Is Biden’s Inflation Reduction Act (IRA) beneficial for US ethanol?

Early this month, the US passed a bill called the Inflation Reduction Act (IRA) which was top priority for US President Joe Biden. The goal of the bill is to reduce US deficit and make significant investments in healthcare, domestic energy production and manufacturing, and tackle climate change.

The law will allocate USD 369b out of its total allocation of USD 430b to direct investment in energy security, reducing carbon emissions and promoting innovation in the energy sector.

The ethanol sector has been given a small slice of the fiscal pie in the shape of USD 0.5 billion for E15 (15% ethanol) and E85 (85% ethanol) infrastructure. The US industry has long complained about the lack of service stations with higher ethanol blends. This prevented the US from overcoming the “blend wall” – the idea that it is not feasible for the US to blend more than 10% ethanol.

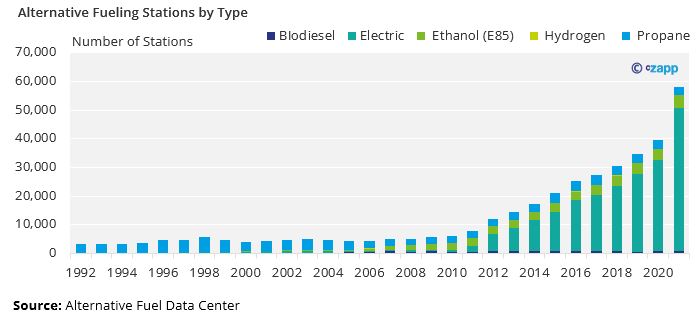

The stations offering E85 have increased in the past years as a result of car manufacturers building more flex-fuel vehicles (FFV). However, over the past decade the number of E85 pumps has risen by an average of just 6% a year. Meanwhile, electric service stations have risen 44% – more on that later.

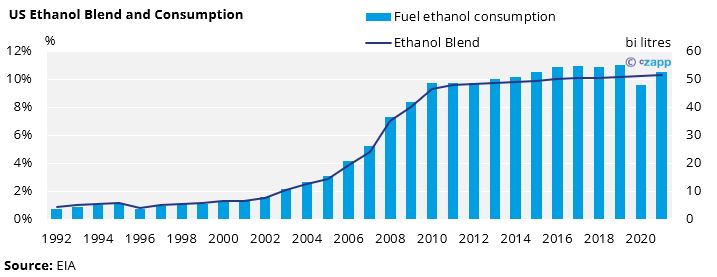

Despite the limited number of fueling stations and the ban on selling blends higher than E10 in the summer (due to smog) ethanol sales have been rising over the past decade. Ethanol sales last year totaled 52.8b litres, still 4% short of pre-pandemic levels.

If the US were able to increase the ethanol blend up to 15% as a result of the new law, then ethanol consumption would rise to 81b litres.

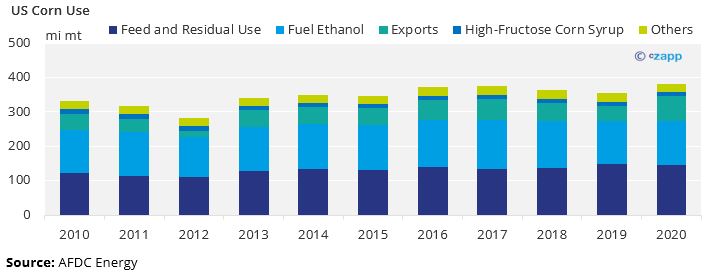

Currently the amount of corn used for ethanol production is the second highest on record, at 130m ton. If ethanol consumption were to rise to 81b litres, corn diverted to ethanol production would need to surpass 190m ton – making it the main use.

But how likely is this to happen? Although the law does offer the ethanol sector some benefits, it seems that its main focus as well as that of the administration is to shift the vehicle fleet towards electric.

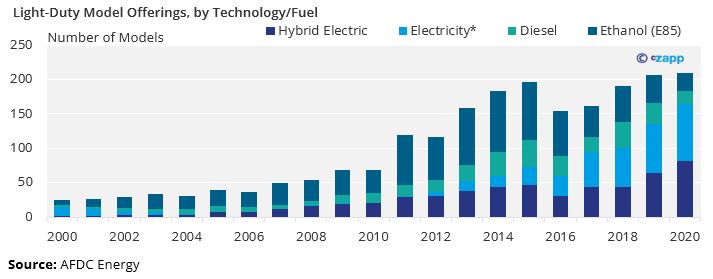

Even the car companies are investing more in electric technologies, with 83 models offered compared with 25 types of FFV.

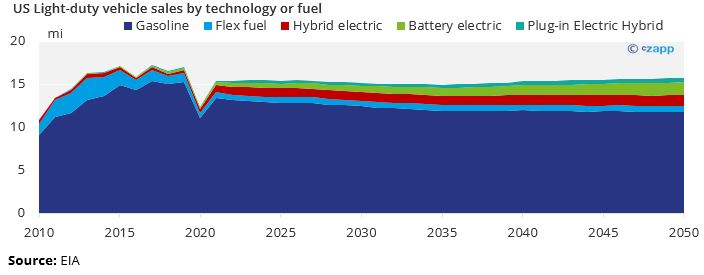

Additionally, the EIA (Energy Information Administration) forecasts that FFV sales will remain somewhat stagnant on the next 25 years, while electric sales should triple.

And yet, with all the move towards electric car technology, the EIA long term forecast still predicts that gasoline will remain the most prevalent fuel.

Even if the outlook for higher ethanol blends seems a bit dampened by the EIA 25 year forecast, with gasoline still expected to remain largely the main source of fuel ethanol consumption could rise on average 0.6% per year.

Other Insights That May Be of Interest…

Ask The Analyst: New Global Corn Trade Between China and Brazil

From ‘Climate What?’ to Taking Steps against Climate Change

Investors, Regulators Drive Carbon Labelling Agenda

Explainers That May Be of Interest…