Opinions Focus

- Domestic demand for US soybean oil is swamping supply.

- Soybean physical prices probably need to trade higher.

- Futures prices also need to strengthen to limit demand.

Another marketing year is in the books for the US soybean processing industry (the industry’s marketing year starts in October with the new harvest and ends in September) and the final month of the year’s statistics (really the last 4 months) cannot leave members of the renewable diesel (RD) industry feeling comfortable about soybean oil feedstock supplies for the new year.

Why?

Let’s look at the National Oilseed Processing Association’s (NOPA, the industry association that serves as the clearinghouse for monthly crushing statistics and soybean oil inventories) September report to answer that question.

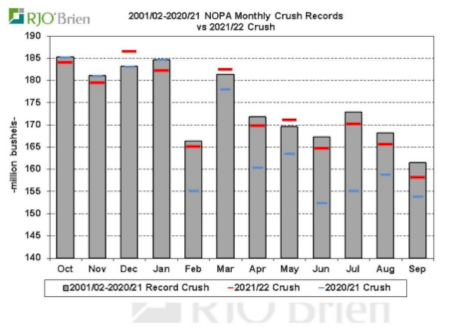

As the above chart from Chicago based futures brokerage RJ O’Brien displays, the US soybean processing industry only achieved three monthly record rates of production during the 2021/22 campaign: December, March, and May (red hash above the grey bar). After December, the highest ever monthly crush rate in NOPA history (so an indication of the true capacity of the US industry when all cylinders are firing), operating rates faded seasonally which is NOT what the US RD industry wants to happen. After May’s record crush the industry could not operate at new record rates even as margins soared toward $4 per bushel (and much higher in the Eastern Corn Belt) as RD demand for soybean oil stepped higher and Argentine processing rates declined as Argentine farmers went on a soybean sellers’ strike.

For their feedstock origination purposes the US RD industry wants to see a chart with bars that all look like December’s: record and NO seasonal slowdowns (the legacy handoff of global meal and oil supply to the South American soybean processors). The RD industry needs continuous high run rates throughout the year and the message I am afraid that is coming from the US soybean processing industry to the RD industry: you want higher run rates and consistent year-round operations then “PAY FOR IT”.

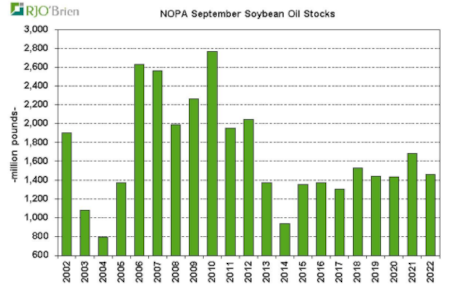

And the RD industry must be concerned that soybean oil stocks continued to draw down year-on-year even as crushing rates for the year moved higher (red hashes in the above chart consistently above the blue hashes except for January). As the below chart, also courtesy of RJO, displays the 2021/2022 marketing year ended with soybean oil stocks significantly below year ago so lower supplies and expanding RD demand will necessarily require maximum crush rates (and the margins to promote that).

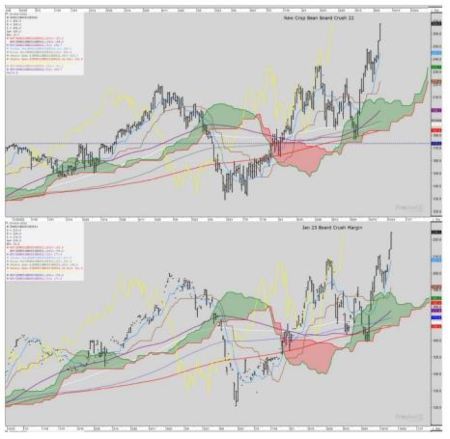

And surprise, what do we have here? (charts [RJO again] of nearby board crush margins promoting that):

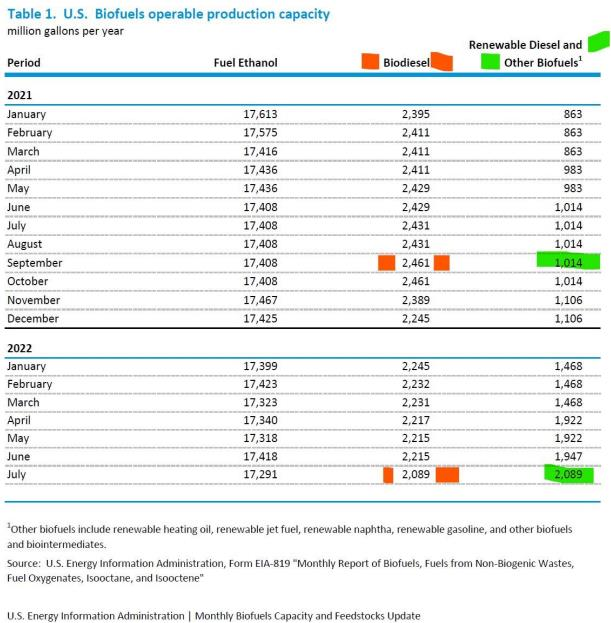

The latest statistics, July 2022 data, provided by the Energy Information Administration (Dear EIA, please refresh your statistics with less delay…call NOPA for help…Best Regards, the US Soy Processing and RD industries) show the uplift in RD production capacity (green for go) and decline in biodiesel capacity (red for stop); the RD capacity doubling with a lot more ongoing expansion underway more than offsets the decline (impending collapse) in biodiesel capacity and not shown slump in US soybean oil exports.

Conclusion

Domestic demand for US soybean oil is beginning to swamp available supply and soybean oil physical prices must move higher (check, that is happening), soybean oil futures spreads must invert (check, that is happening, rapidly), and soybean oil futures likely begin heading higher (much) to ration total supply and limit total demand (just starting).

For regular readers of these posts you know the themes I have continued to outline and will continue to outline:

- US RD feedstock demand’s impact to global vegetable oil pricing is now entering Round II (Round I occurred Q1 2021; see prior posts)

- US soybean oil exports remain ridiculously non-competitive for sales to the world and that is likely a permanent structure due US RD policy with sharply discounted palm and Brazilian and Argentine soybean oil the required vegetable oil of choice for global importers

- US soybean crushing capacity cannot expand quickly enough for the RD industry and so 2023 and 2024 soybean crushing margins will likely remain extremely profitable until new capacity ramps up in the last half of 2024 and the first half of 2025 (belated congratulations to the soybean growers of central Indiana; you are the latest recipients of the US soybean industries’ ongoing expansion in crushing capacity and subsequent expanded need for US produced soybeans; Bunge Limited (NYSE: BG) will provide significant new demand for you at its Morristown, Indiana facility): https://www.insideindianabusiness.com/articles/soybean-processor-bunge-plans-445-millionexpansion-in-shelby-county

- Declines in Black Sea origin sunflower oil due to the global conflict in the Ukraine will exasperate the global vegetable oil supply situation

- Challenged European Union crushing capacity due power availability and prices potentially also exasperates the global supply situation during Q1 and Q2 2023

- Palm production (Indonesia) and palm exports likely fill in a big part of the global vegetable deficit due the US withdrawal from global soybean oil exports so the world cannot afford a decline in Indonesian exports (another attempt at export embargoes or increase in export taxes would be a disaster) nor production

- A severe global economic slowdown potentially delays this scenario but any global recovery reignites the extremely rosy scenario for the US soybean processors.