Insight Focus

- Monthly Chinese PET exports continued ease following May peak.

- Europe records another quarter of high import volume, as imports out-compete domestic production.

- Stable Brazilian supply boosts export volumes, targeting shortfalls in Mexico and US.

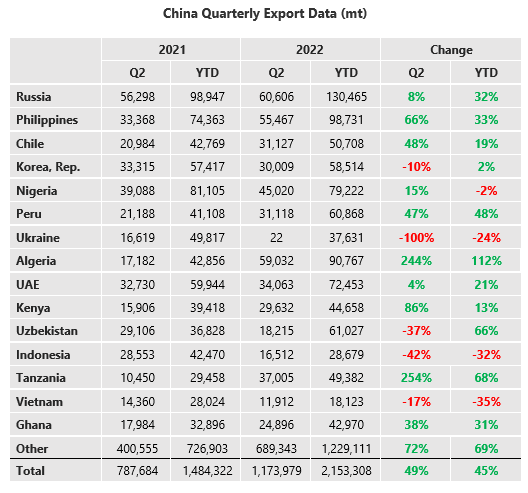

China’s Bottle-Grade PET Resin Market

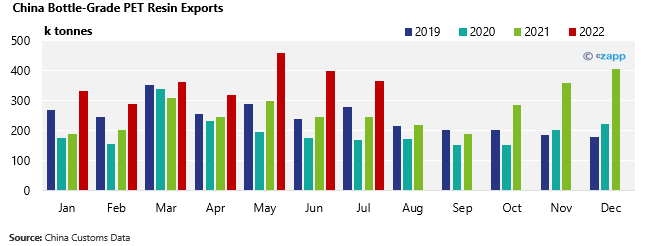

Monthly Exports

- Chinese bottle-grade PET exports stood at 363 kt in July, down 9% on the previous month as export volumes continue to ebb downwards following May’s record high, yet July volume was still up over 48% year-on-year.

- Peru was the largest destination for Chinese PET resin exports in July with around 29k tonnes, jumping up from just 4.7k tonnes the previous month, and 5.6k tonnes in July 2021.

- The intermittent arrival of large breakbulk vessels is the primary cause in swings in monthly Latin American volumes.

- PET resin flows to Russia, China’s second largest export market in July, were relatively robust despite the country’s economic pressures, down just 2.5% from June, but up over 17% year-on-year.

- Exports to the UAE continued to perform well at over 21k tonnes in July, a monthly increase of 29% and an increase of over 132% year-on-year.

- Sizeable increases in exports to the UAE in June and July coincided with preparations for Eid in July, the regional peak-season.

- Exports to Egypt also surged in July, whilst monthly volumes to other African destinations, including Algeria, and Ghana, slumped 49% and 36% respectively.

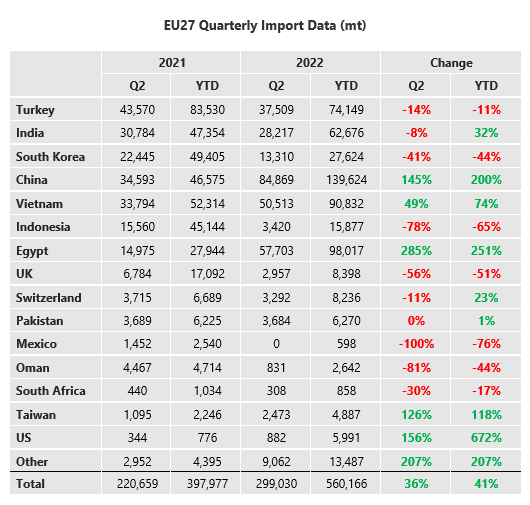

EU Bottle-Grade PET Resin Market

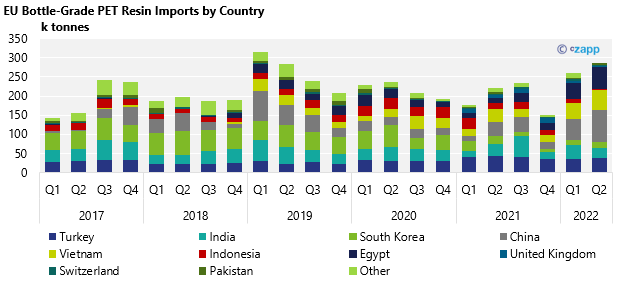

Quarterly Imports

- EU-27 bottle-grade PET imports totalled 299k tonnes in Q2’22, up 14.5% from Q1’22 and 36% year on year.

- Top 5 sources of origin were China, Egypt, Vietnam, Turkey, and India.

- China was the largest source with nearly 85k tonnes of imports, representing over 28% of total EU-27 imports in Q2’22, and an increase of 55% from Q1’22.

- Imports from China, Egypt and Vietnam have seen the largest increases through the first half of this year, up 200%, 251%, and 74% respectively.

- Whilst other origins, including Turkey, South Korea, and Indonesia, are down 11%, 44%, and 65% respectively in the first six-months of 2022 versus the same period a year earlier.

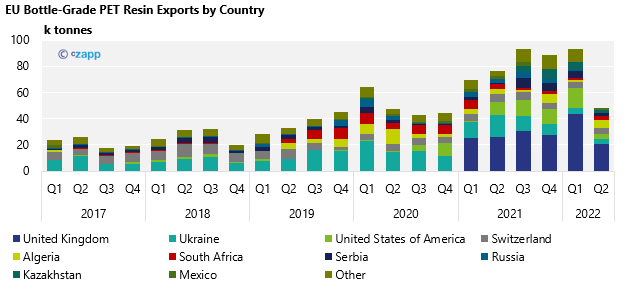

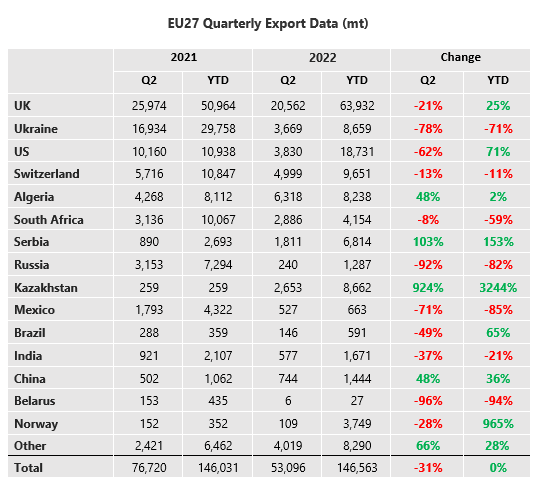

Quarterly Exports

- Extra-regional EU-27 PET resin exports (HS Code 390761) fell sharply in Q2, down 43% versus the previous quarter to around 53k tonne.

- The UK was the largest destinations for PET resin out of the EU block, followed by smaller volumes to Algeria, Switzerland, and the US.

- Monthly exports to the UK fell by 53% to 20.6k tonnes, whilst volumes to the Algeria stood at 6.3k tonnes, and just 3.8k tonnes to the US.

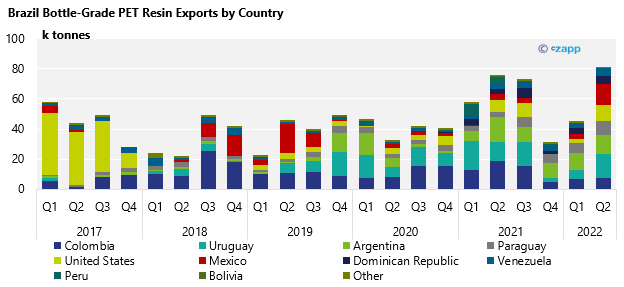

Brazil’s Bottle-Grade PET Resin Market

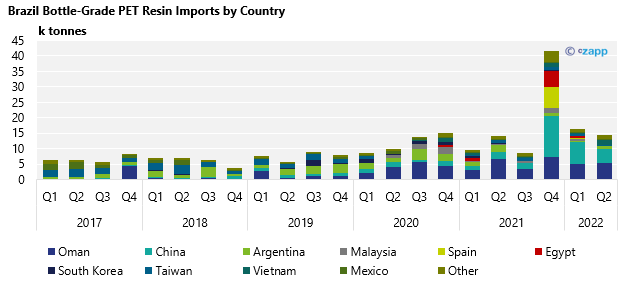

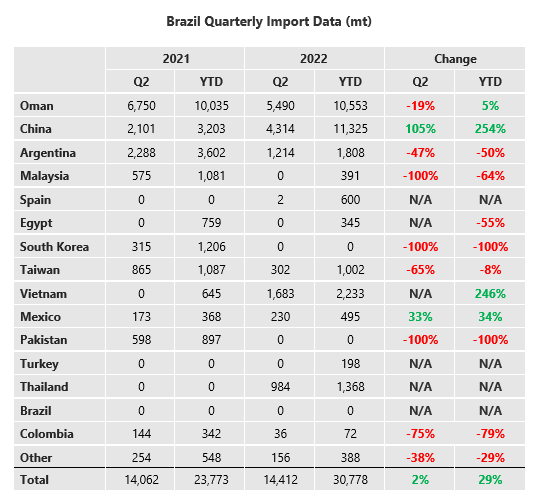

Quarterly Imports

- Brazilian imports continued to ease to around 14.4k tonnes in Q2’22, a 12% decrease on the previous quarterly and just 2% above Q2’21.

- Despite stable domestic Brazilian and Argentinian supply through Q2, import volumes remain elevated against historical pre-COVID levels.

- Oman moved ahead of China as the largest supplier of imports in Q2. Over 38% of Brazilian imports were from Oman, whilst a further 30% came from China.

- The acquisition of the Omani PET resin producer OCTAL by the Alpek Group is likely help cement Oman future flows into the region.

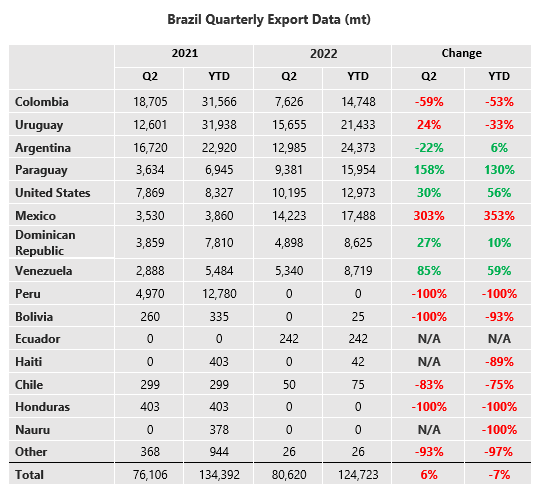

Quarterly Exports

- With domestic production stabilised, exports again rose sharply in Q2’22 to around 81k tonnes, up 83% on the previous month and a 6% year-on-year increase.

- Largest Q2’22 destinations by volume included Uruguay, Mexico, Argentina, and the US, regions where supply has remained tight through H1’22.

- Exports to Uruguay, Mexico, and the US all leapt in Q2’22, increasing 171%, 336%, and 267% respectively.

- However, H1’22 to Uruguay were down 33% compared to H1’21, with the largest H1 change in volume being to Mexico.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com