Opinions Focus

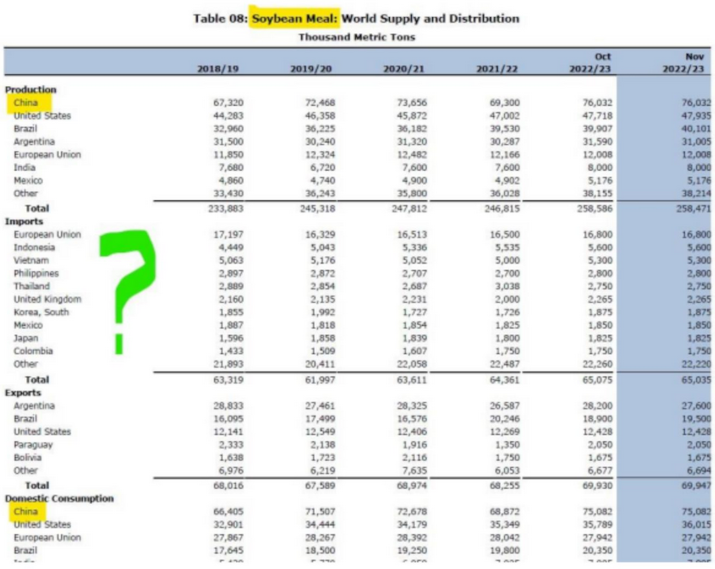

- China is the world’s largest soybean meal producer and consumer.

- However, it is now starting to import Brazilian soybean meal.

- Is this to protect soybean arrivals in case the USA stops exporting?

China is going to import Brazilian soybean meal. Wait, what?

How did this game changing story not move markets last week or at least cause significant market “chatter” when Bloomberg published the story? I am a bit stunned.

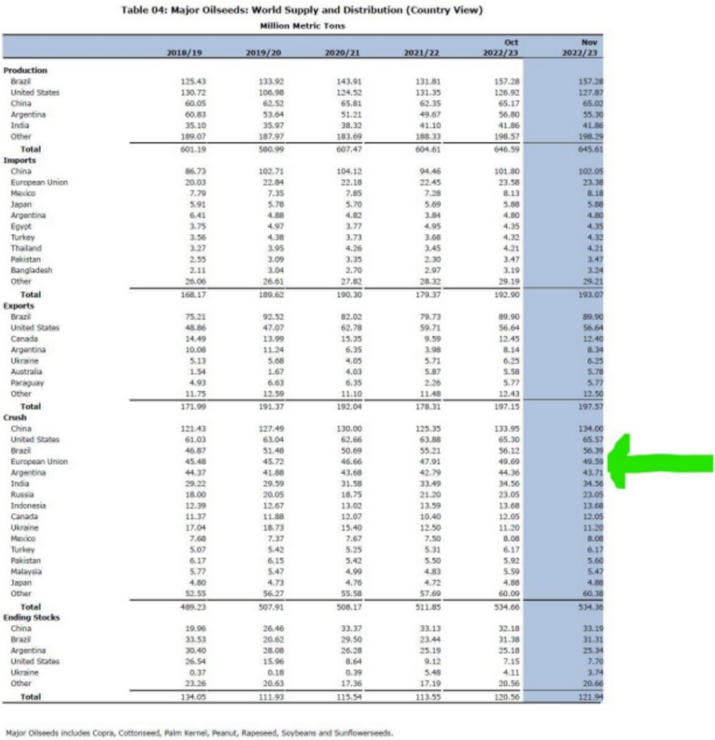

For reference, I have snapshotted the global soybean meal supply and demand table released by the USDA today and put a big green question mark on the “importer” table. China bumps whom out of the league tables? We know for certain if China decides to enter a commodity market the league tables change (and China goes right to the top).

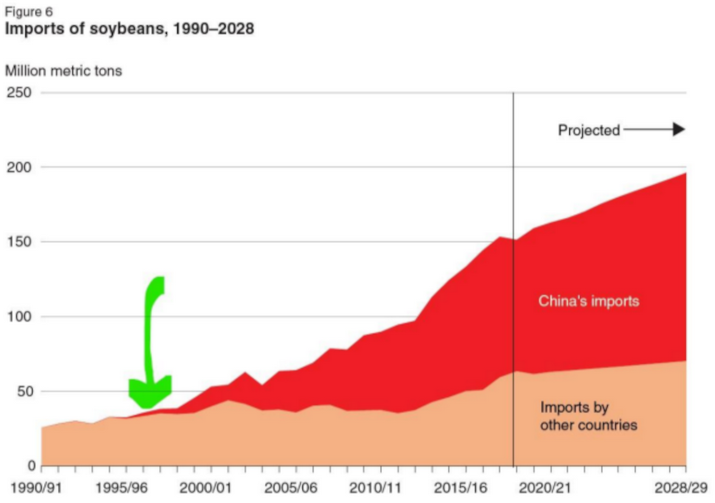

The below chart represents what happened to global soybean imports after China made a food security policy decision in 1997 (allowing Chinese companies to import soybeans at world market prices unfettered by tariffs or phytosanitary limitations also known as non-tariff trade barriers). The green arrow is the policy decision date:

Note: Data are for market years

Source: ERS analysis of USDA, Production, Supply and Distribution data, and USDA (2019).

In short, the Chinese became fully 60% of global soybean demand and the above study projects expansion to roughly 75%. The history of Chinese grain and oilseed imports from global markets is they do nothing small and once policy changes it tends to remain sustained, i.e. the chart above from a 2019 USDA study forecasts expanding imports through 2028/29 and if the authors decided to update the study today they would no reason not to stand by their original projections and may very well conclude they were a bit conservative.

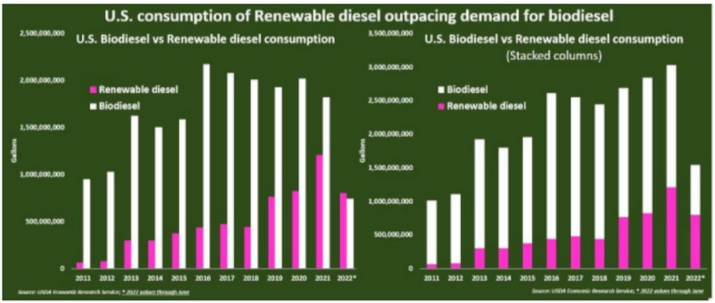

Am I too US centric in my perspective OR is there a chance that this soybean meal import policy adjustment is in effect the first opening of the Chinese soybean meal import door for others as well and effectively a response to the US’s renewable diesel policy?

Have the Chinese made the conclusion that:

- The US RD policy and the demand for soybean oil from the RD industry is sustainable (see the recently passed Inflation Reduction Act but more importantly [chart below] growing demand from the US market for RD) and will allow US domestic soybean processing capacity to expand to the point that the US no longer exports soybeans (the Chinese import 55% of US soybean exports today)?

*** the tipping point…more RD demand than biodiesel demand from US consumers…

- Are the Chinese taking a step with a Brazilian policy to ultimately expand the policy to include the US and Argentine origin soybean meal? The Chinese realize the US build out of its soybean processing capacity to meet growing domestic demand for soybean oil to support the RD industry but primarily to meet global demand for soybean meal, “the” protein building block for meat production, especially given Argentina’s decline as a global supplier (more on this below), may require the Chinese to allow US meal imports as a soybean replacement, i.e. we Chinese can’t get their (US) soybeans but we can get their meal so…let’s go with the meal since we do not have an alternative.”

- Could the Chinese try to rescue (resuscitate, give oxygen to, recapitalize, reinvigorate) the Argentine soybean processing industry with a policy change that provides a potential enormous demand for soybean meal imports and allows some capital to flow to Argentina for maintenance or expansion of its stagnating soybean processing industry thereby insuring 3 suppliers of soybean meal instead of two (the US, a potential questionable supplier who could embargo exports for diplomatic leverage, and Brazil)?

- Whatever the driver, like all things China, this story is BIG! We will keep an eye on it!

A quick review of today’s USDA updated forecast for European oilseed processing that I have promised readers of this post that I would monitor each month: No Change! Even with the EU’s power availability and cost challenges the USDA stands by a “normal” annual forecast. We will see what this winter brings for operating rates. I doubt we will call it “normal”.