Opinions Focus

- A negative week for all grains as US harvest better than expected.

- But doubts about the future of the black sea export corridor continue.

- Vessel owners aren’t fixing new shipments at Odessa ports in case it becomes blocked.

Forecast

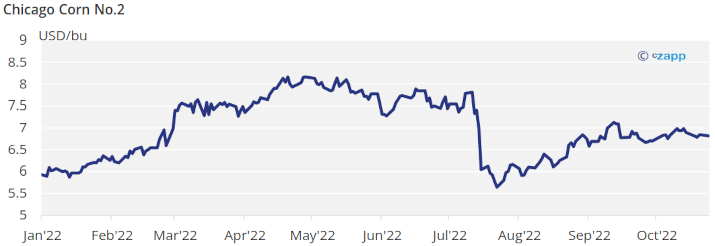

No changes to our average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu. The average price since Sep 1 is running at 6,8 USD/bu.

Market Commentary

Negative week for all grains despite a recovery by the end of the week on harvest pressure and despite continued doubts around the Black Sea export corridor.

The uncertainty about the future of the Black Sea corridor continued last week. November 22 is the deadline for the actual deal and Russia said its extension will depend on the full implementation of previously reached agreements which includes Russian exports of grains and fertilizers. Also Russia destroyed one silo in the largest export terminal in the port of Mykolayiv. This was the major influence to Wheat prices last week and probably of the recovery by the end of the week of the whole complex.

The beginning of the week saw pressure coming from US Corn harvest progress which came in better than expected.

US Corn condition worsened one percentual points to 53% good or excellent vs. 60% last year and is 45% harvested still is 5 points below last year but 5 above the five year average. French Corn is now virtually harvested having reached 92% harvested vs. 30% last year. Summer Corn planting in Brazil has reached 31% vs. 32% last year.

In the Wheat front, US winter Wheat is 69% planted, a 14 point weekly advance and in par with last year and the five year average. French Wheat planting was 46% complete vs. 36% last year. Russian Wheat harvest reached 104,1 mill ton as of October 17 and is virtually finished with 98,5% completion. This number is to compare with the 91 mill ton forecasted by the October WASDE somehow strange to understand.

Two weeks ago Russia said they were considering cancelling their grains export quota given the bumper Wheat crop they have harvested, but last week they mentioned they are considering setting a 25,5 mill ton export quota starting on February 15 and through June 30. We don’t think with will have an impact in the market as last year’s quota of 11 mill ton was not fully used thus the new quota should not be any limit to exports.

On top of the doubts if the deal will be extended, there were rumors that entry to Odesa ports would be blocked starting in November thus the uncertainty increased. Nothing has been said officially, but the reality is that vessel owner are not willing to fix new shipments for November.

Rains are now finally forecast in Argentina which will be key to recovery soil moisture. Brazil will also continue to receive lots of rains. The US is expected to have dry weather while rains are expected in Europe.

We have now more favorable weather for the winter crops and Corn is making good progress in their harvesting pace. This could lead to some selling but it should be limited given the overall supply picture is tight. The uncertainty around the future of the Black Sea export corridor should bring volatility to the market and upside risk if the deal is not extended.