resin raw material forward curve continues to show only a slight reduction into the new year, with the Jan’23 contract at only a marginal USD 8/tonne discount to the current month (December). A market bottom is now being openly called by buyers eager to scoop up some bargains.

Concluding Thoughts

- Following the almost constant fall in price over the last few months, we now look to be past the weakest point of the year and have approached a potential market bottom in the forward curve.

- Improving domestic and export demand is expected to help steadily reduce stock levels and return some margin back to PET resin producers in Q1’23.

- Increased price competitiveness of Chinese material into key markets is expected to lift PET resin export demand coming into Q1’23.

- However, uncertainty around the future of China’s zero-COVID policy is still a major risk to domestic demand recovery, and one that could lengthen overall supply availability.

- With COVID spreading rapidly in most major cities, even with the recent announcements following protests in China, people’s movement and logistical transportation are being impacted/restricted.

- Delays and postponements to some previously anticipated new PET resin plants will help moderate supply increases in Q1’23. Although new additions are expected to increase availability in H1’23 generating greater export competition.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

PET Resin Trade Flows: EU PET Resin Imports Surge in Q3 Driven by Chinese Wave

European PET Market View: European PET Producers Face Difficult Q1 as Import Delta Widens

Plastics and Sustainability Trends in October 2022

PET Resin Trade Flows: Asian PET Exports Weaken in Q3 as Seasonal Demand Withers