Opinion Focus

- Lula win for Brazilian Presidency could pose a risk to ethanol price outlook

- The main issue is regarding view on fuel price policy in Brazil

- How much is the downside risk?

After the shortest presidential campaign in the Brazilian history, since the re-democratization of the country, a winner was declared this Sunday. Current President Bolsonaro failed to get re-elected and Lula (now on his third term) will assume office in January.

What can we expect for ethanol?

Gasoline Prices Short Term – next 2 months

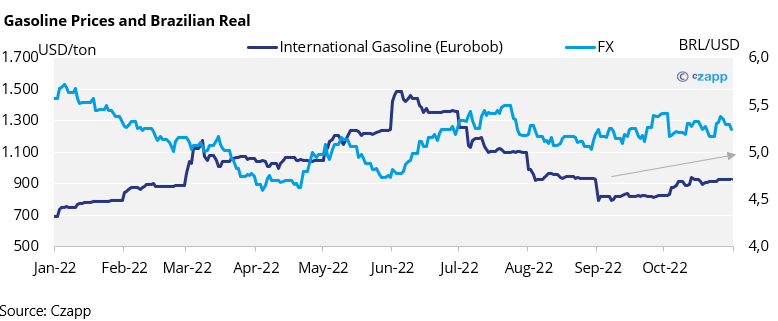

Gasoline prices have been below international benchmark for the past month. It coincided with the period between the 1st and 2nd run of presidential elections, and any increase in gasoline prices would prove to be negative for Bolsonaro campaign. As it turns out, holding off readjustments was not enough.

Rumours are now circulating of a potential increase by the end of the week. And given recent calculations on gasoline international price parity, the price increase could be around BRL0.6/litre.

This is positive for ethanol prices, which could rise 240pts without affecting it competitiveness.

It will not change the sugar mix for 2 reasons:

• Sugar is still offering better returns.

• CS Brazil is at the tail of the season.

Still, it is positive for those mills carrying ethanol for the offseason.

Gasoline Prices Medium/Long Term

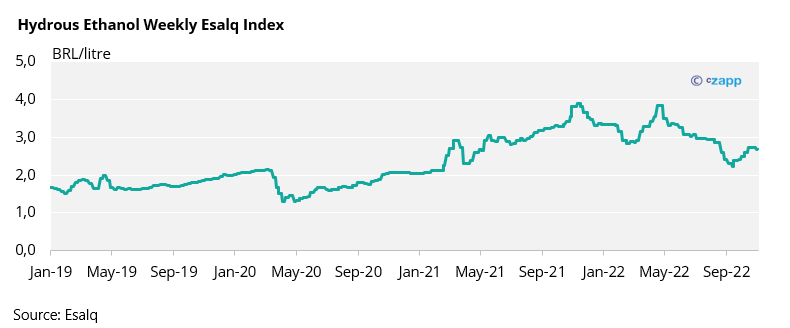

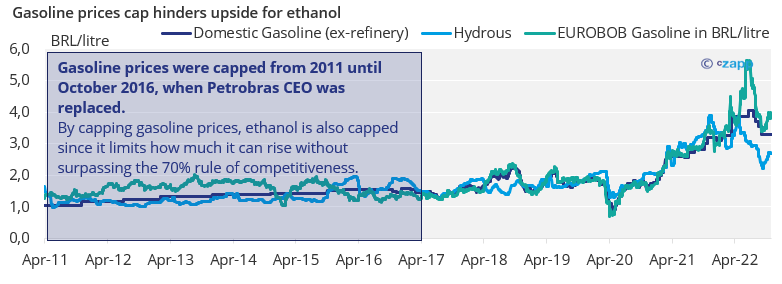

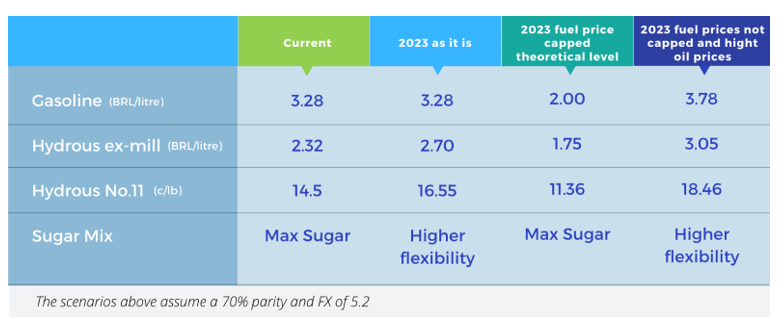

One of the major risks for the next 4 years of Lula’s presidency is the Petrobras’s price policy. During his campaign he has stressed that domestic fuel prices must not follow an international benchmark, and that price levels will be revised. On practice this could mean the return of capped fuel prices, breaking the link with the energy market.

Even if Brent oil outlook is over USD100/barrel, the strength of the energy market would not be passed on to ethanol which in turn means lower support levels for sugar.

On the other hand, fuel tax exemptions instituted by Bolsonaro will end in 31st of December. Cide and PIS/COFINS federal taxes will return, and since gasoline has a higher tax burden, ethanol prices can rise by 200pts without affecting its competitiveness.

In summary, end of federal tax exemptions is positive for ethanol price outlook. However, depending on the changes in gasoline price policy, gains could be offset.

Increase in Blend?

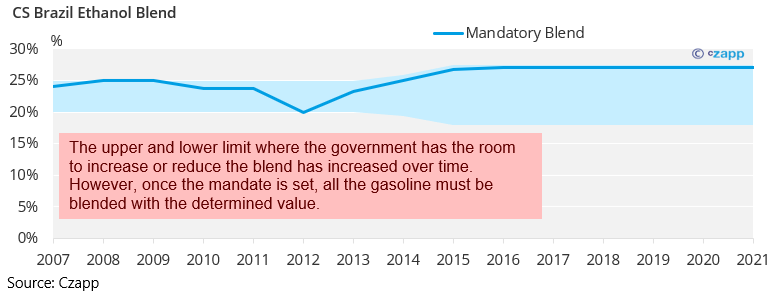

During his campaign, as a nod to the sector Lula has mentioned a potential increase in anhydrous blend in gasoline. However, there is a problem… by law the upper limit for anhydrous blend is 27.5% and current blend is already at 27%. Will he propose a law to increase the upper limit? Even if he does, there is a potential resistance by car manufacturers association to rise the blend even further – similar to what we saw in 2014.

Assuming a rise in anhydrous blend from 27 to 27.5% would mean an additional 160mi litres needed. Even with a max sugar season in 2023/24, it is a volume that the sector can supply.