Insight Focus

- China PET exports continue to surge following the easing of COVID restrictions in June.

- Taiwanese exporters increase focus on the US, with 32% of exports US-bound in Q2.

- US imports continue to post-multi-year highs, with over 50% from Mexico, Oman in Q2.

China’s Bottle-Grade PET Resin Market

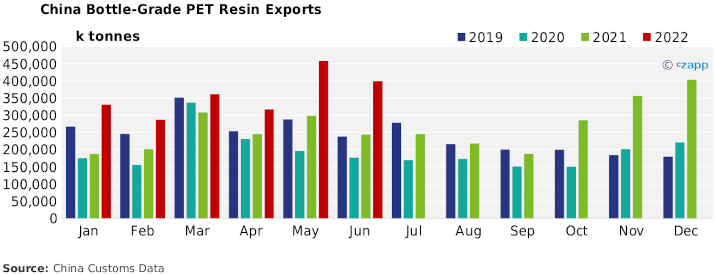

Monthly Exports

- Chinese bottle-grade PET exports hit over 399k tonnes in March, down 12.9% on the previous month, following the previous month’s record high, yet up an impressive 64% year on year.

- Throughput at Chinese ports has bounced back since COVID-19 restrictions were eased, enabling Chinese PET exporters to ramp up delivery.

- Major Chinese PET producers continue to report an oversold Q3, with full order books for August and September. As a result, export volumes are expected to remain high through Q3.

- Mexico was the largest destination for Chinese PET resin exports in June, recording over 26k tonnes, and more than double the previous month’s.

- PET resin flows to Russia have also begun to rebounded, increasing 125% on the month and 38% on the year.

- Exports to Algeria, traditionally a key export market for Chinese PET resin, remained robust in June at around 21k tonnes. Whilst volumes to UAE increased 32% in preparation for Eid in July.

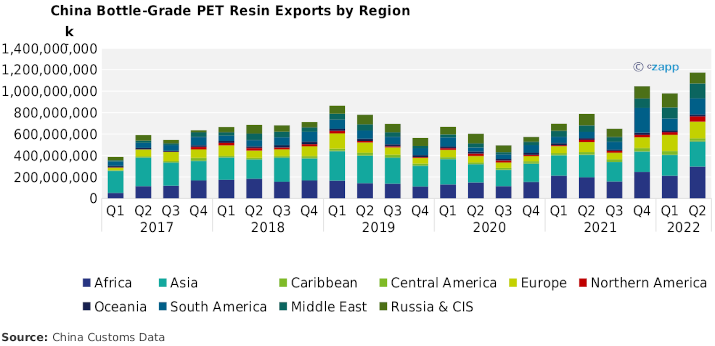

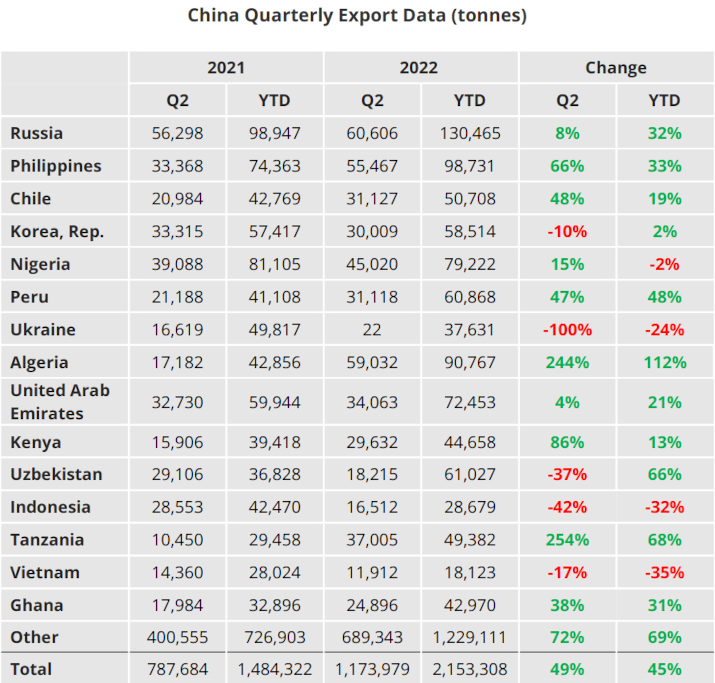

Quarterly Exports

- Looking at the latest full quarter, Chinese bottle-grade PET resin exports totalled 1.17m tonnes in Q2’22, up 20% versus Q1 2022, and up 49% year on year.

- By region, North America and Africa experienced the largest increases in quarterly exports in Q2, up 102% and 41%on the year, respectively.

- By contrast, volumes to Central America and Russia fell 32% and 22%, respectively.

Taiwan Bottle-Grade PET Resin Market

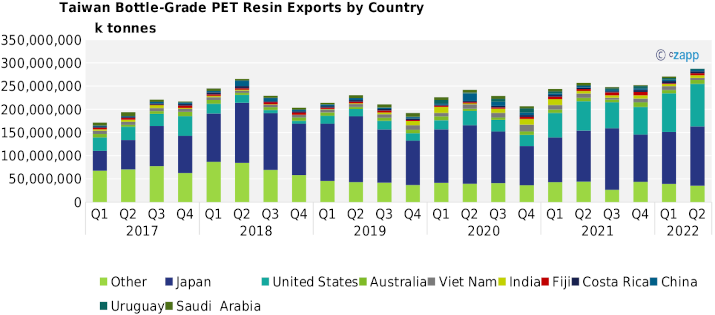

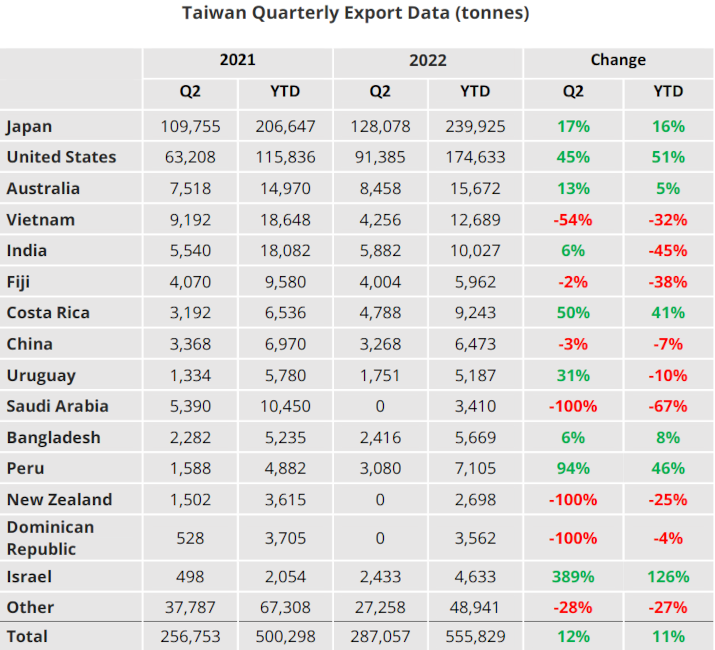

Quarterly Exports

- Taiwanese PET resin exports totalled 287k tonnes in Q2, up 6% on the previous quarter and 12% year on year.

- Japan remained the largest destination for Taiwanese resin, recording over 128k tonnes in Q2, up 14.5% from Q1.

- Exports to the US continued to take a larger share in Q2, with volumes growing to over 91k tonnes, around 32% of total Taiwanese exports.

- Exports to other countries showed sizeable variations due to smaller trade volumes.

- For example, exports to Vietnam and Peru fell 50% and 24%. respectively, whereas volumes to India and Australia jumped 42% and 17%, respectively.

- The US and Japan made up over 76% of Taiwan’s total PET resin exports in Q2.

US Bottle-Grade PET Resin Market

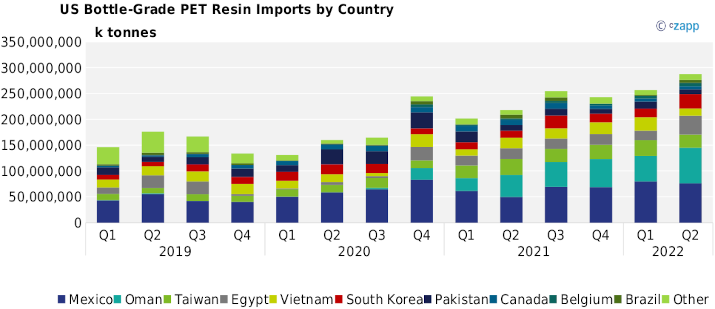

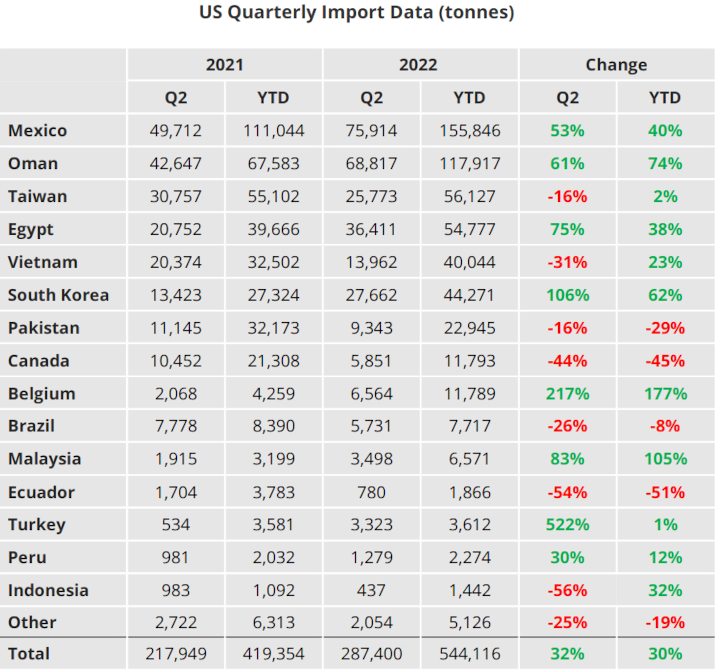

Quarterly Imports

- US bottle-grade PET imports totalled 287k tonnes in Q2’22, up 12% on the previous quarter and 32% year on year.

- US demand for PET resin has remained strong through H1, limiting inventory build and resulting in multi-year high US imports.

- Origins with the greatest volumes in Q2 included Mexico, Oman, Egypt, and South Korea.

- Whilst traditional flows from Mexico fell 5% from the previous quarter, volumes from Oman, Egypt, and South Korea surged, up 40%, 98%, and 67% respectively.

- Flows from Oman have now hit record levels following Alpek’s acquisition of the Omani PET resin producer OCTAL.

- These origins also took market share away from traditional Asian sources, including Taiwan and Vietnam, with volumes from these countries falling 15% and 47% respectively in Q2.

- Continued strong summer demand is expected support high import levels in future month’s trade figures when available.

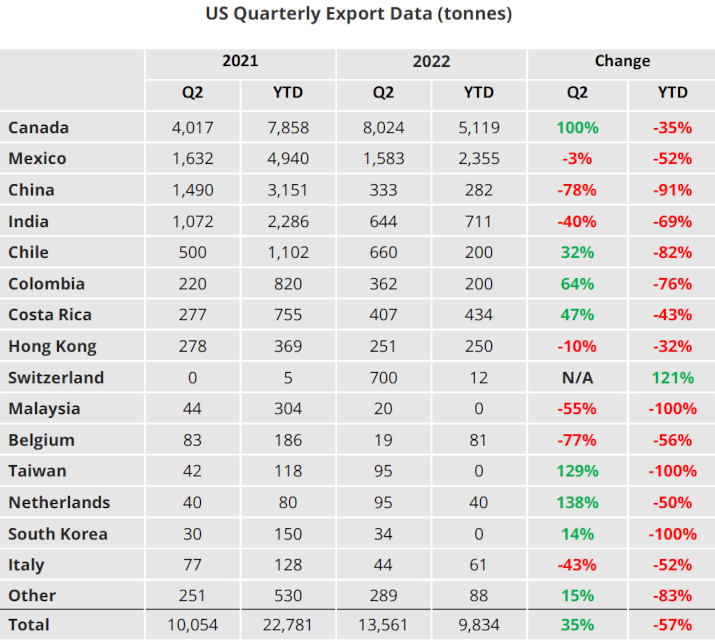

Quarterly Exports

- US bottle-grade PET exports totalled 13.6k tonnes in Q2’22, up 38% on the previous quarter and 35% year on year.

- As is traditional, over 71% of the total export volume remained with North America with Canada the largest destination.

- Around 8k tonnes was exported to Canada in Q2, accounting for the bulk of the increase, up 57% on the previous quarter. Whilst a further 1.6k tonnes went to Mexico

- Given the continued strong summer demand exports may remain subdued into the next quarter.

Data Appendix

If you have any questions, please get in touch with GLamb@czarnikow.com.