Insight Focus

- PTA and MEG futures fundamentals improve as polyester rates increase and inventories fall.

- PET resin export prices stabilise ahead of renewed downward pressure into October.

- Lower future raw material costs to enable more aggressive PET export prices as demand slows.

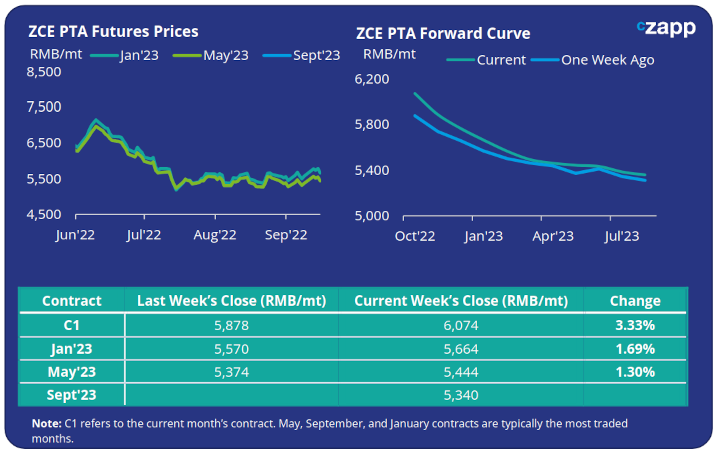

PTA Futures and Forward Curve

- PTA Futures closed higher last week, as production rates continue to be restricted by tight PX supply; transportation of PX and PTA has also been impacted by the recent typhoon.

- Downstream polyester operating rates continued to steadily improve through September, with rates now approaching typical seasonal levels.

- Improved supply/demand fundamentals are expected to support near-term prices. However, new PX and PTA capacities will ease market supply tightness in coming months.

- The PTA forward curve remains in backwardation with the main Jan’23 contract at a RMB 410/tonne discount to the current month.

MEG Futures and Forward Curve

- MEG Futures increased modestly last week, buoyed by falling inventories and rising polyester operating rates.

- Port inventories continue to fall, resulting from delayed arrivals caused by the recent typhoon, an unexpected shutdown at Hengli’s 1.8 million tonne plant, as well as planned maintenance at other facilities, and delayed restarts at some coal-based units.

- Combined with a demand recovery, spurred on by increase polyester operating rates, the decline in port inventories is expected to accelerate through September and October, keeping prices firm.

- The MEG forward curve remains in contango reflecting improved near-term fundamentals. Jan’23 contract prices are now at around 30 RMB/mt premium to current month prices.

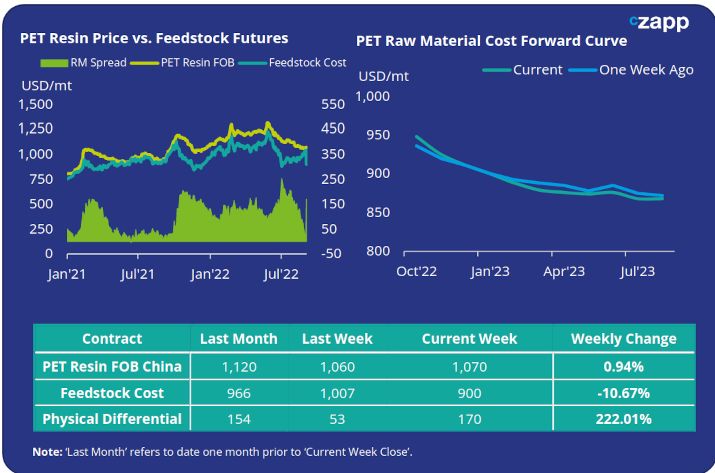

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices remained relatively flat through last week averaging USD 1070/tonne by Friday.

- With the September PTA contact now expired, the calculated physical differential moves to the now main Jan’23 contract.

- As a result, the PET resin export spread has widened versus the previously higher priced Sept’22 contract, to USD 170/tonne on Friday.

- The PET resin raw material forward curve remains backwardated through the remainder of H1’22, flattening into Q1’23. The Jan’23 contract shows a USD 80/tonne discount over the current month.

Concluding Thoughts

- With the expiry of the September contract and backwardation in future prices, PET producers are expected to experience lower raw material costs going into Q4’22.

- With PET resin availability expected to lengthen through September and October, lower raw material costs will enable PET producers to price more aggressively.

- Although we have seen some stability in PET export prices in recent weeks, our forward view is for renewed pressure on the physical PET resin price.

- The addition of new and restarted capacity coming onto the market in Q4’22 is also expected to add weight to this downward pressure.

- Despite current buyer hesitancy, forward interest is still expected to build through Q4, as freight rates continue to fall and export prices move lower.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

PET Resin Trade Flows: Brazil seeks to Export More PET to North America

What Europe’s Deepening Energy Crisis Means for PET Resin

Plastics and Sustainability Trends in August 2022

European PET Market Stumbles as Producers Left Blind on Costs