Opinions Focus

- Low water in the Mississippi didn’t result in higher US basis.

- US corn isn’t competitive vs Brazil and Ukraine.

- EU corn forecasts revised lower again.

Forecast

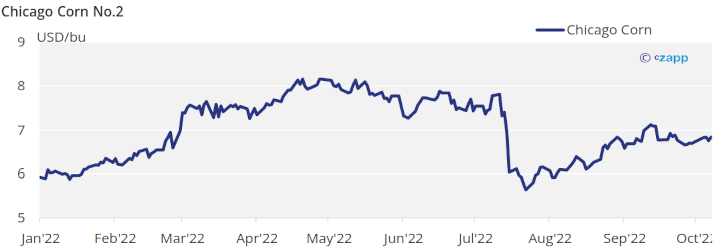

- No changes to our average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu. The average price since Sep 1 is running at 6,8 USD/bu.

Market Commentary

- Another flat week for Corn in Chicago but negative in Euronext together with a negative week for Wheat in all geographies. We have the October WASDE this week.

Low water in the Mississippi River didn’t result in higher basis in the Gulf as US Corn is priced out vs. Brazilian and Ukrainian Corn meaning export markets were not willing to pay more for US Corn having cheaper origins.

The European Commission reduced again their Corn production forecast to 55,7 mill ton in 22/23 which is 3,7 mill ton lower than their previous forecast and a sizable decrease vs. last year’s 73 mill ton crop. This is simply the impact of the very hot and dry summer we had across most of Europe. We were somehow expecting this kind of reduction, mostly coming from Romania where we were seeing all projections were too high as everyone was focusing on France.

Conab forecasted Brazil’s Corn production at 129,9 mill ton vs. 125,5 of their previous estimate. This is vs. 126 mill ton of the Sep WASDE.

US Corn condition was stable at 52% good or excellent vs. 59% last year and is 20% harvested, just an 8% improvement in the week, and below last year and below the 24% expected by the market. French Corn condition remained stable at the all-time low level of 41% good or excellent and is 67% harvested vs. 6% last year, a very quick pace thanks to earlier maturation and dry weather allowing a quick harvesting pace. Summer Corn planting in Brazil has reached 22,7% vs. 24,2% last year. Corn planting in Argentina is 7,1% vs. 21,2% last year with the big delay caused by the very dry moisture in the soil. Corn in Ukraine is just 2% harvested vs. 90% last year. Clearly rains but mostly fighting is having a very negative impact on harvesting activities.

In the Wheat front, Argentina’s BAGE forecasted Wheat production at 17,5 mill ton vs. 22,4 last year due to lack of rain and also frost damage. This is vs. 19 mill of the latest WASDE.

On the other hand, the European Commission increased their Wheat production forecast by 1,1 mill ton to 128 mill ton.

Russian Wheat harvest has now reached 102 mill ton as of October 3 which is a huge 37% above last year’s crop and is 96,1% harvested. This is vs. 91 mill ton of the Sep WASDE.

US winter Wheat is 40% planted a bit delayed vs. last year and the five year average, but not worrisome.

Trade flow out of Ukraine continues to move but inspections of vessels have now a 7 day delay and the general thought is that Russia is causing this delay on purpose. The deal of the export corridor expires on November 22 but it can be extended if all parties involved agree on it. The big doubt is if Russia is now boycotting the agreement and intends not to extend it. This coincides with an all-time high Russian Wheat crop and slow exports.

The weather forecast for this week is expected to be favorable for planting and harvesting activities across most of Europe. The US is expected to remain warm and dry but with some rains across the Corn Belt which could further delay the harvest. Brazil is also expected to receive some rains across the center south region.

Last week’s price action was somehow mixed with Corn moving laterally and Wheat having a sizable correction. The strength of the dollar avoided Corn from trading higher but Wheat saw pressure we think on the back of a confirmation of the bumper Russian crop.

The smaller US and EU Corn crops and the delay in harvesting in the US should continue to be supportive for Corn values. While we expect more volatility in Wheat as despite resulting in a global stock build, supply disruptions out of Ukraine and Russia means Wheat will have it difficult to reach destination markets.

We have the October WASDE this week with the major change expected in an upward revision to Russian Wheat production. We continue to expect prices to remain supported.