Insight Focus

- Chinese PET exports continue to post record monthly highs in August.

- Indian PET exports record flat quarterly growth in Q2, amid greater domestic focus.

- Korean volumes to Europe show recovery, greater market share expected in 2023.

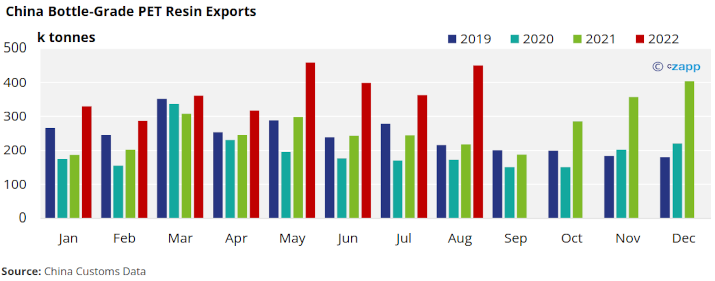

China’s Bottle-Grade PET Resin Market

Monthly Exports

- Chinese Customs reported bottle-grade PET exports of over 450 kt in August, up 24% on the previous month, and more than double the volume a year earlier.

- This comes at a time when new order flows are slowing indicating a potential high point for the year has been reached (see latest Asia Market Overview).

- Turkey was the largest destination for Chinese PET resin exports in August with nearly 54k tonnes, surging from 18k tonnes the previous month, and up from just 6k tonnes in August 2021.

- August volumes to Turkey are a big increase in the monthly average and represent around 34% of total Chinese PET resin exports to the country year-to-date.

- PET resin flows to Colombia and Russia were China’s second and third largest export markets in August, with month-on-month volumes up 260% and 28% respectively. Year-to-date exports to Russia have remained strong, up 28% compared to the first 8-months of 2021.

- Exports to Algeria and East African destinations also continued to perform strongly.

- Other noteworthy flows include the increase in volume to Montenegro, which since Russia’s invasion of Ukraine has become a landing hub into the South-eastern Europe, including Ukraine.

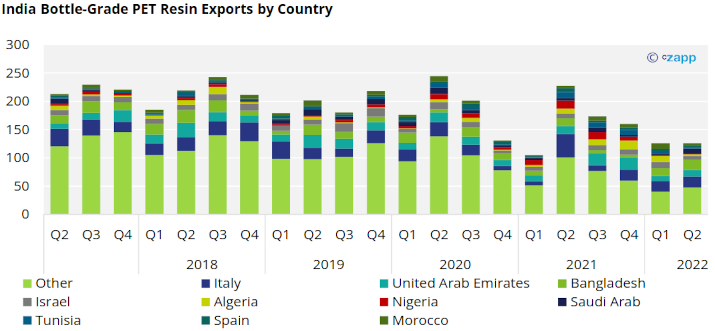

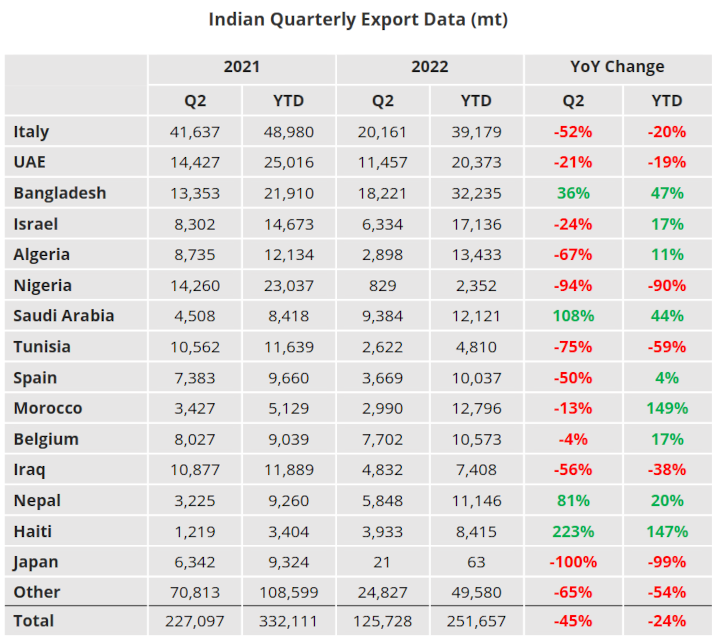

India Bottle-Grade PET Resin Market

Quarterly Exports

- Indian bottle-grade PET exports dipped to just under 126k tonnes in Q2’22, down 0.2% on the previous quarter, but down 45% year-on-year.

- Italy was again the largest destination with over 20k tonnes in Q2 ’22, increasing 6% from Q1’22, followed by Bangladesh, UAE, and Saudi Arabia.

- Despite recording a quarterly increase in exports to Italy, volumes were still down versus previous years, and just half of what was recorded in Q2’21.

- Latest July and August monthly trade figures indicate that Q3’22 will show some improvement moving closer to pre-COVID quarterly levels.

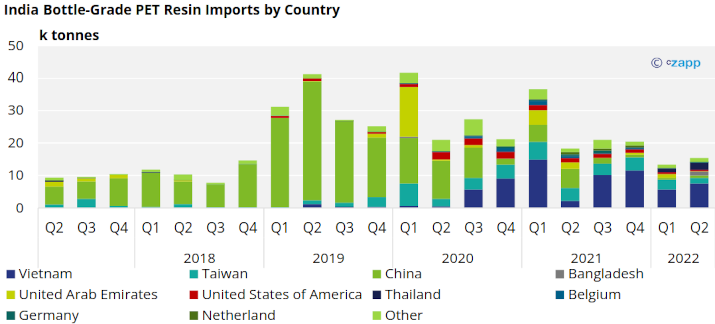

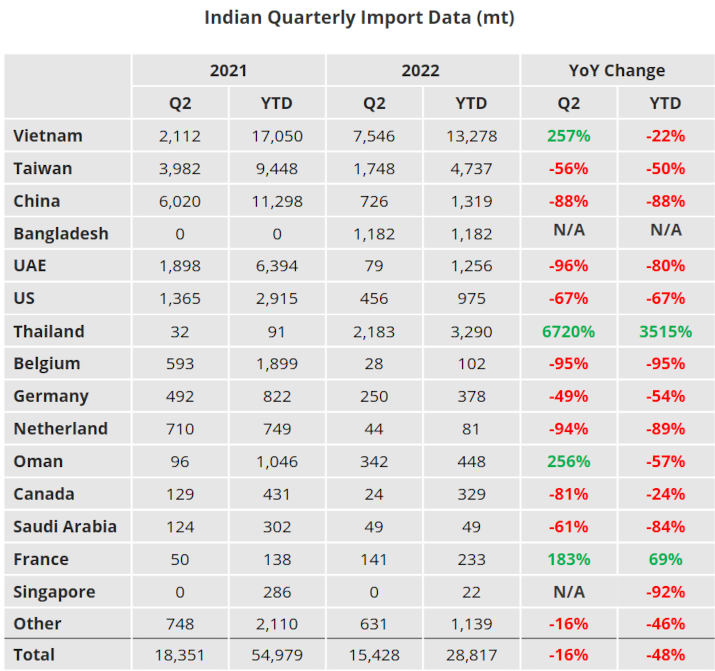

Quarterly Imports

- Indian bottle-grade PET imports totalled 15.4k tonnes in Q2’22, up 15% on the previous quarter but down 48% versus the previous year.

- Origins with the greatest volumes in Q1’22, include Vietnam, Thailand, Taiwan, and Bangladesh.

- Following the introduction of anti-dumping duties against Chinese PET resin into India in 2021, Vietnamese and Taiwanese resin has partially filled the import gap. Volume from Thailand has also entered the market in 2022.

- Combined imports from Vietnam and Thailand, represented 63% of total Indian PET resin imports in Q2’22.

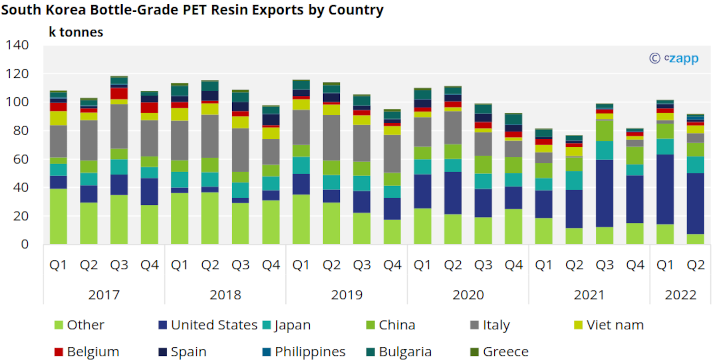

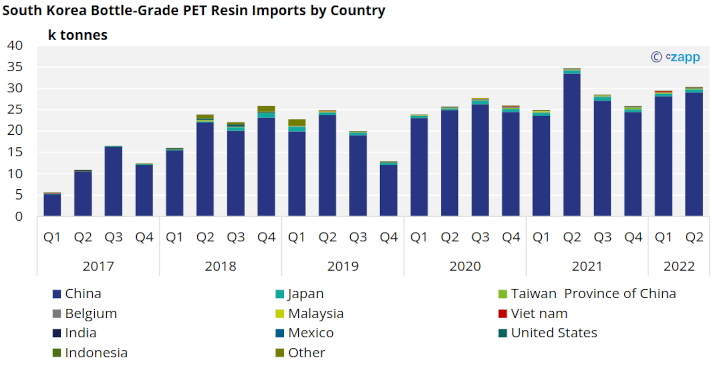

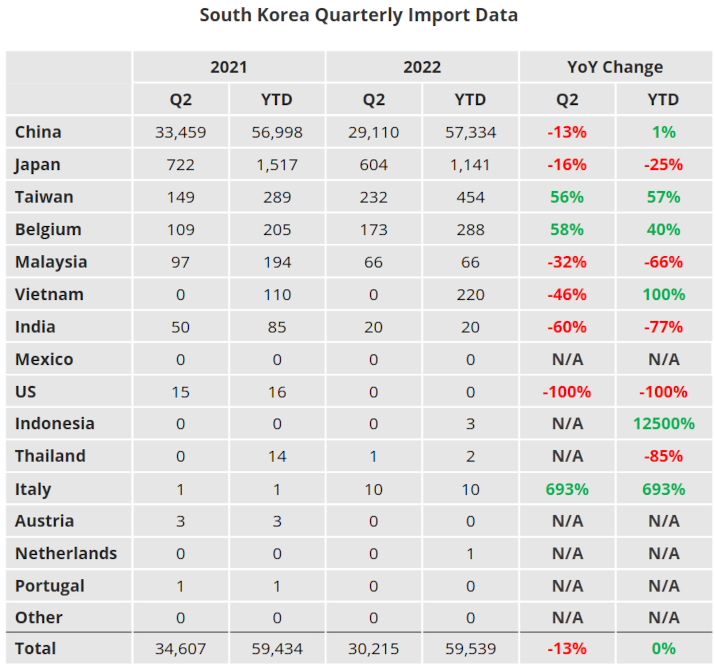

South Korea’s Bottle-Grade PET Resin Market

Quarterly Exports

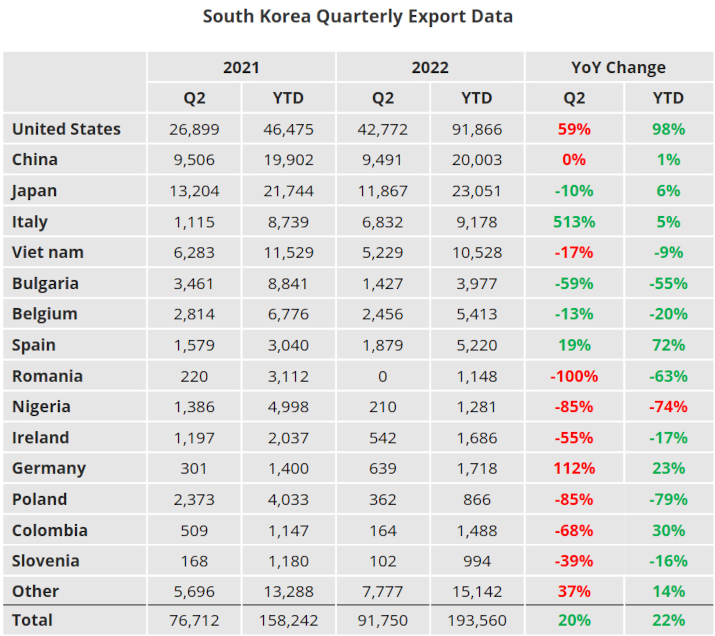

- South Korean bottle-grade PET exports slowed slightly in Q2’22, falling to 92k tonnes in Q2’22, a quarterly decrease of 10%, but still up 22% year-on-year.

- South Korea’s largest export market by far remained the United States, which accounted for nearly 43k tonnes in Q2’22, down 13% on the previous quarter, yet nearly double that reported the previous year.

- Japan and China were the next largest export destinations for Korean resin, recording 12k tonnes and 9.5k tonnes respectively in Q2’22.

- Exports to Italy saw a recovery to just over 9k tonnes, almost triple the previous quarter. The removal of India’s GSP trade status with the EU from Jan’23 may see greater opportunity for Korean exporters to further increase volume to Europe next year, having previous lost market share to other origins, including Vietnam since 2020.

Quarterly Imports

- South Korea’s bottle-grade PET resin imports totalled 30k tonnes in Q2’22, consistent with previous quarters and an increase of 3% versus Q1’22, on par with the previous year through H1.

- China remained South Korea’s main resin supplier, supplying over 96% of Korea PET resin imports, equivalent to around 29k tonnes in Q2’22.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

Asia PET Market View: Will Plummeting Ocean Freight Boost Asian PET Export Demand?

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs

PET Resin Trade Flows: China’s PET Exports Surge as Logistics Ease Post-COVID