Opinions Focus

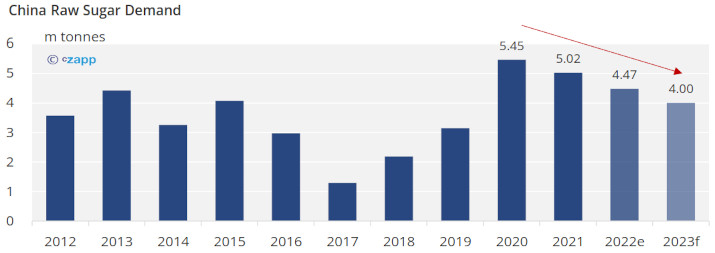

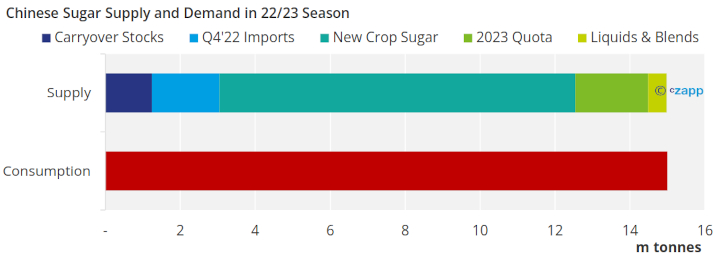

- We think Chinese raw sugar demand might be only 4m tonnes in 2023.

- This would be the third successive year of decline.

- A strong USD and weak domestic consumption are both hurting import margins.

Poor Import Margins Hurt Chinese Refiners

We think 2023 will be an extremely difficult year for Chinese sugar refiners.

They typically buy raw sugar from the world market (mainly Brazil) and process it into refined sugar for domestic consumption. But Chinese import margins have been negative for much of 2022 and this looks set to continue in 2023. Local sugar consumption has been hit by zero-COVID lockdowns, slower economic growth and the strength of the USD.

If Chinese raw sugar imports slow, this is significant for the global sugar market. China is usually one of the largest buyers of raw sugar in the world, accounting for 10-15% of global trade. Chinese refiners are extremely price-sensitive buyers and the timing of their purchases are often significant for the No.11 raw sugar futures market. For example, it was Chinese refinery buying in April/May 2020 that helped lift the market from its post-pandemic low of 9c/lb.

Let’s look in more detail at what happened in 2022 and what it means for 2023.

2022: Chinese Refiners Make Losses

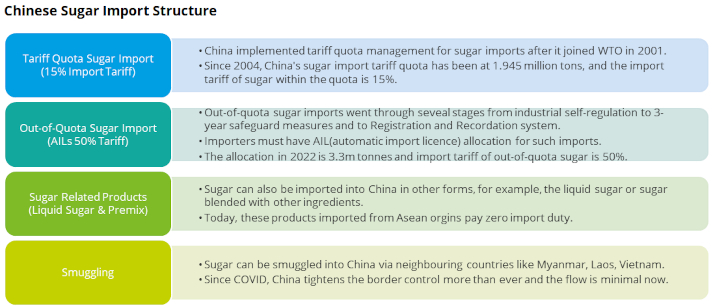

Raw sugar imports are heavily regulated by the government.

Most raw sugar imports take place under quota (15% duty) or out of quota (50% duty; automatic import licences (AILs) required).

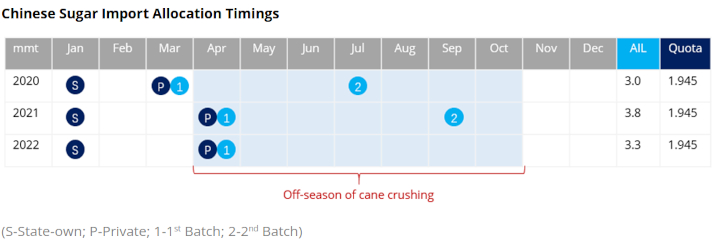

Licences to import raw sugar under quota are normally issued to state companies in January each year, with private refiners getting their allocation once Chinese cane crushing is winding down in March/April. Out of quota AILs are then usually issued in March/April, sometimes with a second batch in Q3.

The government usually expects this raw sugar to have arrived in China by October, ahead of new crop cane crushing which typically begins in December.

However, 2022 has been a bit different.

Chinese raw sugar import margins have been negative for most of the year: COVID lockdowns and a slowing economy mean that Chinese sugar consumption isn’t growing. Sugar stocks are building and domestic prices are low. Nevertheless, refiners have managed to use most of their AILs:

- Strong margins in 2020 and 2021 have supported operations in 2022.

- Refiners hedged some volume in Q1’22 when forward import margins were still positive.

- Refiners who get quota can use margins here to compensate out of quota losses.

- Some refiners command a premium in the domestic market due to brand strength.

The government has also taken a softer stance and is allowing some refiners to extend the sugar arrival date right to the end of December.

2023: No Improvement

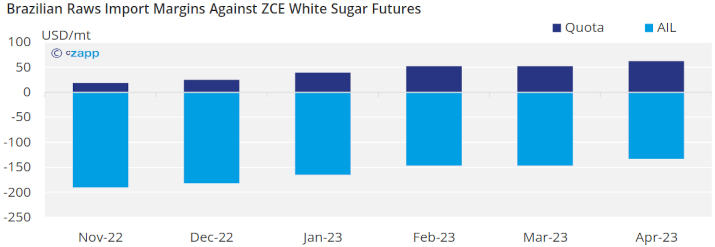

2023 Out of quota raw sugar import margins are negative, as they were in 2022. Unusually, Quota import margins are also barely profitable. We can’t think of a situation where this has happened in at least a decade.

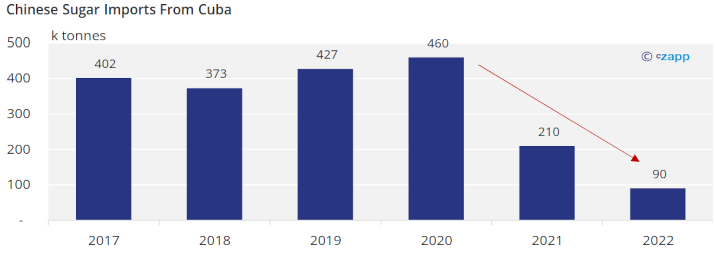

There are only 2 possible items of positive news for sugar refiners. The first is that the domestic cane crop might be lower than usual due to dry weather in 2022. The second is that Cuban sugar may not arrive in China in 2023.

Since 1960 Cuba has had the option to ship around 400k tonnes raw sugar to China each year. However, this agreement may finally stop as for the first time in more than 100 years Cuba has failed to make enough sugar to meet its own domestic consumption.

Putting this all together, we think there’s a risk that refiners don’t use their full AIL allocation this year. Of the 5.3m tonnes Quota and Out of Quota import licences we think will be issued, we think only 4m tonnes will be used.

This means Chinese raw sugar demand could drop by 11% year on year. This would be the third successive year of raws import decline.

However, Chinese refiners are extremely price-sensitive. If global raw sugar futures fall towards 15.7c/lb (breakeven at today’s Chinese domestic price), we can expect to see a flurry of buying activity.

Other Insights that may be of interest…

Chinese Sugar Consumption Lowest in 9 Years?