Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

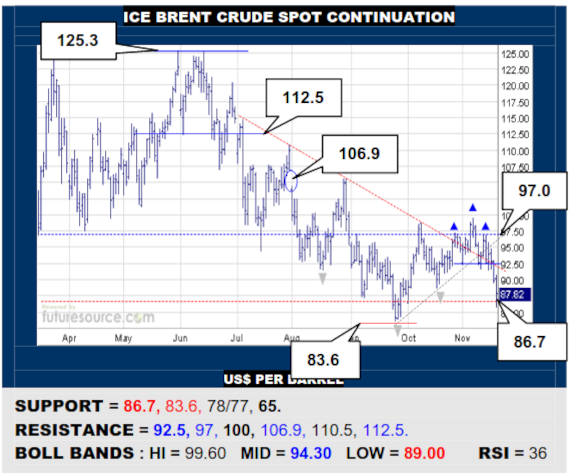

ICE BRENT CRUDE OIL SPOT CONTINUATION

Lunges into the broad ’22 top above 97 failed to grip, raising the bar to 100 while meantime Brent has slumped from a small new H&S. This brings the 86.7 monthly base rim to 83.6 trough back under fire. If 83.6 gave way, beware much more extensive fallout into the mid 60’s. Must otherwise muster a reflex over 92.5 to make any useful repairs.

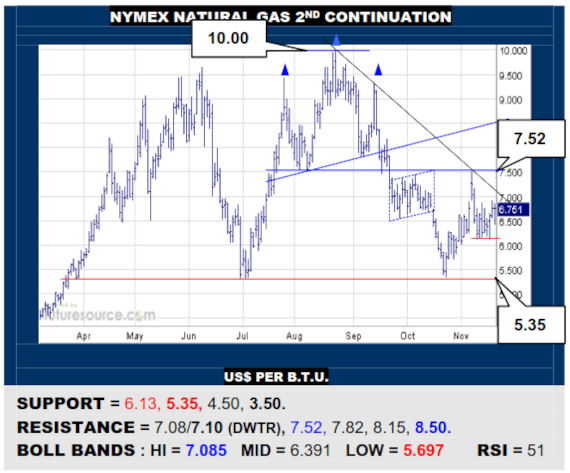

NYMEX NATURAL GAS 2ND CONTINUATION

Blocked by the 7.52 face edge of the prior H&S early in Nov, Nat Gas has reined in the resulting setback but the upper Bollinger and a better defined downtrend now obscure the path back up (7.08/7.10). Must reenter the 7’s with gusto to revive faith then while meantime eying 6.13 as the tripwire back down to the pivotal 5.35 precipice.

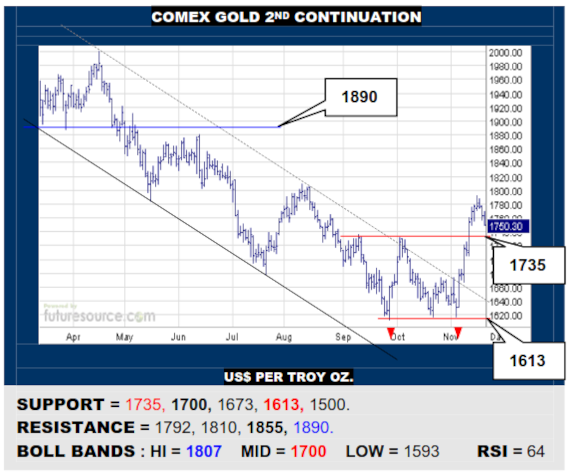

COMEX GOLD 2ND CONTINUATION

Some near term cooling but Gold has left a new double bottom in its wake that should now provide support at 1735. If duly able to mop up dips there, the base depth projects on up to 1855 before a longer lasting rest-stop may be needed. Only gouging back through the 1730’s would instead warn of endangering the mid band (1700) to deflate the base.

LME COPPER 3-MONTHS

Coming up just shy of the weekly top frontier at 8700, Copper swerved back this week towards its oncoming mid band (7933). That feature and 113.7 on the B-Berg must hold up to keep the dip looking corrective and thus preserving a chance to run at 8700 again. If the mid band cracked while the B-Berg fell from 113.7, beware a deeper retreat to 7400/7300.

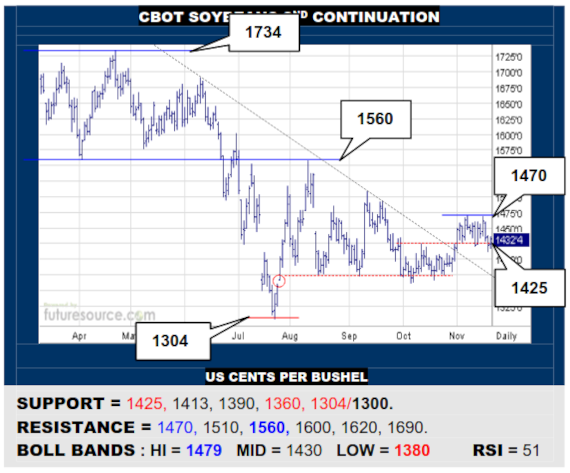

CBOT SOYBEANS 2ND CONTINUATION

Very murky action and some fraying of the 1425 support was contested Friday by an inside day. If Beans can secure this catch by closing back into the 1440’s, it should spark a third attempt on 1470 where escape would expand upside reach to 1560. If confined in the 1430’s early next week though, loss of 1413 would point back down to the 1360’s.

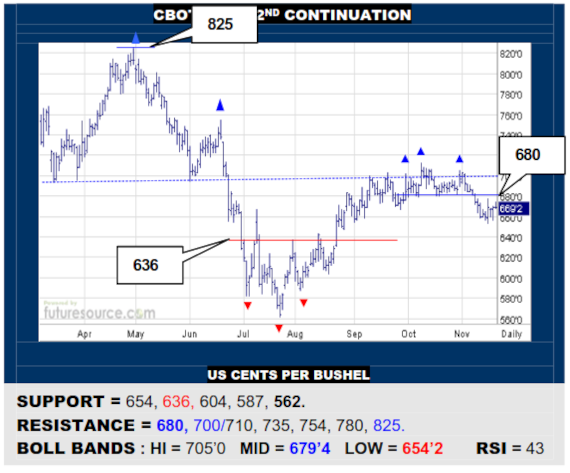

CBOT CORN 2ND CONTINUATION

Multiple rebukes from the 700’s led to Corn posting a small H&S as it broke down below 680. The market has made efforts to shake off this slip but would have to bust cleanly over 680 to do so and have a better shot at overhauling 710. While still blunted by the 680 obstacle, beware a next leg on down to 636 and steeper losses if it were to give way.

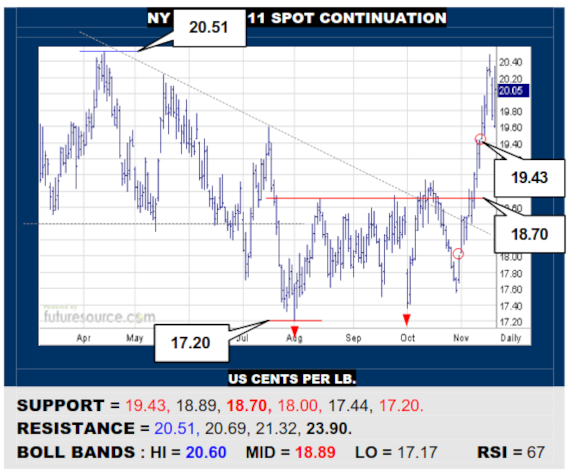

NY SUGAR #11 SPOT CONTINUATION

Preserving the 19.40’s gap, Sugar stretched on up to narrowly miss the 20.51 April peak but is still holding altitude despite twitchier action since. A chance for a thrashy type of bull flag then if able to pop 20.51, in that case bringing the 23’s into sight. Watch that 19.43 gap prop closely as well though as the tripwire back down to the 18.70 former base border.

NY COFFEE 2ND CONTINUATION

Coffee has continued to slide towards the broader weekly base support at 140 but RSI divergence is speaking to weakening momentum in Nov versus Oct. Accordingly making room down to 140 but always with one eye on the trailing mid band (168.8), mindful that an eventual reflex back over it could ignite a pretty swift correction towards 194.5.

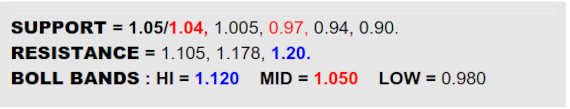

B-BERG / US DOLLAR RATIO

The macro Ratio has scored a good upturn in Q4 to release from the Jun-Sep downtrend but has eased off this week as Crude flounders. If the B-Bergs’ 113.7 ledge duly gave way, beware yet another dunk to 109.8 there that would be liable to put stress on the mid band (1.05) to 1.04 interim base rim here. If nonetheless able to balance on 1.04 (and 109.8), there would remain reason to keep faith in a further upside opportunity towards 1.20, which marks both the early ’22 top frontier and a near perfect 61.8% Fib retracement. Alas, if the B-Berg broke 109.8 though, it would look in trouble regardless of the Dollars’ plight so a break of 1.04 here would threaten a delve back down to the late Sep low at 0.97.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary