Insight Focus

- PTA and MEG futures continue to post-modest weekly gains as inventories decline.

- COVID controls continue to constrain polyester demand prospects as the sector enters its peak season.

- PET export spreads narrow further with prices expected to continue to weaken.

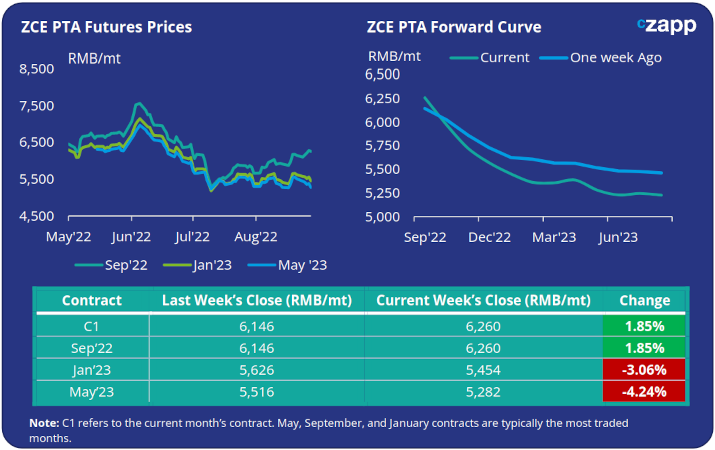

PTA Futures and Forward Curve

- Current month PTA Futures continued to show gains last week, although the most actively traded Jan’23 contract fell by over 3%, reflective of better near-term prospects.

- PTA supply continues to be restricted by tight PX availability and PTA shutdowns. PTA inventories at bonded futures warehouses have also now fallen to the lowest levels since last October.

- Although downstream polyester demand remains subdued, impacted by COVID controls and economic concerns, PTA demand is expected improve through Q3 as the sector enters its peak season.

- The PTA forward curve has steepened in backwardation over the last week with the Dec’22 contract close to a RMB 690/tonne discount to the current month.

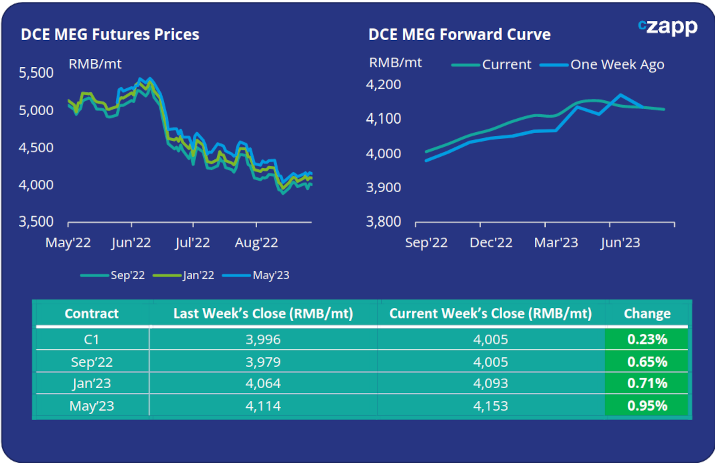

MEG Futures and Forward Curve

- MEG Futures remained rangebound this week, with minimal increases to the current Sep’22 contract.

- Whilst MEG port inventories have fallen, following previously reported production cuts, downstream polyester demand has remains lacklustre.

- Although polyester production is expected to increase as the sector moves into peak season, and power restrictions ease, consumer demand for textiles and clothing continues to be hamstrung by fresh COVID lockdowns and economic headwinds.

- The MEG forward curve remains in contango reflecting expectations of a pick-up in downstream demand through H2’22. Jan’23 contract prices are now at around 90 RMB/mt premium to current Sep’22 prices.

PET Resin Export – Raw Material Spread and Forward Curve

- Chinese PET resin export prices weakened slightly last week averaging USD 1060/tonne by Friday, a weekly decrease of USD 20.

- However, a modest recovery in Sep’22 PTA and MEG future prices has continued to see spreads narrow on rising future feedstock costs.

- The weekly average PET resin–raw material physical differential decreased USD 20 from the previous week to USD 111/tonne. By Friday, the daily spread had fallen further to just USD 91/tonne, the lowest level since mid-June.

- The PET resin raw material forward curve remains slightly backwardated through Q3; The November contract shows a USD 45/tonne discount over the current month.

- The backwardated PET resin raw material forward curve has steepened over the last week, with feedstock futures facing declines through to year end. The current December contract shows a USD 82/tonne discount over the current month.

Concluding Thoughts

- Although Q3 PET resin exports remain over-sold, constraining near-term supply, the physical differential has eased through August.

- Producers have gradually reduced PET prices from being over-extended, following the sharp drop in raw material prices in June, bringing them back into range.

- Key Northern-hemisphere markets have also now moved into the off-season, adding weakness to demand outlook for the remainder of Q3.

- PET resin export prices are expected to continue to weaken, with the raw material forward curve showing a potential discount of over USD80/tonne by end of year on feedstock costs alone.

- Buyers are likely to now move to the side lines awaiting bargain prices later in Q4.

For PET hedging enquiries, please contact the risk management desk at MKirby@czarnikow.com.

For research and analysis questions, please get in touch with GLamb@czarnikow.com.

Other Insights That May Be of Interest…

What Europe’s Deepening Energy Crisis Means for PET Resin

PET Supply Chains Groan Under Global Heatwaves

Plastics and Sustainability Trends in July 2022

European PET Market Stumbles as Producers Left Blind on Costs