Insight Focus

- The production surplus in 2022/23 has grown.

- Good water availability in India gives confidence in another strong crop year.

- The EU+UK is facing a severe heatwave and drought which adds downside risk to the upcoming crop.

2022/23 at a Glance…

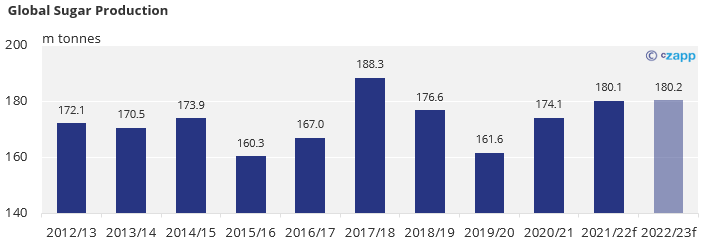

Global Production

The world will produce 180.2m tonnes of sugar in 2022/23, slightly larger than 2021/22 and the second largest on record. This is 1m tonnes higher than our forecast in the July Statshot.

We have increased our forecast for India following increased cane planting on marginal land and with reservoirs filled to a high level, this offsets a reduced forecast for the EU due to the recent heatwave.

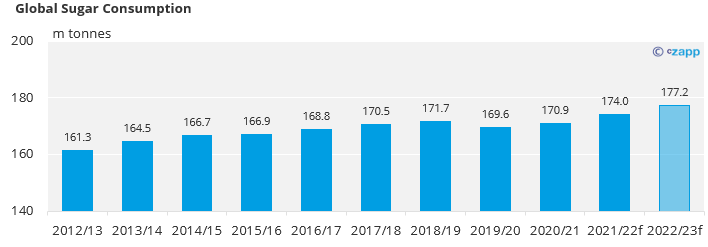

Global Consumption

In 2022/23 we will consume over 3m tonnes more sugar year-on-year than in 2021/22. This is in part due to more economies returning to pre-Covid consumption and through an increase in population.

Consumption in China will also rebound by over 500k tonnes following demand dampened by COVID lockdowns in 2021/22.

This global forecast is 100k higher than the last update, following minor revisions to a few countries.

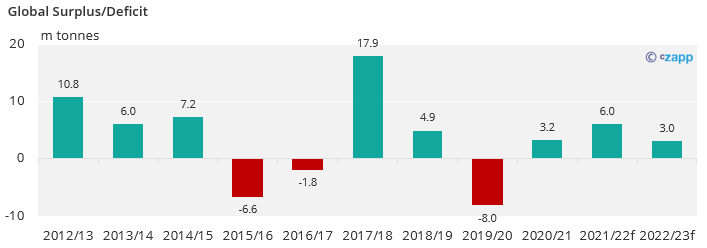

Small Production Surplus

We now expect a small surplus of 3.0m tonnes to form in 2022/23, up from 2.3m last month.

Growth in consumption means this is around half the size of the surplus observed in 2021/22, despite similar production.

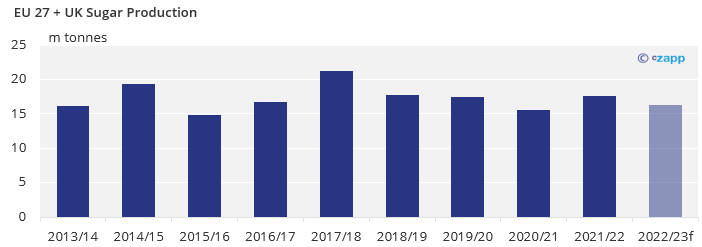

EU+UK Production Update

We think that the EU plus the UK will produce around 16.4m tonnes of sugar in the upcoming 2022/23 crop. This is around 1m tonnes lower than the previous year.

The recent heatwave and drought felt across Europe is partly responsible for this downturn. Yields in Italy, Spain, and Romania are forecast to be well below average.

If there aren’t meaningful rains in the next few weeks, it is likely that our production forecast will have to be lowered further.

The other aspect of this reduction is due to falling acreage through competition from other crops, and increased input costs.

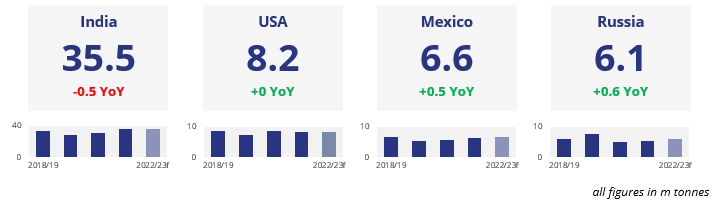

Other Producers at a Glance…

If you have any questions, please get in touch with us at Will@czapp.com

Other Insights That May be of Interest…

Farmer Diaries (UK): Sugar Beet and Maize Struggle for Water

Freight Price Likely to Reverse

Explainers That May be of Interest…