Opinions Focus

- Increased demand in 2022 for EU Carbon Emission allowance.

- Widespread shift back to coal as the most profitable electricity source.

- Coal emits twice as much carbon dioxide as natural gas per megawatt-hour of electricity.

Analysts see European carbon prices staying flat in 2023 amid competing pressures.

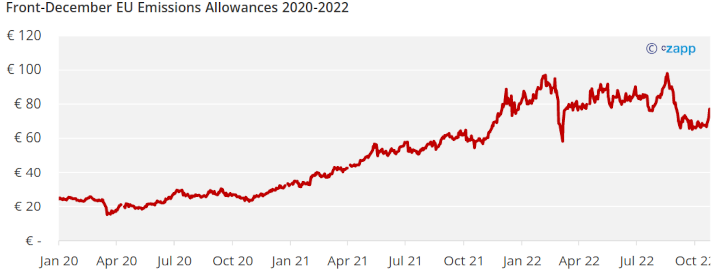

European carbon prices are expected to fluctuate around their current levels for the next 15 months as Europe comes to terms with the energy crisis and sets a course for a speedier transition away from gas and coal as its main energy sources.

Russia’s invasion of Ukraine led to the suspension of gas deliveries to Europe through the Nord Stream pipeline, trebling gas prices and threatening the region’s energy security.

European buyers scrambled to replace much of the lost supply by purchasing liquefied natural gas (LNG) cargoes from overseas producers, and underground storages have been successfully replenished ahead of the high demand winter season.

But the sharp jump in prices meant that natural gas became uneconomical as a power-generation fuel, and there has been a widespread shift back to coal as the most profitable electricity source.

And with coal emitting roughly twice as much carbon dioxide as natural gas per megawatt-hour of electricity, this has increased demand for EUAs in 2022, sources say.

Some sources put the increase in demand for EUAs from the power sector at more than 80 million tonnes this year, and say the trend will likely continue into next year.

However, the same high gas prices have hurt industrial companies, many of whom have been forced to reduce or even suspend production during 2022. One analyst counted over 70 separate announcements of reductions or stoppages this year.

Analyst Florian Rothenberg of ICIS recently told a carbon markets conference that industrial demand was likely to fall by at least 16 million tonnes in 2022, and that some industrial companies are also switching from gas to coal or oil to run their plants.

The EU’s response to the energy crisis has been to propose measures to speed up the transition away from Russian fossil fuels.

The REPowerEU initiative, proposed by the European Commission in the early summer, would spend €210 billion to phase out imports of Russian fossil fuels. Part of this funding would be generated by sales of additional EUAs taken from the Market Stability Reserve.

Current proposals call for the EUA sales to generate €20 billion, implying that more than 250 million additional allowances would be brought back into the market.

Legislators in the European Parliament have disagreed with the Commission plan, and have proposed instead that the additional EUA sales should instead come from member state auction. This would avoid bringing new supply into the market, in favour of simply bringing forward future sale volumes. Negotiations over the final scope of the sales will begin in November.

At the same time, legislators are debating a package of reforms to the EU ETS that would strengthen the market over the period to 2030, tightening supply and raising the market’s target to a 55% reduction in emissions compared to 1990.

This “Fit for 55” package is widely seen as a long-term bullish influence on prices, though some analysts are concerned that some of its measures might be watered down to protect business and industry from the impacts of the energy crisis.

“We believe the market should question whether the ‘Fit for 55’ reform is viable against the current economic backdrop,” analysts at Morgan Stanley wrote in a report.

Morgan Stanley cut its EUA price forecast for the end of this year to €62/tonne, a drop of 23% from the previous prediction of €80/tonne, saying that the influence of recession and a European Union intervention in the market would outweigh a rise in demand due to increased use of coal for power generation.

Meanwhile, analysts from Refinitiv estimated that EUAs would average €80/tonne in 2022, a €1 drop from the company’s forecast of €81/tonne published in June.

Refinitiv predicted that prices would average €70/tonne in 2023, a drop of €10 for the previous estimate.

So far this year, the daily closing EUA price has averaged €66/tonne and the market settled at €77.11 on October 25.

Refinitiv’s adjusted forecast reflects “the assumption of an extraordinary sale of EUAs in the coming years (2023-2026) to raise €20 billion to partially finance the REPowerEU plan to move Europe away from its dependence on Russian fossil fuels.”