For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

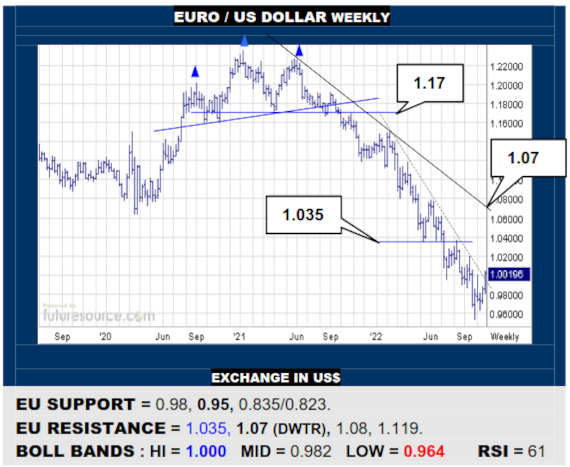

EURO / US DOLLAR WEEKLY

A pivotal juncture as the EU pokes over 1.00 while the Dollar index dices with 110. If able to get a grip over 1.00 and so negate the ’22 downtrend, there would be scope on up to 1.035 and later even the broader trend (1.07). If the index held 110 and the 1’s fail to endure here, a twist back under 0.98 would signal a correction peaking.

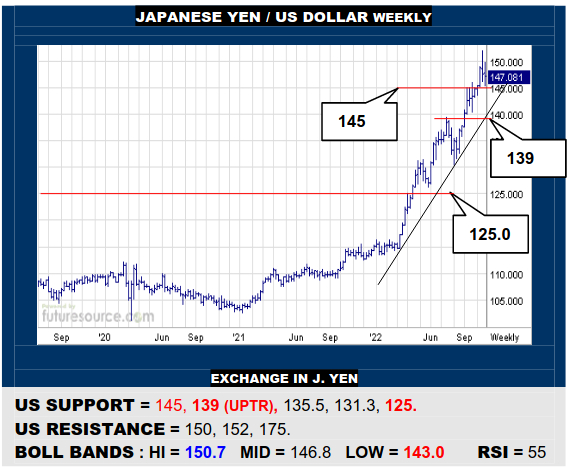

JAPANESE YEN / US DOLLAR WEEKLY

A fleeting lunge at the 150’s has seen a swerve back to the initial 145 support. If the US can grip here, a correction could come and go and the 150’s would be prone to further assault. However, if 145 gave way, beware more extensive losses that could then challenge the 139 support as it hosts the ’22 uptrend.

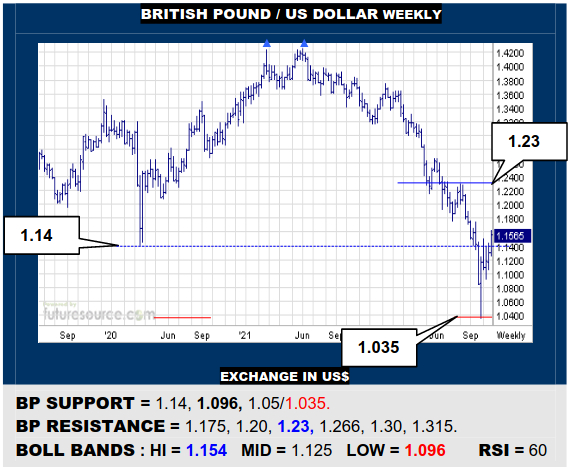

BRITISH POUND / US DOLLAR WEEKLY

The BP has bounced from a new all-time low (1.035) to provisionally resurface over the 1.14 post-Brexit low. The job is to secure this and so highlight the prior delve as a false breakdown, exhausting the ’21-’22 decline. Success would target 1.23 and even 1.30 but failing to grip above 1.14 would warn of a dip back to the lower Bollinger (1.096).

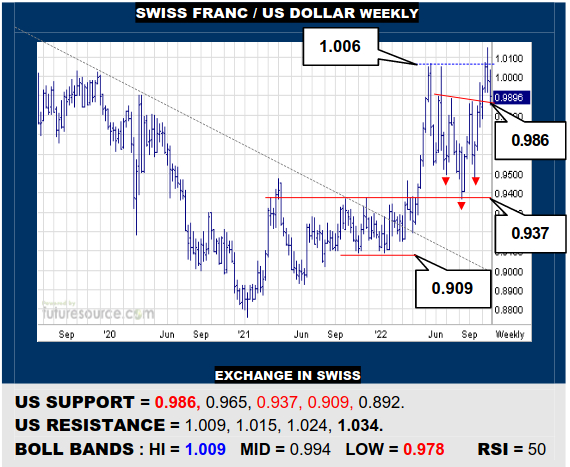

SWISS FRANC / US DOLLAR WEEKLY

A jab over 1.006 was promptly reeled back and the US is testing the 0.986 neckline of the previously formed inverse H&S. If it could grip here while the index held 110, beware a correction ending and a new foray higher. If the neckline broke though, it would hail a false break- out topside and further steps back to 0.965 and later the 0.937 base.

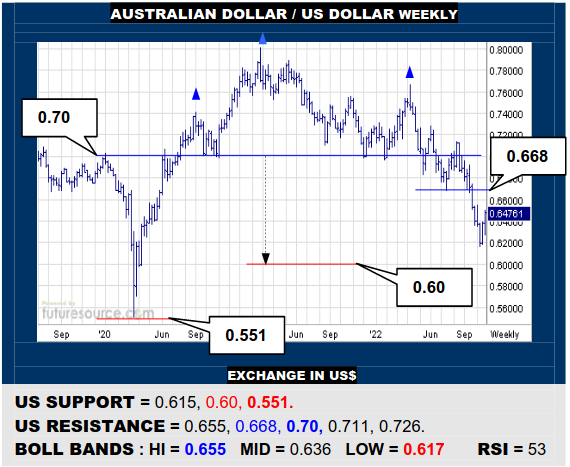

AUSTRALIAN DOLLAR / US DOLLAR WEEKLY

The AD has fought back without first reaching the big H&S target at 0.60 and has some additional nearby space overhead until 0.668. That will be the key crossing to secure the turn and train sights back on the 0.70 top frontier. If curbed in the 0.66’s, beware this proving just a correction and resuming south towards that 0.60 top projection.

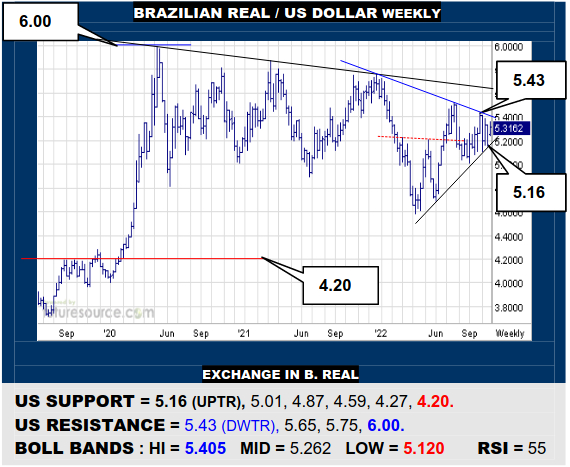

BRAZILIAN REAL / US DOLLAR WEEKLY

A midyear uptrend has continued to gather in dips but the past couple of months still give a very H&S type vibe. The US would only shake this off with a getaway over 5.43, then foreseeing renewed impetus. Minding that underlying trend closely meantime (5.16) as the trigger to resolve a toppier pattern, then threatening a delve back towards 4.60.

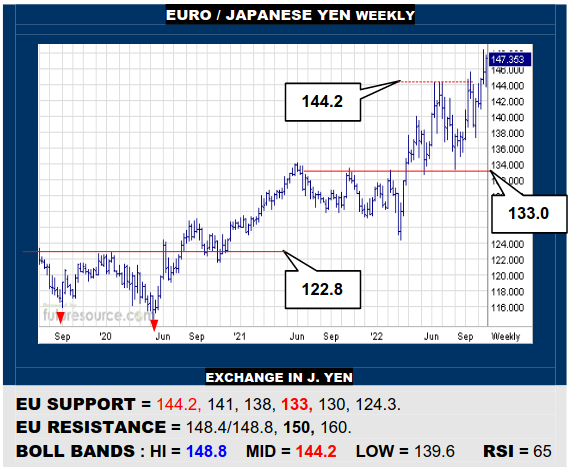

EURO / JAPANESE YEN WEEKLY

Despite a sharp correction back to the 144.2 prior peaks, the EU has stayed the course of its latest step higher but must dispatch the 148’s to recover upside momentum. Leery of the upper Bollinger (148.8) meantime as failure beneath there would instead warn of a second backlash, loss of the 144’s pointing on to 138.

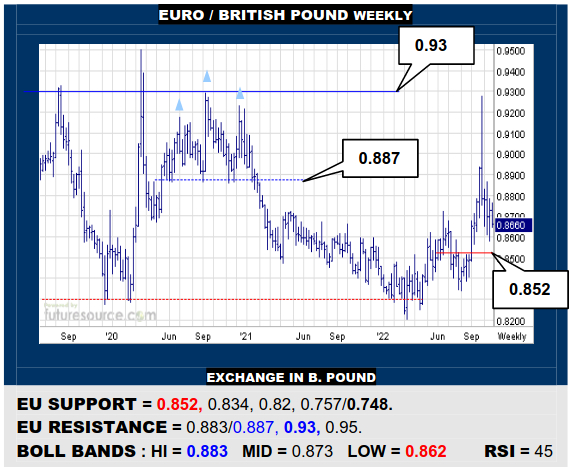

EURO / BRITISH POUND WEEKLY

The brief shot towards 0.93 as the BP hit its new Dollar low has been reeled in but the EU has shown some braking during Oct. It must arrest the setback aboard the 0.852 support to bolster prospects of a new sortie higher, next time needing to grip over 0.887 to endure. If 0.852 gave way, look for another rummage in the 0.82’s.