Insight Focus

- Chinese sugar consumption growth is still depressed.

- Many cities aren’t free from strict COVID-19 controls.

- 2022/23 cane crushing is normal.

Optimized 20 Measures in Dilemma

The Central Government laid out 20 measures to optimize COVID-19 control on Nov 11th 2022. The general idea was to cut quarantine periods and increase people’s mobility. With this, the market had hoped domestic consumption will be stimulated, driving the economic growth.

Over two weeks have since passed and the actual effect is below expectation. Local governments continue to exceed the new measures, by imposing additional curbs or massive PCR tests.

A recent survey showed that the queue of trucks stuck on a highway in Shanxi Province was over 3000 meters because the exit was shut down due to COVID restrictions. Farmers in Henan, Shandong, Anhui are destroying their crops because they can’t sell due to logistics interruption.

January 22nd is the Chinese Lunar New Year in 2023, which is usually the peak of consumption in a year. Thirty percent of candy sales occur in this period, because people will visit relatives and friends with gifts. This year, we may not see lively Spring Festival activities.

Cane Crushing Started Despite COVID Impact

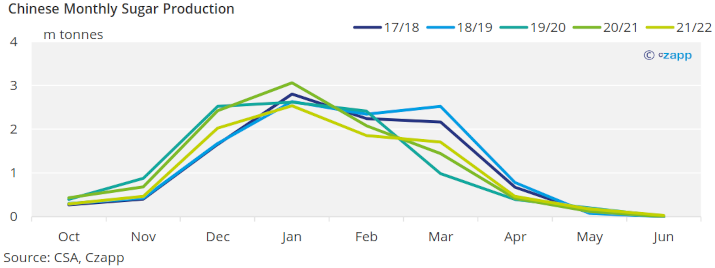

The recent pandemic situation in Guangxi has caused some sugar mills to delay 2022/23 cane crushing. However, the impact is small, and in general the campaign is orderly.

This means new crop sugar will be supplied to the market shortly: around 2m tonnes in December.

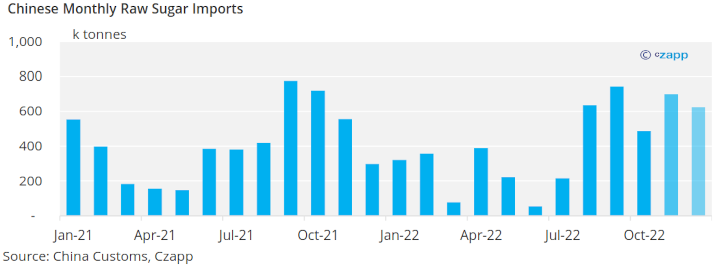

There’s been no major COVID lockdown impact on the operation of sugar refineries neither. With a large volume of raws arriving in Q4’22, the domestic market seems to be well supplied.

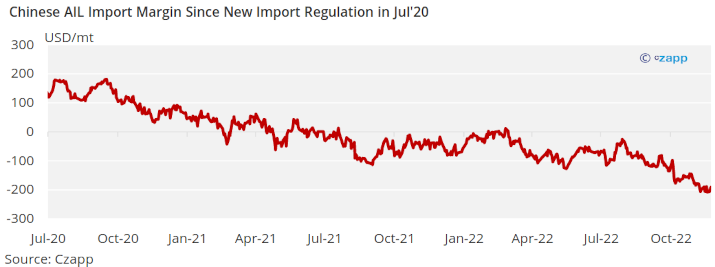

Demand Destruction Drags Raws Import Margin to Record Low

To answer the question, it’s hard to see how sugar consumption improves in the short term. China’s new direction of COVID control should be positive for consumption and economy, but it will take time.

Meanwhile because sugar production and supply are relatively normal, raw sugar import margins have reached a historical low.

2023 sugar import demand could be at risk unless consumption recovers.