Opinions Focus

- The US biofuel industry is using increasing amounts of soybean oil.

- They are using this to make renewable diesel.

- This new source of demand could push soybean oil prices higher.

- Demand for soybean oil from the US biofuel’s industry has begun to adjust domestic and export trade flows in the first year of significantly increased demand from the renewable diesel (RD) industry; next year the RD demand increases at a greater volume than this year.

- The decline in demand from US soybean oil exporters and slowing demand from the US biodiesel industry have cushioned the RD demand impact this year but that will diminish moving forward.

- The next two years will likely feature soybean oil prices marching dramatically higher and domestic soybean oil supplies becoming extremely tight (without an economic meltdown).

- The collapse in the relationship between soybean oil prices and palm oil prices likely takes on a more permanent nature.

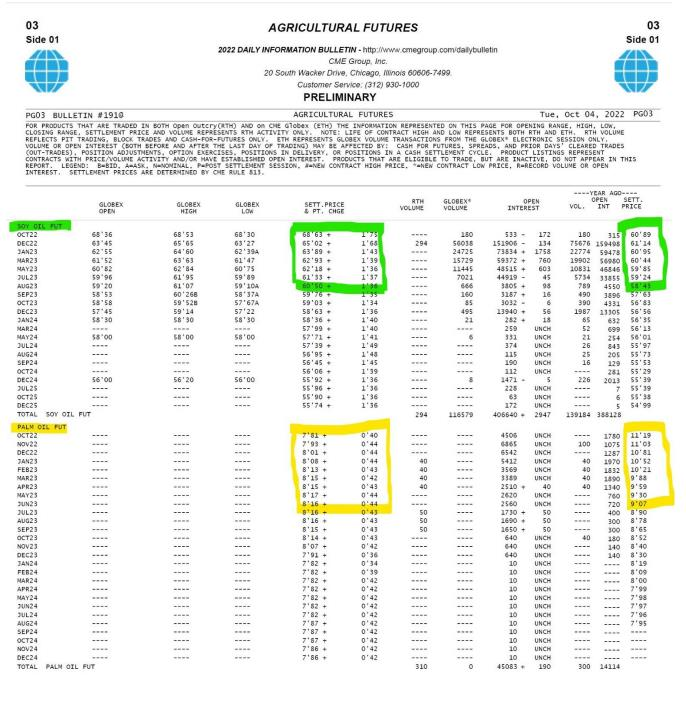

The above table features the CME’s daily volume and open interest report which features a lot of useful information, especially a record of year ago prices to compare to current prices. I highlighted soybean oil futures prices in green, palm oil futures prices in yellow; year ago prices are at the far right column.

What are the observations to be made from the two price curves?

- Soybean oil futures prices remain sharply inverted (spot prices higher than deferred prices), especially in the front delivery month with October prices $.035 per pound higher than December.

- Prices for soybean oil remain significantly above year ago prices, October prices currently at $.6850 cents per pound versus $.6100 cents per pound a year ago.

- Palm prices are the exact opposite: prices are SIGNIFICANTLY lower than a year ago, and in a carry structure, spot prices much lower than deferred prices.

- Palm prices a year ago were inverted, discouraging nearby consumption, and promoting waiting, i.e., you can buy palm at lower prices if you defer your purchase.

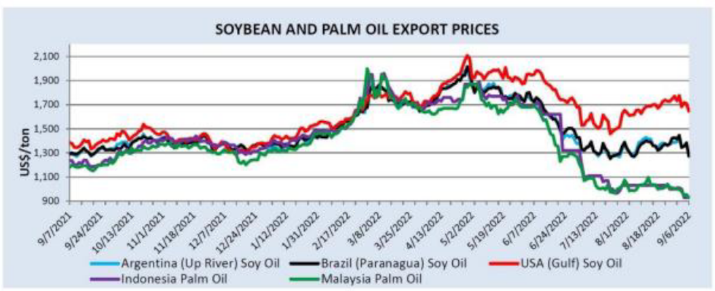

The impact from biofuel demand for US soybean oil, still primarily biodiesel consumers but soon to be overtaken by demand from the renewable diesel (RD) industry as biodiesel fades away, has established a significant price premium for domestic soybean oil over global prices and relative to palm prices and that premium is not going away any time soon (see USDA’s price chart for global prices on the next page).

Compounding the problem for palm prices is a failed intervention in markets by the Indonesian government to impede exports and it has backfired dramatically and built domestic stocks. Famed palm price whisperer Dorab Mistry predicts more damage coming as detailed in this Bloomberg article.

Next year’s USDA projected soybean oil stocks to usage ratio, a common commodity traders’ measurement of how tight or loose supplies may become, is smaller than this year’s as supply increases due to higher US soybean crush rates but soybean oil demand increases at a greater rate.

This year’s lower price movement as depicted in the above chart did not break the soybean oil bull market but did break the palm market and if Dorab Mistry is correct in his predictions there is more breaking to come (in the article he also forecasts a tremendous uplift in production for the world’s largest palm oil producer Indonesia in the coming year).

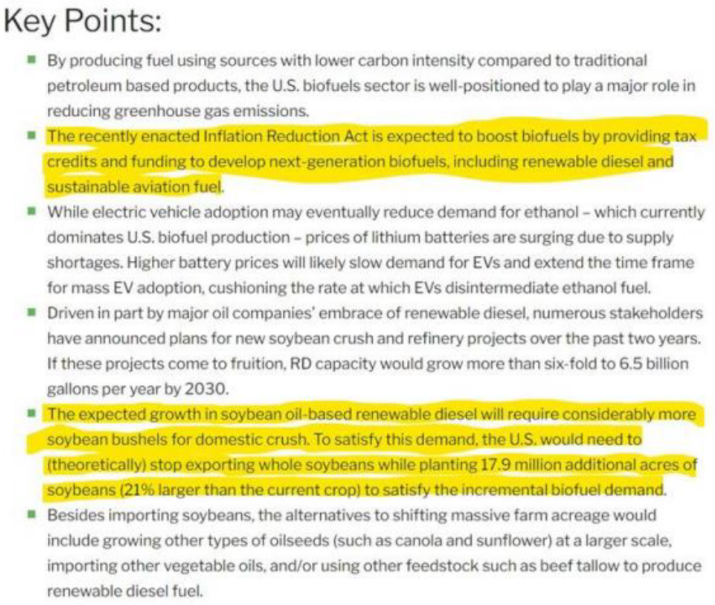

The permanence of RD policy and its impact on US soybean oil prices is here today. The impact accelerates in the coming year. If you choose to read the detailed projections from CoBank, one of the largest US lenders to the agricultural industry, you might note their conclusions with which I agree wholeheartedly: