Insight Focus

- Mexico’s consumer price index is the highest in the last twenty years.

- Prices for the basic foods continue to increase.

- Despite this, Mexican sugar demand continues to grow.

Mexico’s consumer price index has reached record highs in 2022. Prices are rising across all sectors, but notably for basic foods. As a result, consumers have stopped purchasing some items altogether or are buying generic products instead of brands. However, demand for sugar doesn’t seem to have been affected by rising prices.

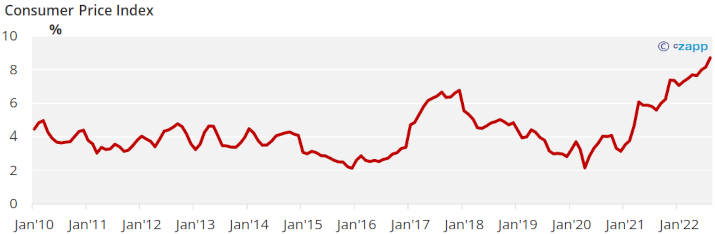

Consumer Price Index Hits Record High

The consumer price index in Mexico has hit an all-time high this summer and is currently showing 8% year on year growth.

Source: National Institute of Statistic and Geography (INEGI)

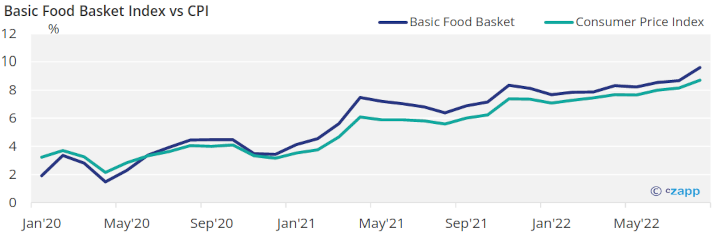

The prices for the basic food basket have increased even faster than the consumer price index. Consumers in Mexico with lower incomes are unable to purchase quantities and products that they were used to consuming before. Around 38 million people in Mexico cannot afford to buy the basic food basket.

Source: National Institute of Statistic and Geography (INEGI)

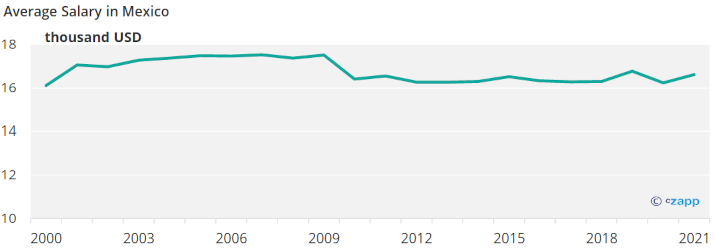

Average salaries in Mexico have increased compared to 2020, but not at the same pace as inflation meaning people are struggling to afford basic goods. Increasing costs of living are mostly affecting families with lower incomes as they spend most of their salaries on basic goods leaving less money available to spend on healthcare or education.

Source: Organisation for Economic Co-operation and Development (OECD)

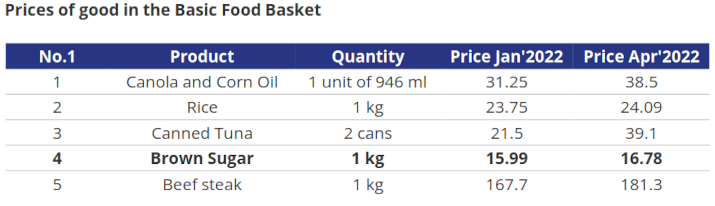

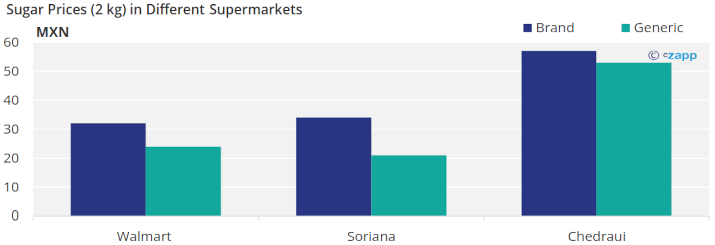

As a result, we are seeing consumers continue to purchase the same quantities of basic goods but looking for alternatives to cut their costs. In June the OCC Mundial, the biggest job centre in Mexico, passed a survey to consumers in Mexico to determine what were the changes in consumer behaviour as prices for the basic food basket increased. 45% of the surveyed consumers expressed that they are purchasing similar products but that are less expensive, 40% said they stopped purchasing certain products whose prices were too high and 15% expressed that they are buying less quantities of goods. Sugar was amongst the top five products that have had the highest increase in price since January 2022 along with oil, rice, meats, and some vegetables.

Source: www.gob.mx

For consumers to be able to afford these basic goods, they are moving towards purchasing generic goods rather than purchasing the famous local brands to save money. This means that for some goods they are still purchasing the quantities they used to but for cheaper prices. Consumers are also spending less money on certain goods like produce and meats and using that money for other basic goods.

Source: expansion.mx

What Does This Mean for Sugar Consumption?

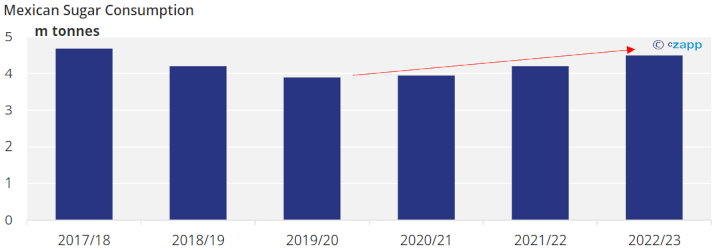

Even though prices for sugar have been increasing due to inflation, sugar consumption has continued to increase. We expect sugar consumption for 2022/23 to be the highest since 2018, reaching 4.5 million tonnes.

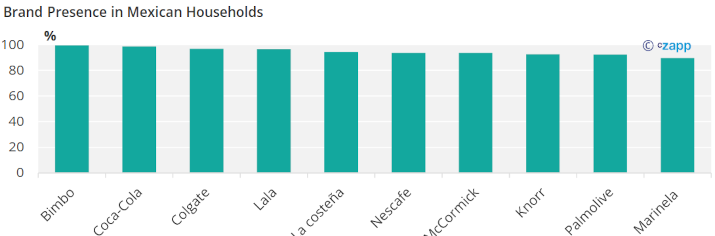

In addition, sugar demand from industrial consumers is firm as even though some consumers are cutting back on branded goods, many are not. Major brands have high recognition in Mexico. 99.4% of households in Mexico have Bimbo products at home and 98.6% have Coca-Cola products at home.

Source: Kantar World Panel

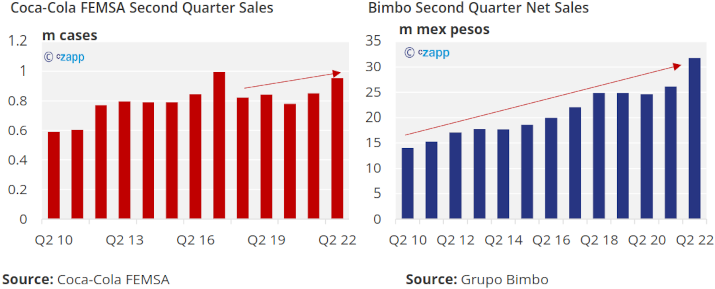

As a result, Bimbo and Coca-Cola FEMSA’s sales continue to increase year-on-year. Net sales for the second quarter of 2022 for Coca-Cola and Bimbo in Mexico have reached record highs for the first time since 2017. In other words, consumers continue to purchase products with high sugar contents despite the rise in prices.

Other Insights That May Be of Interest…

Czapp’s Sugar Consumption Case Studies