Insight Focus

- Europe’s hot and dry summer has affected beet health.

- EU+UK sugar production will be 8% lower this year.

- What are growers doing to mitigate drought?

The 2022/23 EU (and UK) sugar beet harvest is now underway in several countries, following a summer of severe drought and frequent heatwaves. This is likely to be detrimental to sugar yields for various producers.

Four of the last five European beet crops have been affected by adverse weather conditions. Is this something farmers need to adapt to?

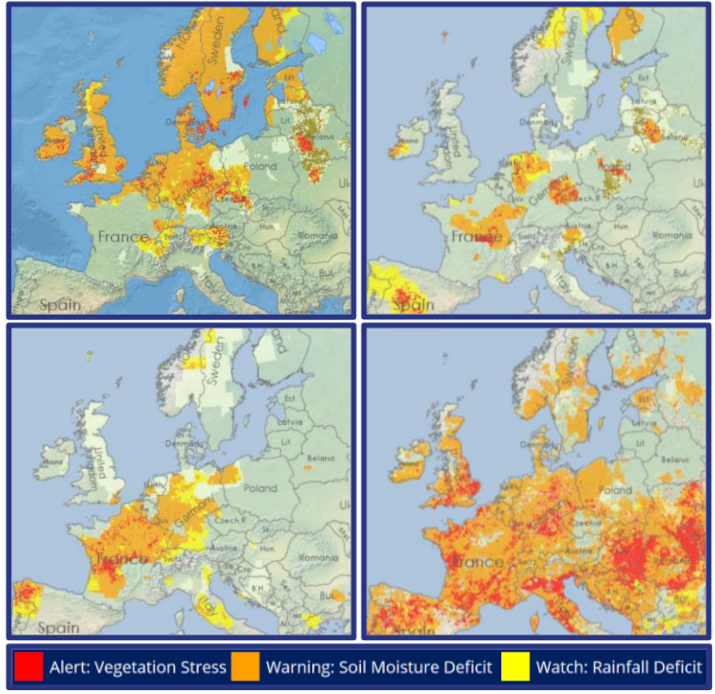

Europe Summer Droughts at their Peak: 2018-2020, 2022

Source: European Drought Observatory

Another Hot, Dry Summer

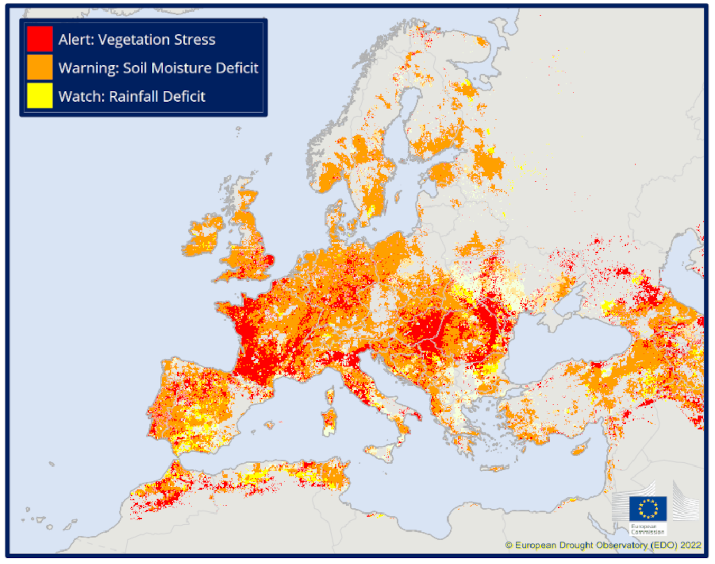

The latest European Drought Observatory (EDO) report from August put almost 50% of the region in a state of warning and more than 20% in a state of alert over the level of vegetation stress faced, this has broadly been the case for much of the last few months.

Source: European Drought Observatory

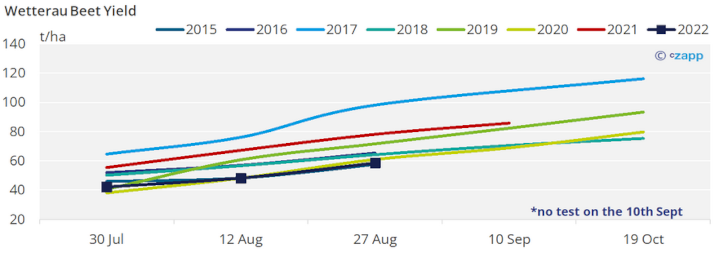

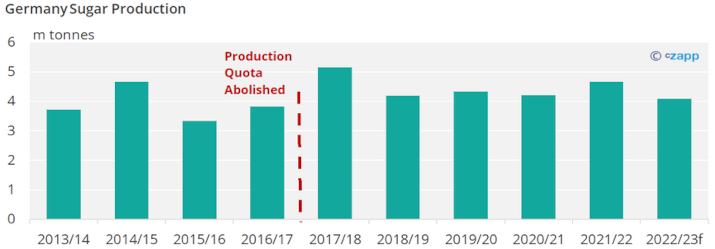

This year, heat and dryness in the south Germany mean beet yields there are close to the lowest since 2015.

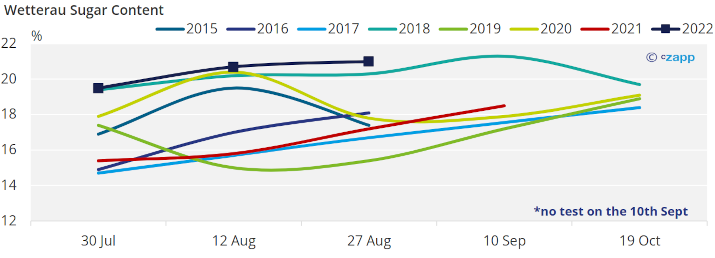

Likewise, unusually high sugar content reveals the stress the crop has been under.

We think Germany will make around 4m tonnes of sugar in 2022/23, the lowest since the abolition of production quotas preceding the 2017/18 season.

Yields (and production) in Italy, Spain and Romania are also expected to be harshly affected by the drought and heatwaves.

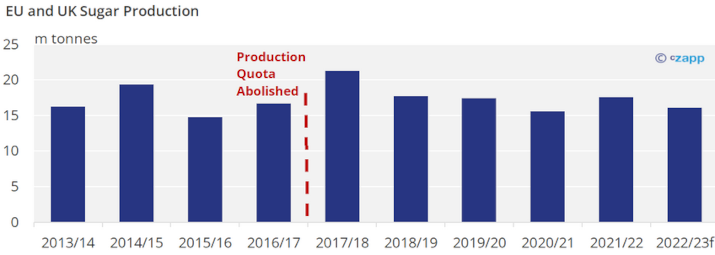

This all in mind, our current view is that Europe and the UK will make 16.1m tonnes of sugar in 2022/23, an 8% decline on the 2021/22 campaign but still larger than the dismal 2020/21 crop.

Are Weather Affected Crops Becoming More Common?

2022 follows droughts recorded in 2020, 2019, and 2018 across parts western and central Europe, though this summer has been more severe.

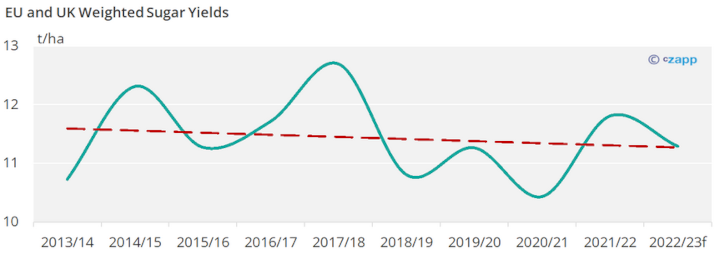

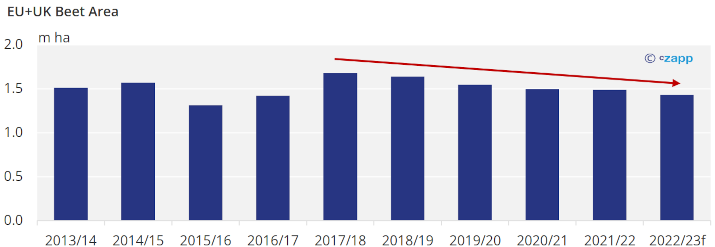

Alongside the ban on neonicotinoids during 2018/19, this increasingly regular hot, dry weather could be influencing sugar yields – the weighted average of EU+UK yields has been in gradual decline since at least 2013/14.

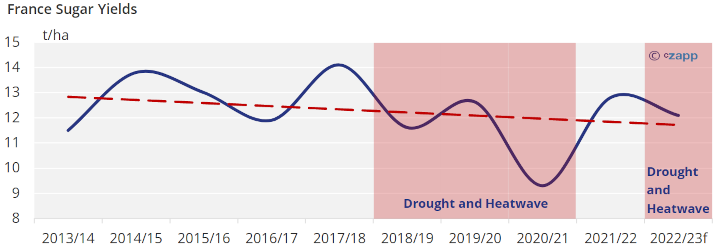

This is particularly evident in France, which produces a quarter of all sugar in the region and is commonly at the centre of recent drought and heatwaves (highlighted in red).

These factors and increased input costs and competition from other more profitable crops has caused the EU+UK beet area fall to every year since 2017/18.

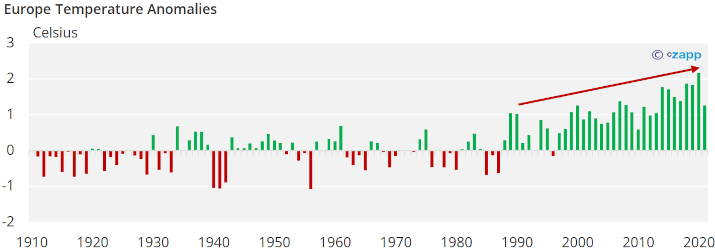

Each of the last 8 years rank in the top 10 hottest in Europe since 1910 and the effects of climate change are increasing the likelihood that this trend will continue in years to come.

If true this would mean that long term averages of sugar yields become less and less applicable when predicting future crop seasons.

Besides the weather the EU sugar market is currently facing a range of other challenges:

- The region has been in production deficit for the last five years.

- 2022/23 closing stocks are expected to be less than one month’s consumption, the lowest since at least 2017/18.

- There are still no real alternatives to neonicotinoids.

- Rising energy prices have greatly increased the cost of beet processing.

Has there been a Response?

Several Italian members of the European parliament have started to call for the relaxation of laws controlling gene-edited crops, after Northern Italy was hit especially hard by this year’s drought.

This follows a 2021 study by the European Commission outlining that loosening regulations could be beneficial.

The modern CRISPR technique for gene editing is currently heavily restricted in the EU, allowing for minimal experimentation into creating drought or pesticide resistant crops.

New crop varieties with an increased ability to withstand adverse weather would be a useful tool for producers to protect against future droughts or crop diseases. Especially when any reversal to the neonicotinoid ban looks extremely unlikely.

However, whilst the summer just passed has helped catalyse this conversation, it could be a few years before change is enacted, if it all.

All in, EU sugar production has faced a difficult combination of growing environmental risks, it is yet to be seen firmly how a likelihood of hotter summers to come will be countered.