Insight Focus

- PTA and MEG futures rally as rumours circulate of China’s easing zero-COVID policy.

- PET raw material forward curve indicates a sharp drop-off in near-term prices.

- PET export prices expected to follow lower, with a potential market bottom in sight.

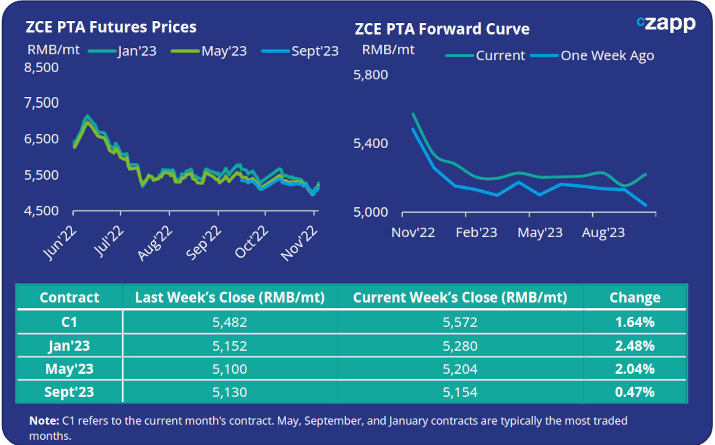

PTA Futures and Forward Curve

- PTA futures saw a modest rebound last week, with the main Jan’23 contract up nearly 2.5%, with crude rising higher on a weaker dollar and rumours that China may be looking to ease some of its Covid regulations.

- Whilst PTA liquidity has eased on higher PTA operating rates from some larger producers, lower polyester operating rates and weakening PTA demand is expected to keep pressure on prices, with further declines anticipated.

- The PTA forward curve remains heavily backwardated in the near-term. At last week’s close, the Jan’23 contract traded at a 290RMB/mt discount to the current month.

MEG Futures and Forward Curve

- MEG futures saw a bounce on last week’s crude rally fuelled by speculation of potential easing of China’s zero-COVID policy.

- Some traders bought to cover short positions. However, any meaningful change in policy is thought unlikely before the government’s ‘two sessions’ meeting in Mar’23.

- MEG supply from the Middle East to Asia, is expected to tighten through November and December, with producers, MEGlobal and Sabic, announcing production cuts and maintenance turnarounds.

- However, new domestic Chinese MEG capacity and weakening downstream demand from the polyester textile industry is likely to see inventories increase in the short-term.

- Any upward momentum in the MEG market looks set to remain limited; the Jan’23 contract closed last week at a small RMB 44/tonne premium to the current month.

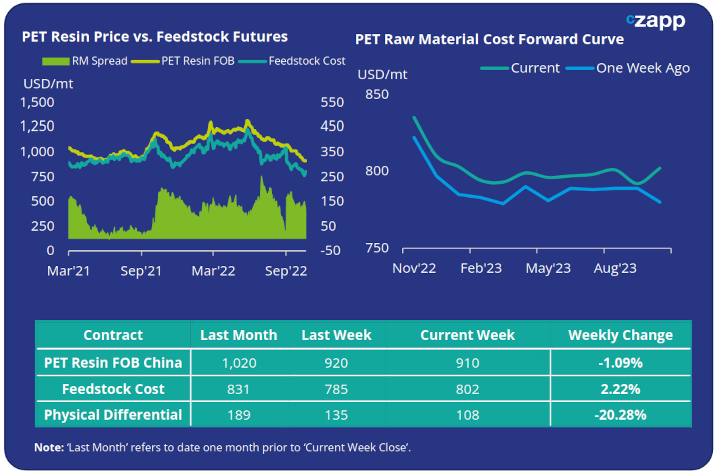

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices again softened slightly last week, falling USD 10/tonne on the previous week and to 910USD/mt, sub-USD 900/tonne prices are expected in the coming weeks.

- The weekly average PET resin physical differential to feedstock costs saw a marginal increase of USD 5/tonne last week, to USD 132/tonne. However, the jump in crude and upstream prices towards the end of the week, left Friday’s daily spread at just USD 108/tonne.

- The PET resin raw material forward curve remains in backwardation with the Jan’23 contract showing a USD 32/tonne discount to the current month.

Concluding Thoughts

- The near-term steepness of the forward curve for feedstock costs, indicates that a large part of any future discount is likely to be seen in Q4’22 before the cost profile flattens out into 2023.

- Whilst greater interest in Asian exports is being shown by some large foreign buyers, new order intake remains sluggish.

- Expectations are for export demand to continue to move lower through Q4 before buyers in the Northern hemisphere target an increase in deliveries ahead of the 2023 peak-season.

- PET export prices are expected to fall below the USD 900/tonne level over the coming month, resulting from this softer short-term export demand, combined with a backwardated raw material forward curve.

- However, prices much below the USD 900/tonne mark could equally catalyse a round of fresh buying activity lessening the downward momentum in prices seen recently.

- Could the PET resin export price be close to bottoming out?

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

PET Resin Trade Flows: Asian PET Exports Weaken in Q3 as Seasonal Demand Withers

European PET Market View: European PET Producers Facing Losses Contemplate Further Shutdowns

Plastics and Sustainability Trends in September 2022

PET Resin Trade Flows: Korean PET Exporters Eye Greater European Share in 2023