Opinion Focus

- As the cost of living rises sharply, there are fears of a global slowdown in demand.

- Based on information from previous recessionary periods, we can get an idea of how consumers should behave.

- While consumers tend not to eat less in tough economic periods, they do tend to eat differently.

While predictions of a coming recession are causing concern for consumer-facing businesses as demand is set to take a tumble, the food and beverage industry may be in a better position. Research shows that, although consumer behaviour changes greatly during a recession, consumption volumes don’t necessarily drop.

Consumption Bounces Back Slowly

Many economists are warning of an imminent economic recession, especially in Europe, the US and the UK. The most recent severe recession happened in 2008 when the housing bubble crashed and consumption in different sectors and countries took a variety of time to recover.

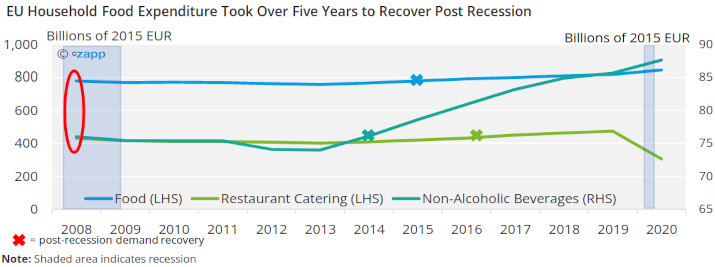

For instance, in Europe, recovery in the value of non-alcoholic beverage sales recovered in 2014, while food sales only recovered in 2015 and restaurant dining remained down into 2017.

Source: OECD

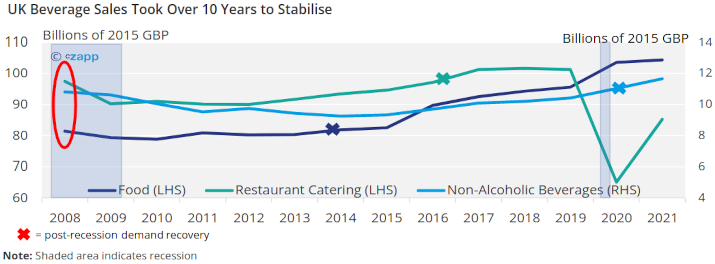

In the UK, it was food sales that recovered first – in 2014, followed by restaurant sales in 2016 and finally non-alcoholic beverages in 2020.

Source: OECD

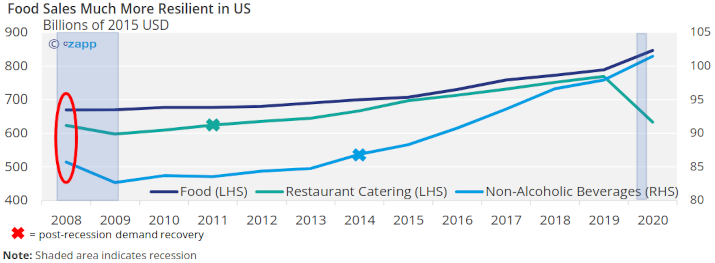

The US was a much more resilient market, and food sales continued to grow post-recession, while restaurant sales recovered in 2011.

Source: OECD

This all tells us that seemingly similar markets behave very differently due to cultural priorities, government policies and food availability. However, there are some trends that remain stable across the three regions.

Volumes Sacrificed as Price Rises

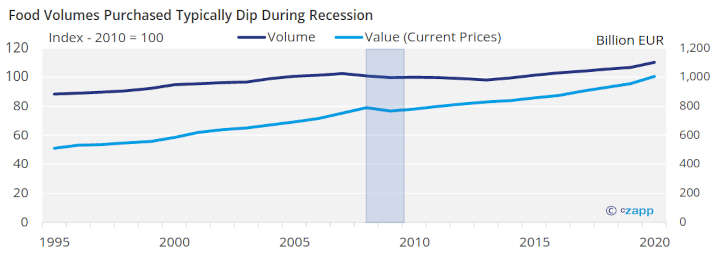

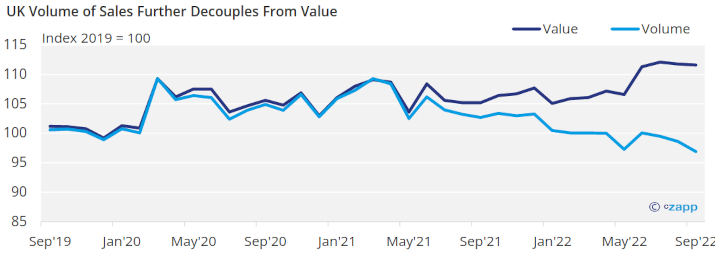

While the value of products in the European consumer basket is set to increase due to inflation, the volumes purchased typically decline during a recession.

Source: Eurostat

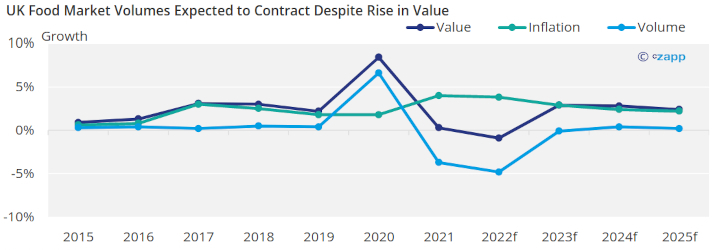

And in the UK, volume purchases of food products are starting to fall away from price. This indicates that people are buying less but higher prices are pushing up transaction values.

Source: ONS

Customers Favour Discount Stores

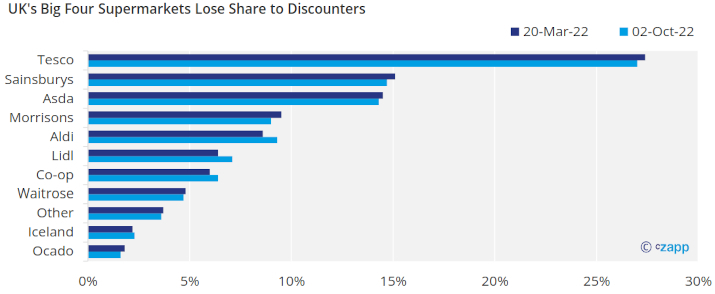

One of the biggest trends across the three regions has been the rise of discounters, indicating that consumers are trying to get more with less.

In fact, market share has changed dramatically in the UK since March. The big four UK supermarkets have gone from accounting for 66.5% of the total market to 65%. Meanwhile Aldi, Lidl and Iceland went from a 17.2% share to an 18.7% share – accounting for all the big four’s losses.

Source: Kantar World Panel

Just a 1.5% share may not seem like a lot in the grand scheme of things, but in a GBP 217 billion market, the sales add up to GBP 3.3 billion.

Similarly, in the US, discounters now occupy the top nine spots in grocery rankings out of 69 retailers, while major brands such as Costco, Walmart and Trader Joe’s have been relegated to the low teens.

Source: DunnHumby

According to research by DunnHumby, visits to discounters have grown by 4.6% so far in 2022 compared to the same period in 2021, while other retailers have seen visits decline.

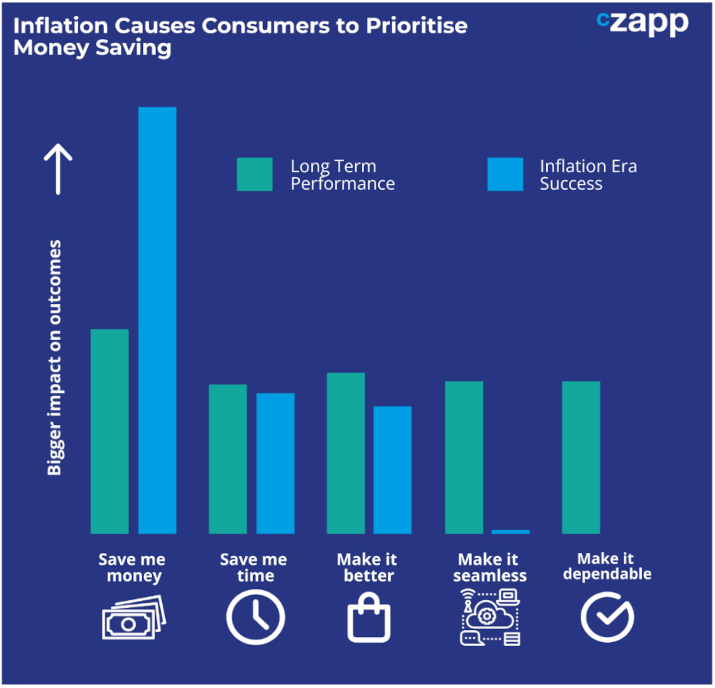

The same research found that monetary savings are the most important factor for customers during a recession. Consumers are willing to sacrifice on convenience to save financially.

Source: DunnHumby

Cheaper Alternatives Take Centre Stage

We already know that during a recession, some shoppers are turning to discounters. But many of the customers that continue to shop at big brand stores are changing the way they shop.

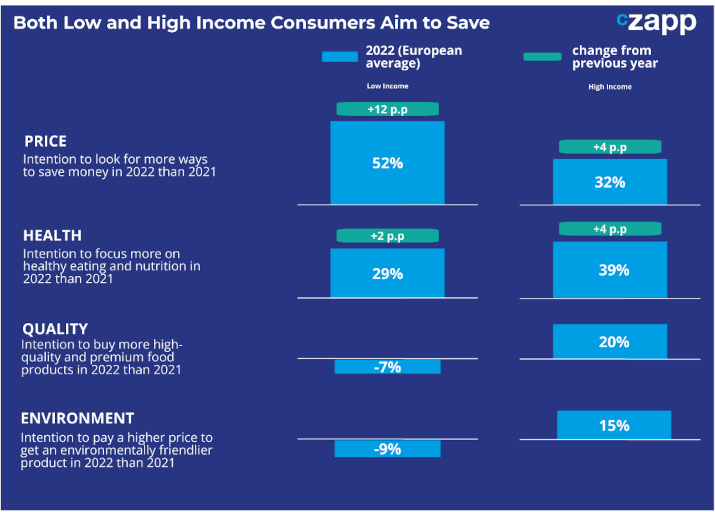

Price concerns have certainly taken centre stage, with more European consumers from both low and high incomes saying they want to save on price in 2022 than did in 2021. There is also less of a focus on quality among low-income consumers than there was in 2021.

Note: European average = share of consumers who want to do more of activity minus share of consumers who want to do less of activity in 2022 vs 2021; thus negative numbers imply that consumers want to reduce their grocery shopping in these categories.

Source: McKinsey State of Grocery 2022

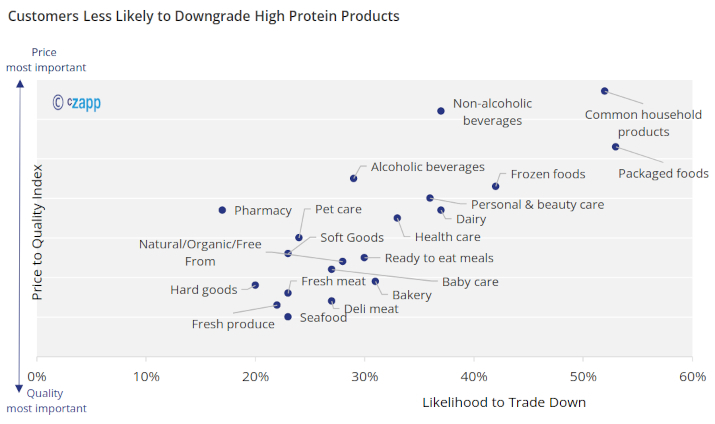

In a recent DunnHumby survey, only 17% of US consumers said they were not looking for cheaper alternatives in any category. That means 83% of shoppers are trading down or buying more own brand labels. There are certain “low value” items that are more likely to be traded down.

For those products of which quality is deemed most important, such as fresh produce, meat and seafood, it is more likely that consumers will buy less of these products rather than trading down.

Source: DunnHumby

Consequently, items such as packaged food, frozen food and non-alcoholic beverages are likely to make up a much larger proportion of the diet.

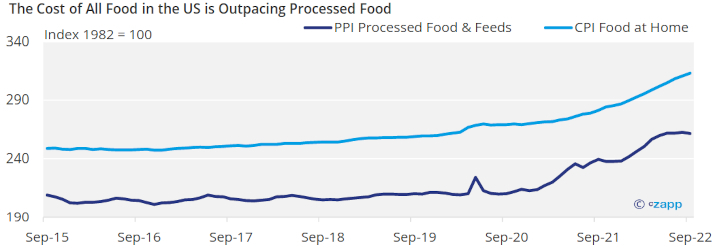

Given that the cost of processed food and feed is not rising nearly as quickly as the cost of all food, it is likely that processed options will remain the preference for many households that are keeping a close eye on budgets.

Source: St Louis Fed

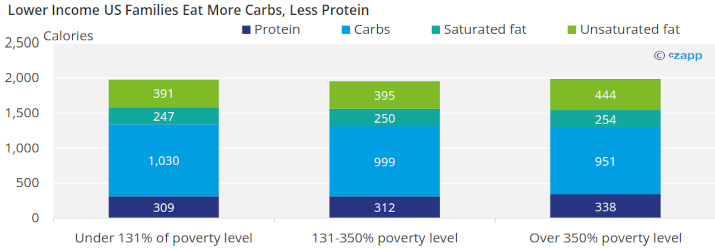

And when income is lower and buying power is limited, consumers tend to turn towards cheaper, higher calorie foods in the form of carbohydrates, while they eat less protein-rich foods. This typically means increased consumption of processed and ultra-processed foods.

Source: USDA NHANES

Bulk Buying Compensated by Smaller Purchases

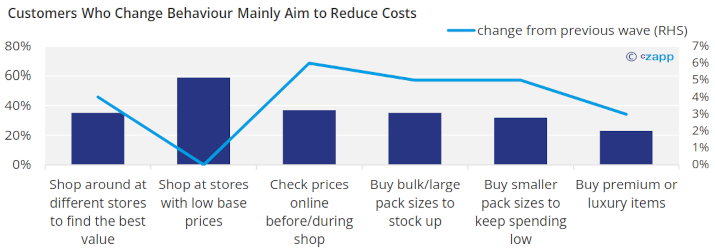

There are two reasons why spending has not dropped in absolute terms. Firstly, goods cost more so supermarket revenues are remaining stable for the time being even with volumes dropping. Secondly, those who can afford to are stockpiling.

Source: DunnHumby

But almost the same number of people stockpiling are now downsizing. For those who cannot afford to stock up, smaller pack sizes are the answer, which compensates for stockpiling in terms of volume purchases but often ends up costing more.

“More affluent households, with an income of $100k+, are significantly more likely to buy bulk/large pack sizes to stock up as a means of being efficient with their spending,” says DunnHunby. “For lower income households, less than $50k, that option is not always available to them and so this group are significantly more likely to buy smaller pack sizes to keep their immediate spending low.”

As a result, volumes are expected to drop further but value of spend will be pushed up by inflation.

Source: Savills

Debt Levels Increase to Compensate for Higher Spending

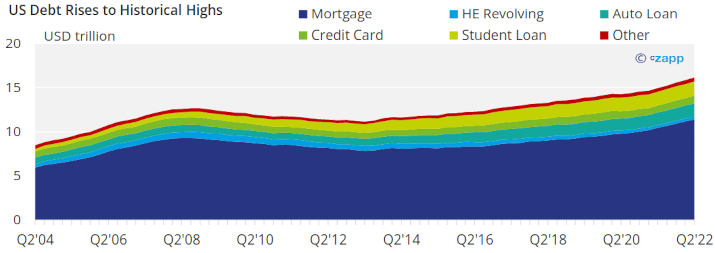

Although supermarket spend has not been significantly dented so far, it is likely that the value of spending will drop in the near future. This is because of high leverage rates, which will be exacerbated by higher interest rates.

Credit card debt in the US is at levels not seen since 2007. If consumer spending is reined in in the next few years, it is likely that shoppers will continue to downsize purchase values and try to get even more bang for their buck.

Source: New York Fed

Recession Has Longer Term Implications

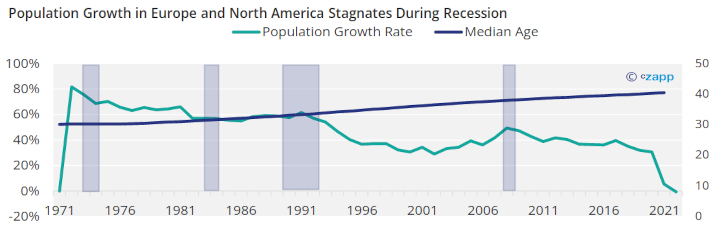

The recession has much longer-reaching impacts on consumption activity. One such example is population growth.

Higher levels of consumption are underpinned by healthy population growth. But the population growth rate has been declining in developed countries and is likely to decline even more as families can no longer afford as many children.

Source: United Nations

An ageing population is also negative for consumption in general and sugar consumption in particular.

Concluding Thoughts

- As the cost-of-living crisis worsens consumer behaviour is likely to continue to change.

- Although the total caloric content consumed does not tend to change, shopping habits do.

- Consumers are looking for more for less, meaning they are likely to change to cheaper stores and brands.

- Spending on lower cost products with longer shelf life is likely to increase.

- Carbohydrate heavy foods should win out against pricier protein-based foods.

- This could prompt a push back on certain government policies to decrease the consumption of processed food, particularly in the UK.