Insight Focus

- The raw and white sugar markets continue their decline through last week.

- The No.11 has fallen enough to see consumer buying pick back up after a month of little action.

- Raw sugar speculators closed many of the recently opened long positions.

New York No.11 (Raw Sugar)

No.11 values continued to slide over the last week, closing near 17.5c/lb on Friday.

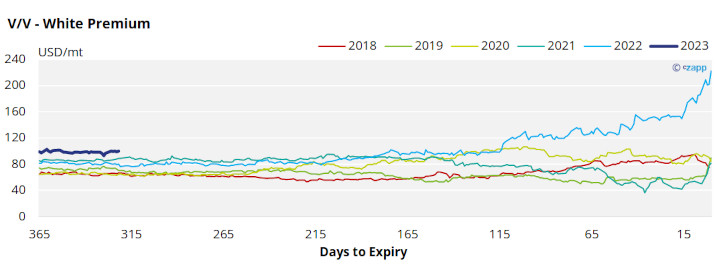

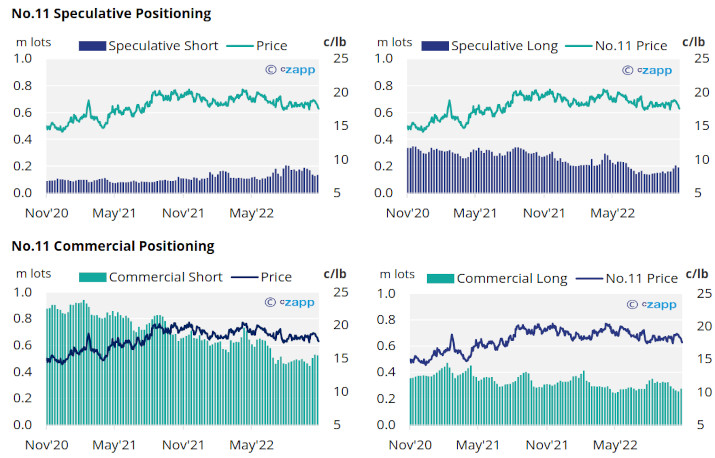

As of the 25th October (latest CFTC CoT report) raw sugar consumers bought more aggressively with prices in decline, adding almost 22k lots of new hedges.

The commercial short position retreated by over 2k lots as producers were not willing to add any additional cover with the market toward 18c/lb.

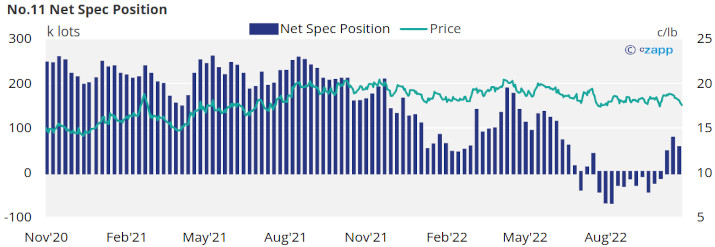

With much of the recent spec long position built with the market above 18c/lb, many recently opened positions may have been under pressure as the market retreated. As such over 15k lots were closed, reversing all gains made in the week before.

Alongside this, a modest increase in the spec short position means the No.11 net spec position now stands at 55k lots long.

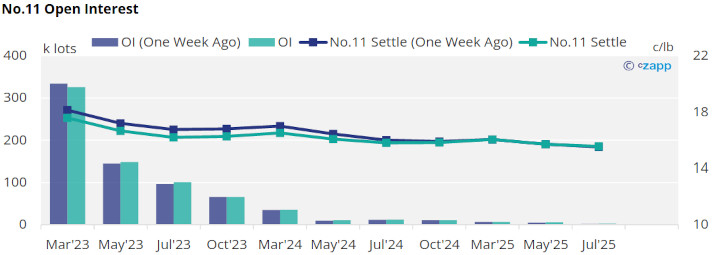

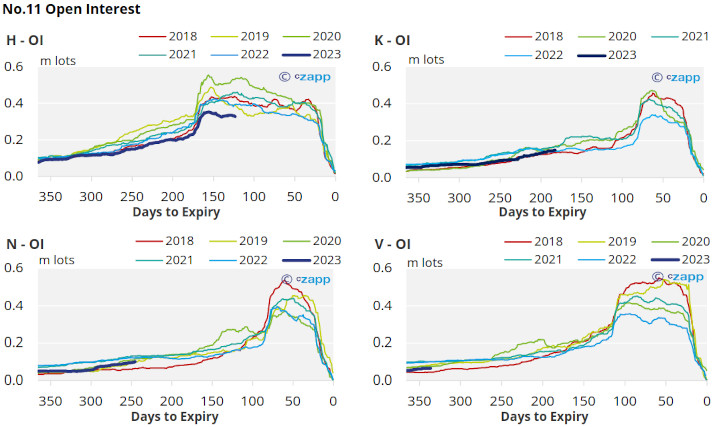

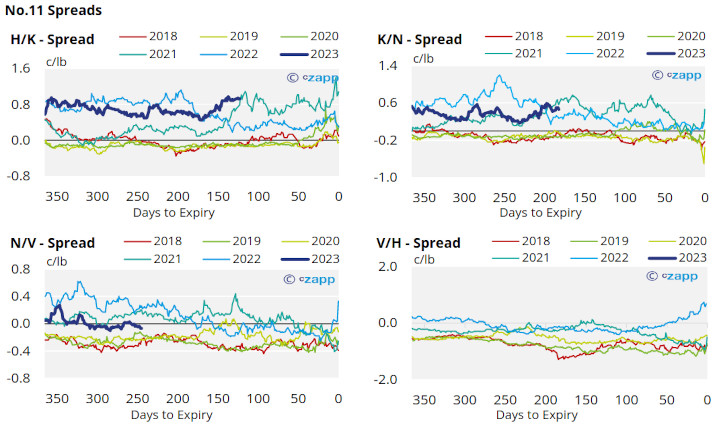

With prices down the board weakening over the last week, the No.11 forward curve remains backwardated toward the middle of next year, moving into carry toward Mar’24.

London No.5 (Refined Sugar)

Refined sugar prices have also continued to weaken over the last week, moving below 520USD/mt by the end of trading on Friday.

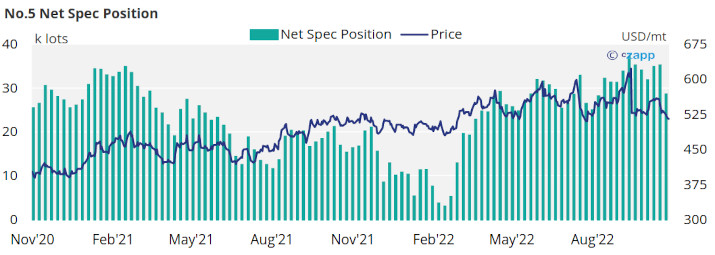

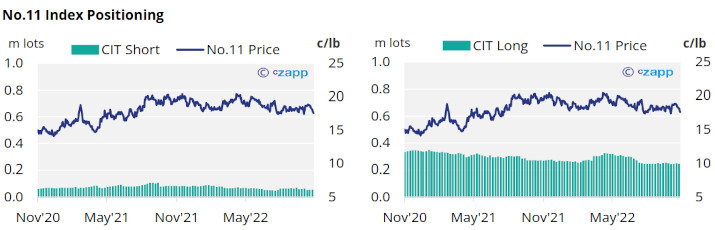

Perhaps aiding this decline, refined sugar speculators have closed almost 7k lots of long positions by the 25th of October. This is the largest one week change since February and leaves the net spec position at its lowest point since the start of August.

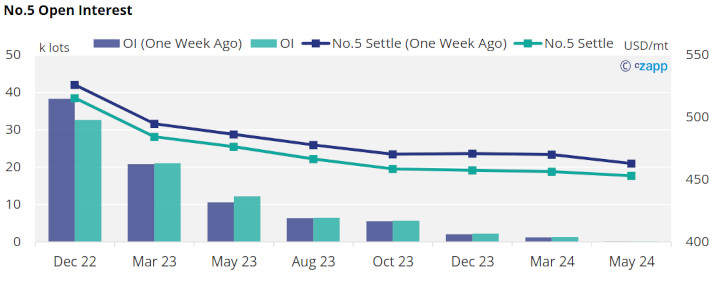

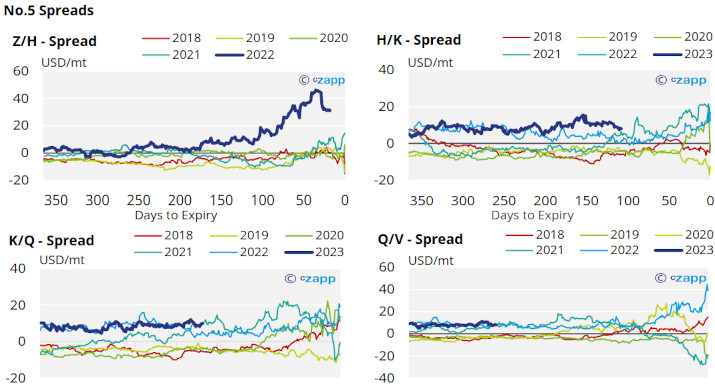

The No.5 forward curve remains strongly backwardated for at least the next 12 months as prices fell all down the board.

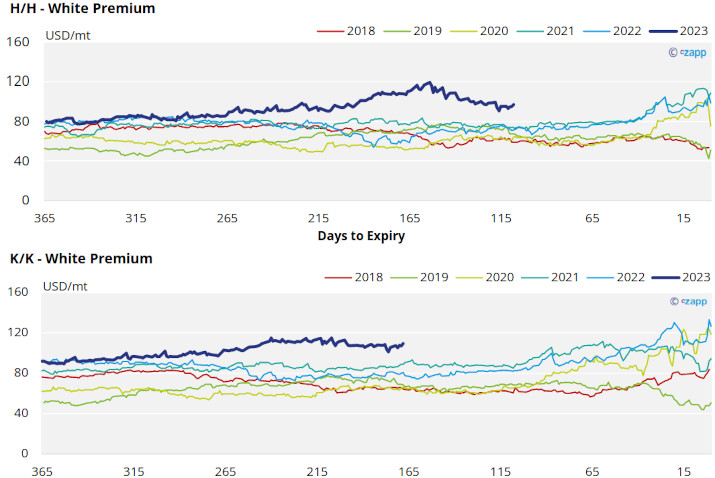

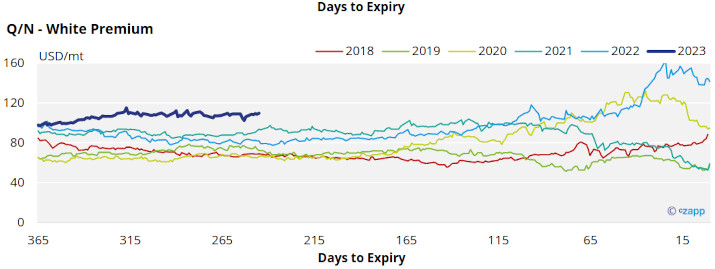

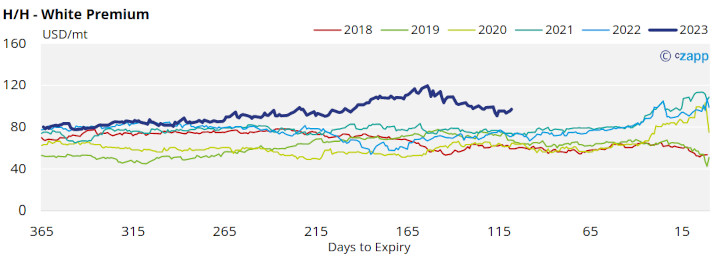

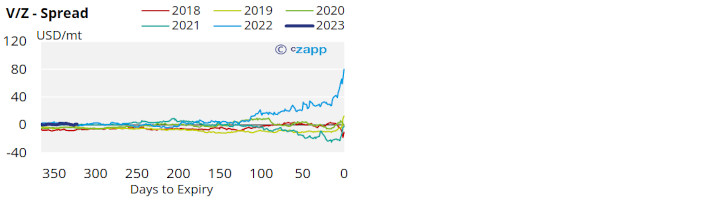

White Premium (Arbitrage)

With the No.11 experiencing more downwards pressure over the last week, the white premium has recovered slightly, reaching almost 97USD/mt by Friday.

Whilst we think the wider decline has been partially driven by bearish macroeconomic factors, there is also a growing case that inflationary pressure on economies around the world could be causing a decline in usually robust sugar demand.

Many re-exports refiners need around 120-130USD/mt above the No.11 to produce refined sugar, therefore the current white premium is not strong enough to incentivise this.

The proceeding K/K and Q/N white premiums remain above 100USD/mt, stronger than the front month H/H white premium, though this would still not be high enough to incentive strong re-export refining.

For a more detailed view of the sugar futures and market data, please refer to the data appendix below.

No.11 (Raw Sugar) Appendix

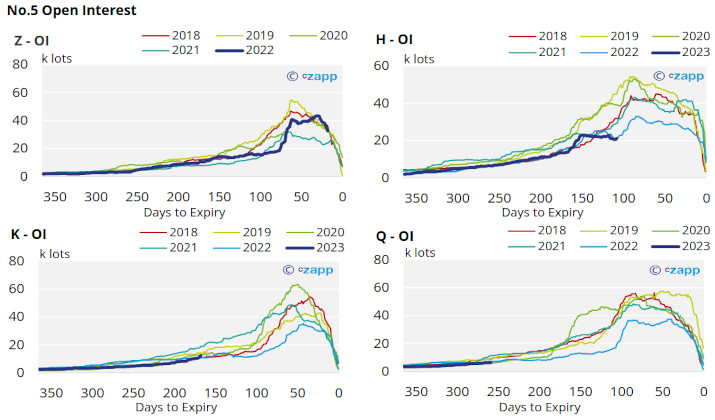

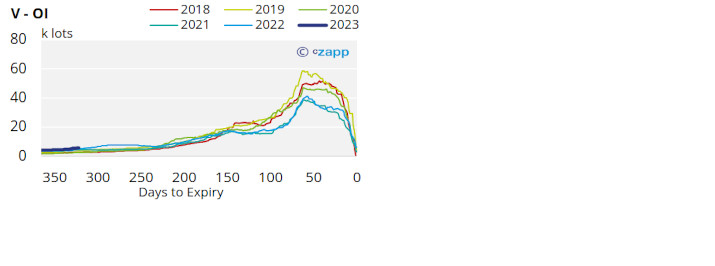

No.5 (White Sugar) Appendix

White Premium Appendix