Opinion Focus

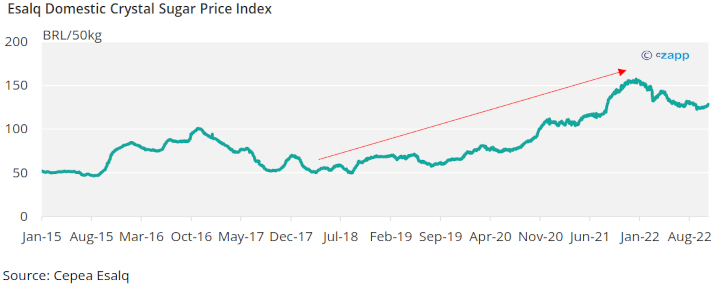

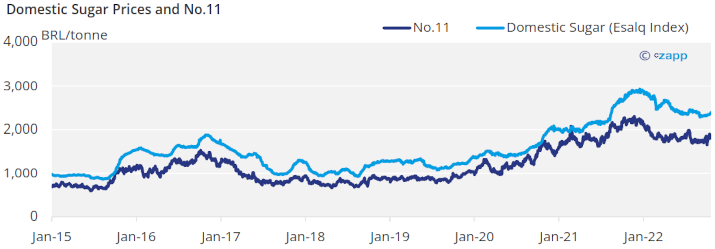

- Brazilian domestic sugar prices remain high and are not expected to fall in the upcoming months.

- Strength in No.11 market has helped push prices higher.

- Consumers can be exposed to spot market or choose to hedge No11 plus a premium.

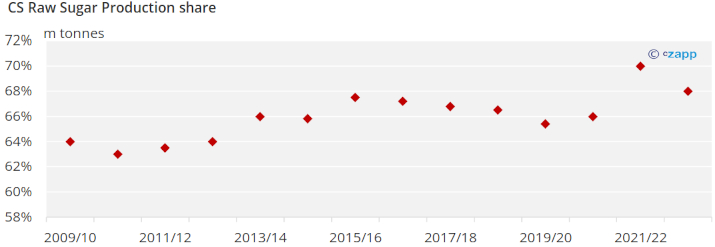

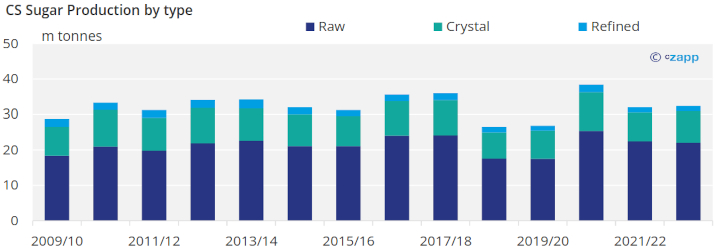

When we discuss Brazilian sugar production, most will think of raw sugar. And even though it is the bulk of total sugar output, around 68%, it is a product focused on the export market. What about the rest of Brazilian sugar production?

The second most produced sugar quality in Brazil is crystal (150 ICUMSA) sugar. 70% of this is made for domestic consumption within Brazil.

Domestic sugar prices in Brazil prices remain high, just 8% down from the peak reached last December. So how can we explain this behaviour?

Following Raw Sugar

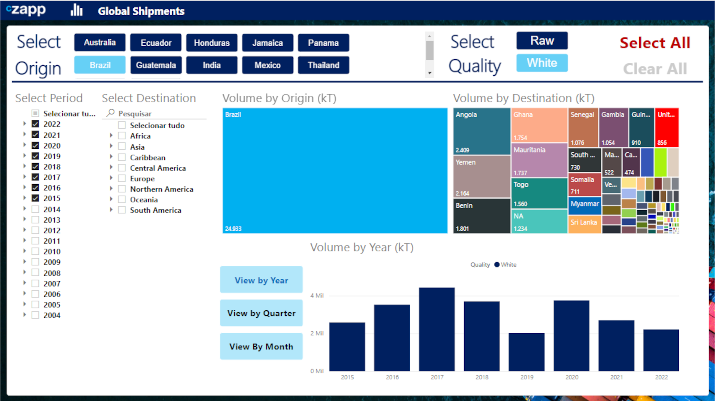

After raw sugar, the largest volume of exports from Brazil is of crystal sugar. Millers have the option of selling domestically or exporting.

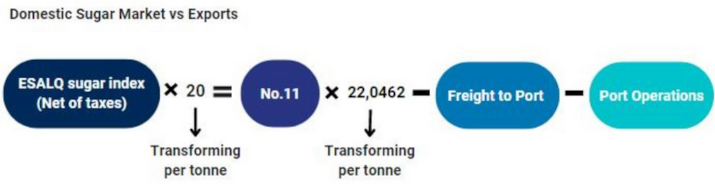

To compare the two markets, No.11 is used as a benchmark since the price for export will be No.11 plus the 150s premium.

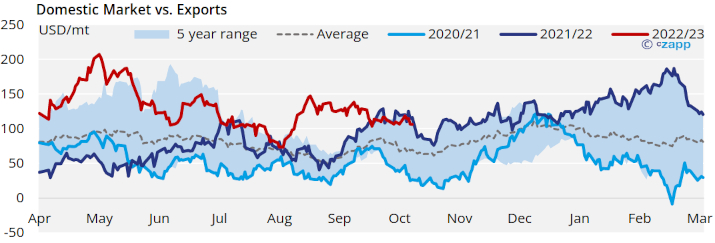

The domestic market has been showing strength since the 2H of 2021, with the spread over exports above the top of the 5-year range.

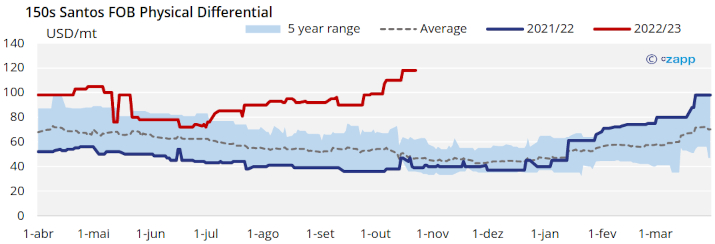

Consequently, the 150s physical differentials have followed suit and are at record levels. Premiums needed to strengthen to make exports more attractive.

Although Brazil’s whites exports are mainly to West African countries, high European sugar prices have led to increased flows there too. Crystal exports to Europe until August rose 80% year on year, mainly to Eastern European countries.

CS Brazil Crystal Sugar Market Strength

However, whites production is highly committed to the domestic market, suggesting that 150s premiums could strengthen even further this quarter.

Why is Brazil’s Crystal Sugar Market So Strong?

Brazilian sugar consumption has increased since the COVID pandemic, on average 1,5% a year over the last couple of years. Production is adjusting to the higher white sugar demand.

Raws production share fell from 70% last season to 68%. It might seem a small reduction, but in volume terms it means an additional 700k tonnes of whites availability. Given that Brazilian consumption is around 10,3m tonnes, this additional supply is 6% of annual sugar demand. And yet it still has not been enough.

The late start of cane crushing this season and a more ethanol-oriented production mix resulted in delayed fresh sugar availability. Even after mills started making more sugar, another signal was needed: mills that can produce crystal sugar instead of raws needed to increase their share as well.

Unfortunately, there are no official consumption stats for Brazil – remarkable given the per capita consumption is close to 50kg – so we rely on companies (very few) that disclose balances as well as industry stats.

One sweets and candy company showed a 12% growth in candy sales during Q2’22, while another disclosed an increase of 2% in biscuits.

Demand in November with the football World Cup in Qatar and December with the holidays will mean a further increase in domestic demand. The recent fall in prices is not expected to last too much.

Will the Strength in Domestic Prices Continue Next Season?

Our initial estimates for 2023/24 season assume higher cane crush, and maximum sugar output resulting in around 35m tonnes of sugar production. Despite an initial forecast of 2% domestic demand growth, the higher output is enough to increase crystal sugar availability.

What will support domestic prices is the constructive long-term view for No.11, and also any weakness of the Brazilian Real.

Most industrial consumers in Brazil remain exposed to the spot sugar market since the Esalq Crystal Sugar is not hedgeable; there is no financial tool in the Brazilian stock exchange to hedge sugar. The alternative is hedging No.11 plus a premium for the 150s quality.

Other Analysis Insights You Might be Interested

Recession Data Points Away From Consumption Slump

Ask the Analyst: How Brazilian Mills Make Hedging Decisions?