Insight Focus

- European PET spot prices move sharply down, set for further declines in coming weeks.

- Imports remain competitive against domestic European spot material as freight rates tumble.

- All eyes are on September PX settlement as 2023 contract negotiations begins.

Following a slow August, European PET producers reported a modest improvement in September spot sales.

With converters having whittled down stocks over the last couple of months, lower spot prices encouraged fresh demand from some seeking to partially rebuild inventories.

That said, recent reductions in operating rates, and plans for extended shutdowns over the coming months are a clear indication of an overall tepid market for domestic resin.

Economic Concerns Cloud Procurement Strategies

Buyers are equally facing heightened uncertainty.

Whilst September many see some restocking, the cost-of-living crisis is beginning to impact downstream consumer demand for certain products and creating uncertainty for future PET resin demand.

According to the European Commission’s latest economic update, “as the reality of a protracted Russian invasion of Ukraine sinks in, the assessment of its economic consequences for the global economy is turning grimmer”.

“The rapid increase in energy and food commodity prices is feeding global inflationary pressures, eroding the purchasing power of households and triggering a faster monetary policy response than previously assumed”.

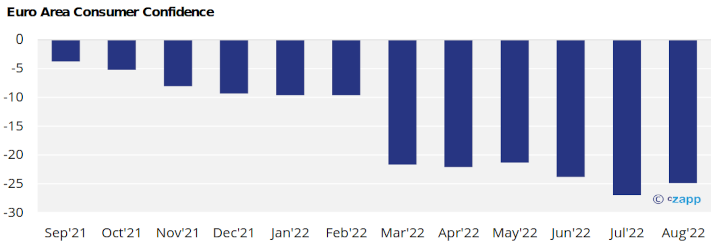

Although consumer confidence in the Euro Area increased slightly in August, from a record low in July, consumers remain pessimistic about the economic outlook and on their own personal financial situation.

Coming out of the summer months, some economists are predicting a further decline in consumer confidence through H2’22.

As a result, discretionary spend for non-essential is likely to be fall sharply, impacting PET resin demand for products, such as home and health care items.

Soft drinks and luxury beverage brands may also face headwinds.

European PET Spot Prices Continue to Tumble

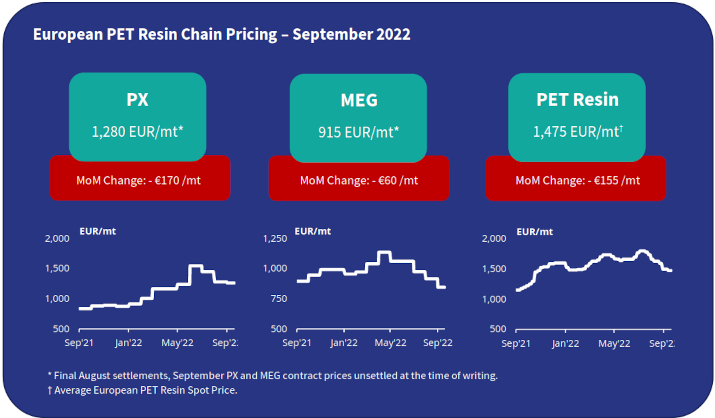

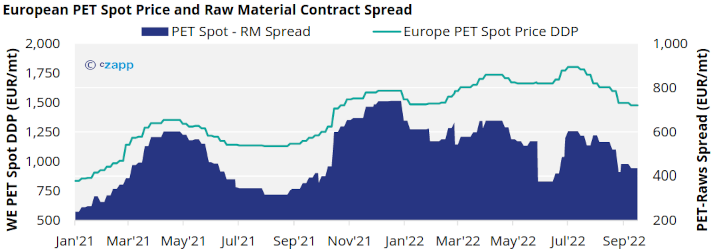

European spot prices for virgin resin typically ranged from EUR 1450 to EUR 1490/tonne, averaging EUR 1475/tonne mid-September. This represents an average EUR 155/tonne decrease from August, and a fall of EUR 350/tonne in just two-months.

Some higher prices were heard in the low 1500s, depending on destination. However, overall, there were few buyers willing to accept prices above EUR 1480/tonne.

One large buyer reported concluding business at EUR 1400/tonne, with offers from at least two producers at this level, indicative of continued downward pressure on prices.

Other buyers continue to hold out for an anticipated further adjustment in spot prices, with expectations of EUR 1350-1370/tonne in October.

However, any further adjustment in spot prices will be largely dictated by future European raw material contract settlements.

At the time of writing both MEG and PX September European contract prices (ECP) remained unsettled adding to buyer hesitation, with rumours flying of unconfirmed and expected settlements.

In August, paraxylene (PX) ECP was fully settled at EUR 1280/tonne, down EUR 170 from the previous month.

And August’s monoethylene glycol (MEG) European contract price (ECP) settled at EUR 915/tonne, down EUR 60 from July.

Although European PX contracts have fallen sharply since June, down EUR 265/tonne on average to August, in order for European PET resin producers to compete with lower priced Asian imports, European PX prices need to drop further still.

Another sizable correction in PX prices would be a game changer for European producers, giving relief to the pressure of rising energy costs and enabling them to prices aggressively against imports.

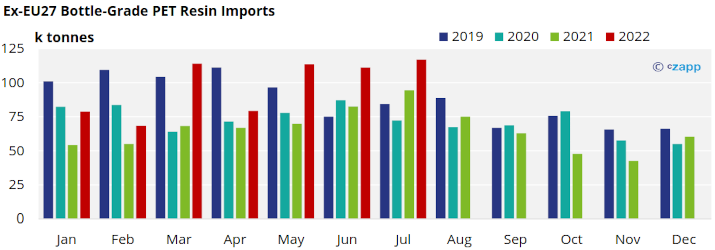

EU PET Resin Imports Post Another Record Month in July

Latest EU trade data shows that the region continued to experience high levels of imports coming from outside the block in July, setting a new monthly record for the third time this year.

In the first seven-months of the year, EU-27 bottle-grade PET imports totalled 682k, up 38% year-on-year, and on par with the infamous wave of imports that arrived in H1’19.

With high import volumes expected to be reported for the remainder of the summer months, when data is made available, 2022 is now almost certain to surpass 2019’s annual record; a threat to European production that had been anticipated since Q4’2021.

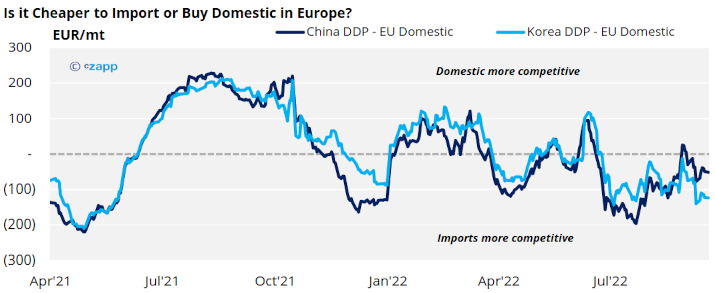

Is it cheaper to import?

At the time of writing, China PET resin export price averaged around USD 1060/tonne, down around USD 60/tonne over the past month.

Whilst European spot prices have fallen, the delta between containerised Asian imports and domestic European PET resin on a delivered basis is still considerable, averaging around EUR 87/tonne.

A combination between lower Asian PET resin prices and reduced freight rates have enabled imports to remain competitive against domestic European spot material.

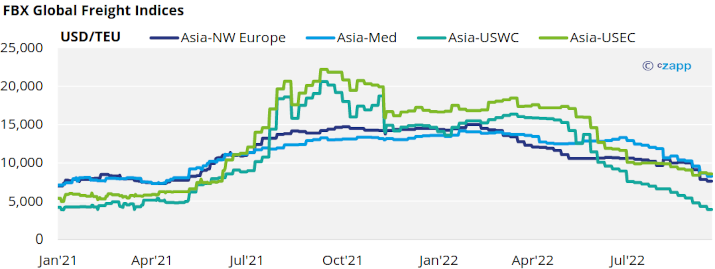

Container freight has seen a rapid decline over the last month with major shipping indices in near free-fall. One of the leading indicators, the Shanghai Containerised Freight Index has dropped 41% since the end of July.

Rates from Northeast Asia to major European ports have fallen from over USD 310/tonne to less than USD 200/tonne over the same period. Rates as low as USD 150/tonne have been achieved between Shanghai and Antwerp.

A continued deterioration in freight rates is expected by shipping analysts, driven by sustained decreases in deep-seas cargo volumes, and a gradual resolution of supply bottlenecks.

However, even with these precipitous declines, rates are still around 215% higher than seen in September 2019 before the pandemic.

Market Outlook & Concluding Thoughts

- European PET producers find themselves at an impasse, held captive to volatile, and uncertain raw material settlements and rising energy costs.

- However, supply reductions over the course of the next few months may play in their favour.

- As producers move to maintenance, capacity loss is expected to peak at around 895k tonnes in October, equivalent to around 27% of existing European PET resin production capacity.

- Potential energy rationing in countries such as Germany could also impact PET resin supply and packaging production in Q4.

- These supply reductions may precipitate a lower PX ECP and enable European producers to aggressively target import price parity ahead of going into 2023 contract negotiations.

Other Insights That May Be of Interest…

PET Resin Trade Flows: Brazil seeks to Export More PET to North America

Plastics and Sustainability Trends in August 2022

European PET Resin in Major Downward Correction

US PET resin Imports Hit New Highs as Volumes from Oman Leap