Opinions Focus

- European MARS bulletin cuts corn yield forecast by 4%.

- Ukrainian grains export steady.

- US wheat plantings accelerate.

Forecast

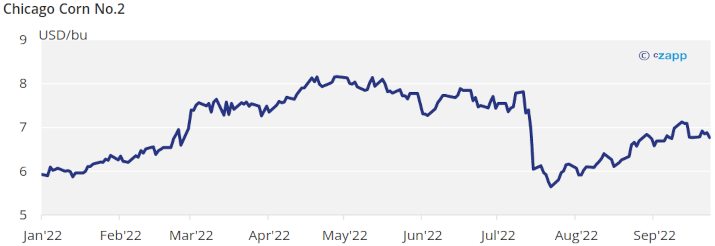

No changes to our average price forecast for the 22/23 (Sep/Aug) crop in a range of 5,8 to 6,3 USD/bu. The average price since Sep 1 is running at 6,85 USD/bu.

Market Commentary

Flat week for Corn in Chicago, while positive in Euronext together with Wheat making gains in both geographies. The week ended negative influence by a macro selloff after the Fed increased interest rates again.

After the Sep WASDE the previous week, we had the EU MARS bulletin last week which once again reduced their production forecast for spring crops due to hot and dry weather during the summer reducing Corn yield by 4%.

In Ukraine and despite doubts raised by Russia around the grain corridor, exports were steady at 1,1 mill ton last week. But the announcement of the referendum in some of the occupied regions organized by Russia and mobilization of reservists sparked a rally by the middle of last week mostly in European grains as supply concerns increased.

US Corn condition was down again to 52% good or excellent vs. 59% last year and is 7% harvested, a poor 2 percentual points weekly progress. French Corn condition was unchanged at 43% good or excellent vs. 89% last year still an all-time low. French Corn is 26% harvested vs. 1% last year thanks to earlier maturation. Russian Corn is 7% harvested very much delayed vs. last year’s 47%. Ukrainian Corn is 1% harvested vs. 5% last year.

In the Wheat front, US winter Wheat is already 21% planted above last year and above the five year average. Russian spring Wheat is 90,7% harvested with an average yield 28% higher year on year. Wheat planting in Ukraine is 8,7% complete.

The big doubt with Wheat continues to be around Russian production with the USDA forecasting 91 mill ton while local analyst are already seeing a crop slightly above 100 mill ton.

In the weather front the US Corn belt is expected to see dry weather again but no heat with a cold front coming from the north. Brazil’s center south region is expected to receive rains for a third week in a row. Europe is also expected to see some rains in the north west.

We continue to think Corn will tend to trade higher and close the gap with the expiry of the September contract once the US and EU crops continue to deteriorate. Is not the case for Wheat, with healthy production, but the upside risk on the Wheat front comes from potential supply disruption in the Black Sea.