Insight Focus

- PTA and MEG futures rebounded on improved demand prospects and lower inventories.

- PET resin export orders fall sharply in August as near-term demand slows.

- PET export spreads narrow further with prices expected to continue to weaken.

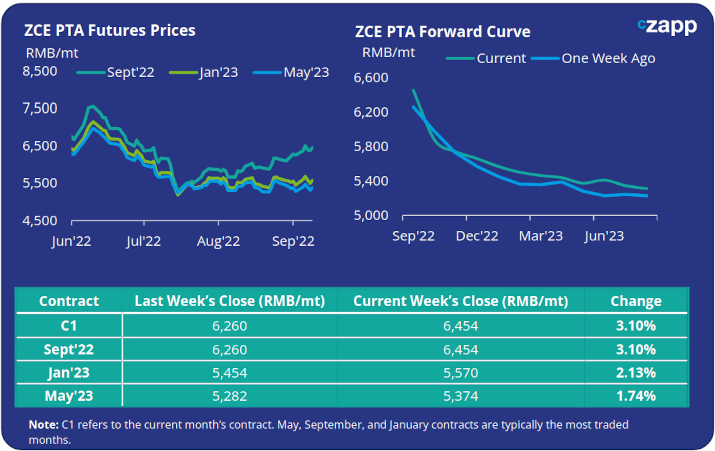

PTA Futures and Forward Curve

- The PTA Futures market closed higher last week, pushed higher by rising costs and steadily improving downstream fundamentals.

- Textile mills are now operating at typical seasonal levels; the inventory burden that has dampened fresh polyester demand is now expected to slowly reduce through September and October.

- If polyester demand improves and PTA production remains constrained by tight PX availability, inventories may lower further, supporting PTA margins.

- The PTA forward curve has steepened in backwardation over the last week with the Jan’23 contract at over RMB 800/tonne discount to the current month.

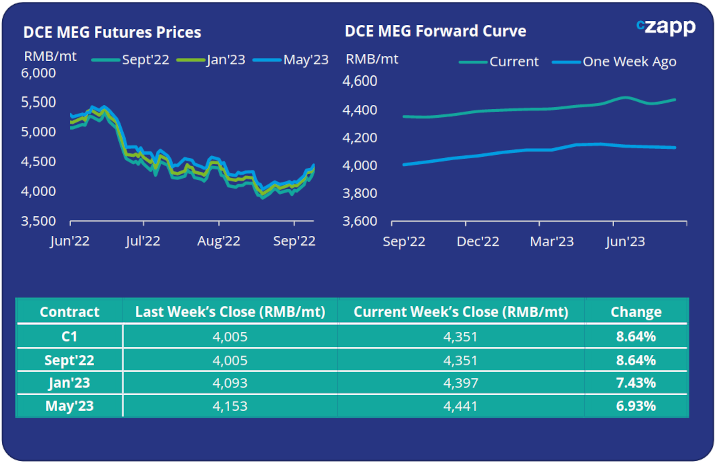

MEG Futures and Forward Curve

- MEG Futures rebounded strongly last week, buoyed by falling inventories and rising polyester operating rates.

- Port inventories that have hamstrung the MEG market through the summer, have fallen sharply since mid-August and may further decrease as typhoon Hinnamnor delays new arrivals.

- Expectations are now for a demand recovery through September and October as polyester sector heads into peak season. However, this will be dependant on a sustained decrease in inventory levels.

- The MEG forward curve remains in contango reflecting expectations of a pick-up in downstream demand through H2’22. Jan’23 contract prices are now at around 90 RMB/mt premium to current month prices.

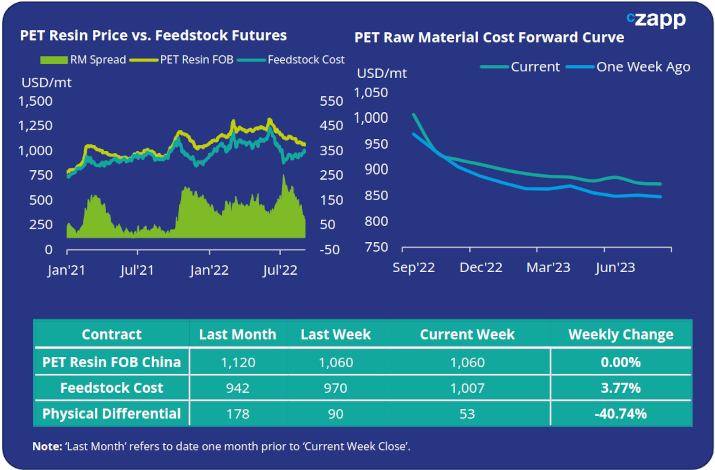

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices remained flat through last week averaging USD 1060/tonne by Friday.

- However, continued recovery in feedstock future prices has narrowed the raw material spread further.

- The weekly average PET resin–raw material physical differential decreased USD 40 from the previous week to USD 71/tonne. By Friday, the daily spread had fallen further to just USD 53/tonne.

- The PET resin raw material forward curve remains backwardated through Q3, with more bearish short-term prospects before beginning to flatten through Q4’22. The Jan’23 contract shows a USD 107/tonne discount over the current month.

Concluding Thoughts

- New bottle-grade PET export orders fell sharply in August with the physical differential to raw material futures at its lowest point since Oct’21.

- Demand has been slowed as key Northern-hemisphere markets move into the off-season, and most buyers find themselves with ample coverage for H2’22.

- The strong US Dollar has also eroded the competitiveness of USD denominated PET exports into many of these markets, erasing any edge over domestic production in local currency.

- However, with freight rates continuing to fall and the Chinese PET export forward curve looking relatively flat through H1’23, pre-buying and forward interest is expected to build, albeit later than last year.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

What Europe’s Deepening Energy Crisis Means for PET Resin

PET Supply Chains Groan Under Global Heatwaves

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs