Insight Focus

- Voluntary carbon offset prices could weaken in the coming weeks.

- This follows weakness in the global economy.

- Interestingly, supply in voluntary offsets has fallen sharply in Q3’22.

Voluntary carbon offset prices could edge slightly lower towards the end of the year as corporate buyers reflect on the worsening macroeconomic outlook, even as buyers focus more closely on more recent, higher-quality credits, according to an analysis firm.

Trove Research, a leading carbon offset consultancy, polled 280 participants during a recent quarterly outlook webinar and found that for most categories of offset the outlook is bearish.

Around 50% of participants expect renewable and energy efficiency offsets to price between $3.00-$6.00 at the end of this year. Three months earlier, around 40% of participants had predicted prices in this band.

In June, around 45% had predicted prices for renewable and energy efficiency credits to stand between $7.00-$10.00 at the end of the year; at the most recent event this share had fallen to about 36%.

Price ideas for avoided deforestation (REDD+) credits improved slightly, with around 45% of those polled expecting prices of between $11.00-$14.00 at the end of the year, as higher expectations were reduced. In Q2 the share expecting price in this range was around 35%.

Nature restoration offsets saw improved price forecasts as well; around 35% foresaw prices of $15.00-$18.00, up from around 29% in Q2, while the share of those predicting levels of $19.00-$22.00 was slightly lower.

Volume-weighted average offset prices fell from $9.50 in Q1 to around $7.00-$7.50 in Q2 and Q3. However, during the peak summer month levels rose to around $9.00 due to a couple of large REDD+ issuances and below-average renewables-based offset supply.

Since the summer prices have fallen to a volume-weighted average of around $6.40, and most recently have begun to rally to around $7.50.

Nature restoration and REDD+ credits continue to achieve the best prices of $10.50-$12.00, while fuel-switching and energy efficiency offsets have rallied from as little as $4.00 in late September to nearly $7.00 in October.

Supply of voluntary offsets slumped in the third quarter, bringing the year-to-date total to 203 million tonnes, a drop of 30% compared to the same period in 2021.

The decline is due mainly to moratoria imposed on the sale of credits by two large forest nations – Papua New Guinea and Indonesia – which have suspended credit exports as they research the implications of such deals for their own national emissions targets.

Under new UN rules, countries that sell carbon credits overseas may need to account for these transfers by adding to their own domestic targets, under a principle known as “corresponding adjustments”. UN negotiators are preparing to meet in Egypt this month and the issue will be high on the agenda for many countries.

Total supply of REDD+ credits in Q3 was just 4 million tonnes, the lowest quarterly total since early 2018, according to Trove research.

Retirement of carbon credits reached 37 million tonnes in Q3, giving a year-to-date total of 116 million tonnes, up 8% on the same period last year.

The market balance now stands at a surplus of 667 million tonnes, an increase of 15 million from Q2 and up 78 million from Q3 2021, Trove said. Supply is growing mainly due to a slowdown in the rate at which offsets are being issued. REDD+ credits represent around one-third of the total supply.

Trove analysts noted that the pace of retirements shows a strong correlation to the S&P 500, and that despite the weakness in global financial markets, retirement of nature-based offsets and also recent vintage offsets have so far shown resilience.

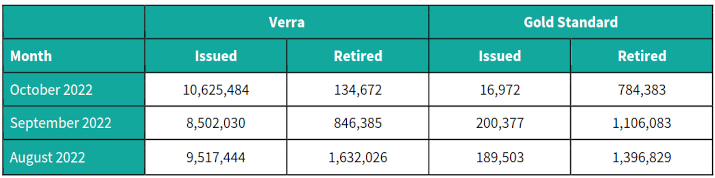

This table shows monthly issuance and retirement data for the two most widely-known voluntary carbon offset standards.