Opinions Focus

- High cassava prices make Thai cane growing less attractive.

- Higher fertilizer and fuel prices have also hit cane growing.

- We expect a significant decline in the amount of cane crushed the year after next.

Most Thai cane farmers are small holders who own less than 10 rai (1.6 ha) farmland. Although small individually, together they contribute 70% of total Thai cane production.

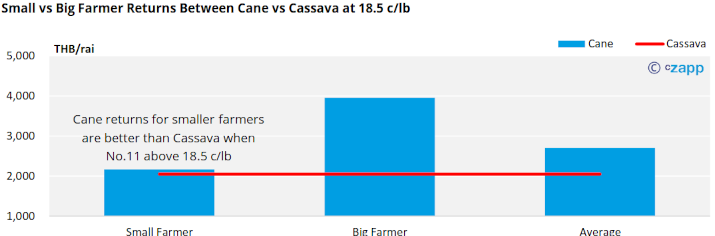

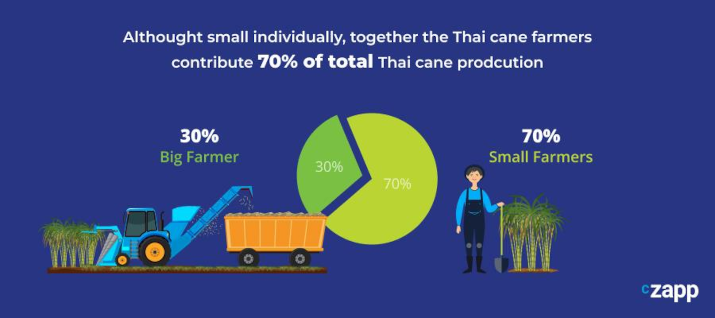

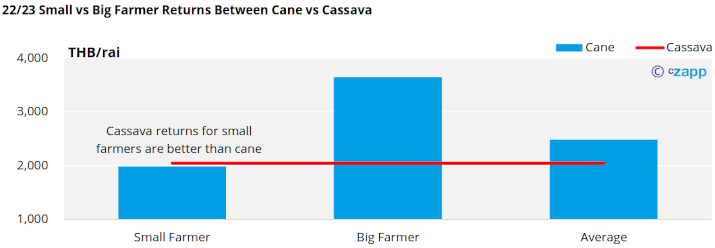

We see that the returns for cassava is better than the returns of cane for small farmers, and this may push them to make a switch to cassava from cane.

For a start, fuel and fertiliser prices have increased significantly in the past two years. This makes cane planting and maintenance more expensive than crops which require less husbandry, like cassava.

Cane farmers often receive fertiliser from sugar mills as part of a prepayment deal for their cane, but this year we have heard of increasing numbers of small farmers refusing to accept this fertiliser, using lower amounts or lower quality fertiliser so that they reduce their obligations to sugar mills.

As a result, small farmers will achieve an agricultural yield of about 8 mt/rai versus bigger farmers (with correct fertiliser application) at 11.2 mt/rai.

On top of this, labour costs for cane planting and harvesting are increasing. Small cane farmers often lease machinery from local cane mills rather than own it outright. There’s also a shortage of migrant workers following the covid pandemic; fewer people are travelling from Cambodia, Myanmar and Laos for work. Government regulations are also to blame: this year Thailand wants more than 95% of its cane to be harvested without burning the cane fields beforehand, as a measure to improve air quality. It costs small farmers around THB 1/bundle to harvest burnt cane, but THB 3/bundle to harvest unburnt cane.

In contrast, cassava requires less fertiliser and is easier to harvest by hand. We think cassava could potentially pay small farmers more than cane in 2022/23 and this will affect planting decisions in 2023/24.

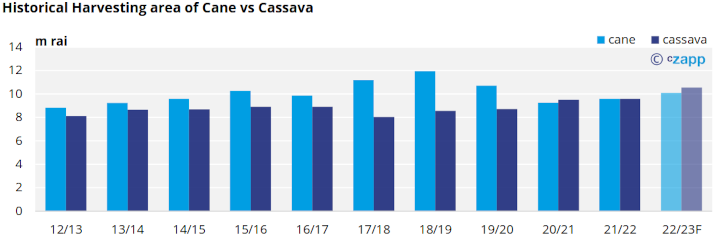

We think that the Thai cane area has increased to 10.1m rai this year, from 9.5m rai in 2021/22. Farmers who then thought about planting cane during pre-rainy season (Feb – Apr 2022) could have been impacted by the high cost of production, which has dampened enthusiasm for cane.

In a longer term, we expect to see increased cassava acreage at the expense of sugar cane in 2023/24, both as a result of our analysis and from what we’ve heard on the ground during our crop tours.

The story isn’t just about farmer costs. Cassava returns are improving faster than sugar cane returns too. Chinese demand for Thai cassava is increasing thanks in part to India’s ban on broken rice exports.

At today’s cassava prices, we think raw sugar futures will need to reach at least 18.50c/lb to reverse the threat of reduced cane acreage in 2023/24. If Thai mills can hedge above this level and it filters through to the cane price paid to small farmers, they will be incentivised to plant sugar cane once more.