Insight Focus

- US August soybean meal futures surge as delivery period starts.

- US soybean meal industry’s output expansion is being absorbed domestically.

- Brazil making major difference to global trade flows, but US meal still needed.

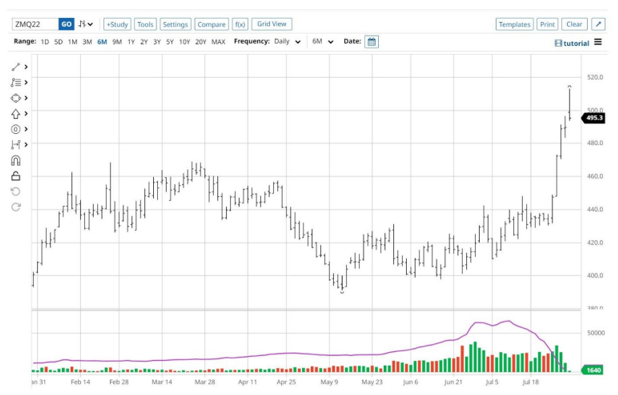

August soybean meal futures rallied $85 a short ton this week as the contract entered its delivery period and the futures necessarily caught up with the much higher physical price of spot soybean meal.

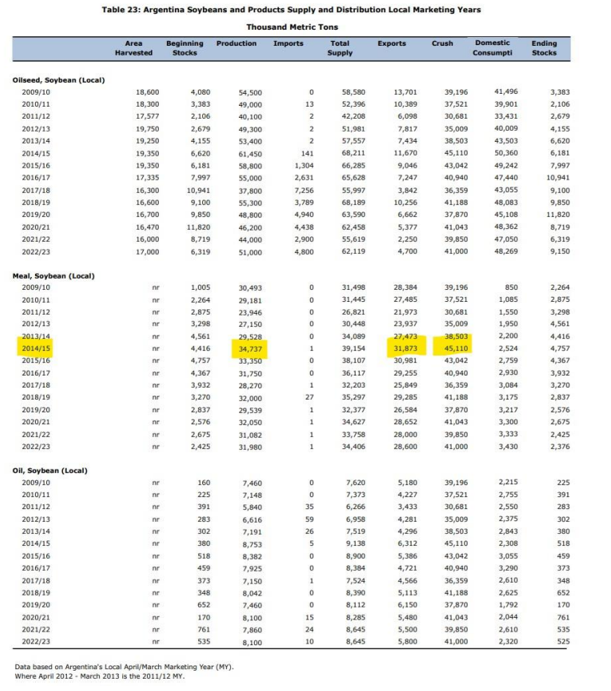

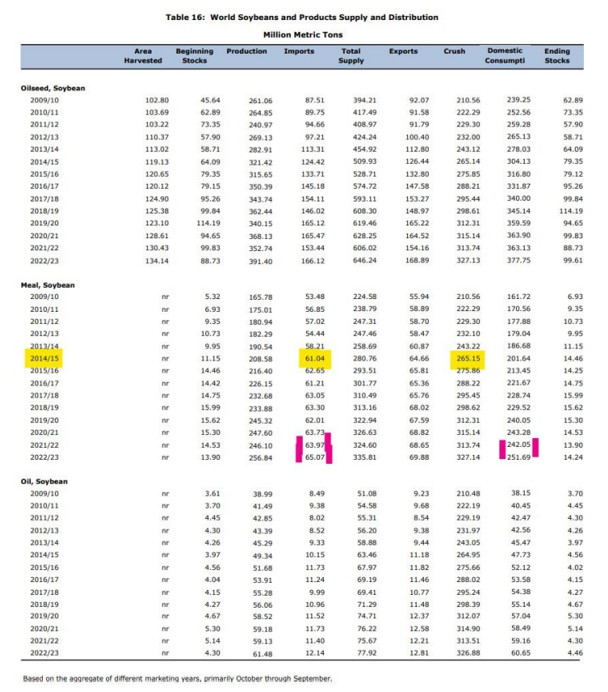

All the while the US soybean processing industry continues expanding, producing 7m tonnes more since Argentina’s 2014 peak, but domestic consumption (green highlights) has absorbed most of this, with exports up only about 1m tonnes.

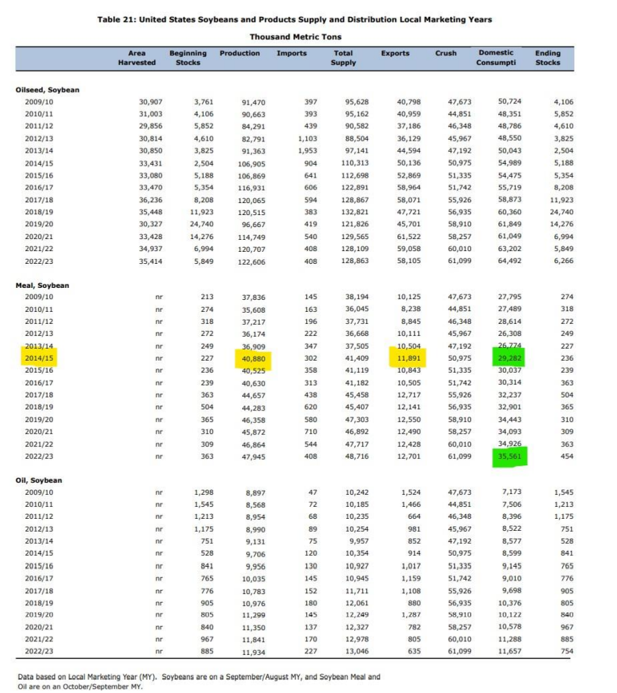

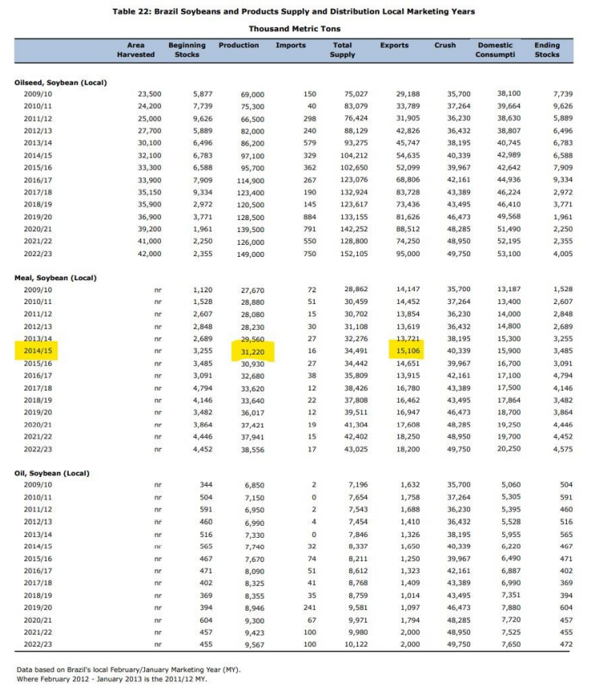

Daniele Siqueira provides an insightful look into Brazilian meal exports, making a real difference in available global supplies. Meal production has expanded over 7m tonnes since peak Argentina, the same as the US, but exports have increased 3m tonnes compared with the US’ 1 m.

The USDA forecasts global consumption growth of soybean meal of 9.5m tonnes in the upcoming year (neon red highlights) with over 1m tonnes coming from imports.

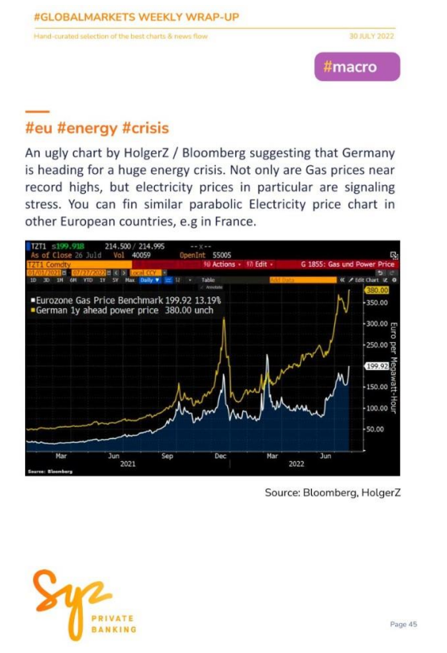

The global protein meal markets are quickly understanding that without Argentine production (farmers not selling soybeans due peso crisis, labour busy protesting instead of loading vessels) and with the potential for European import expansion the US soybean processing industry probably needs to provide more to the world from an already tight domestic market. As Daniele points out, Brazil will help but the US, soon to enter harvest, must provide the largest part of any increase in global imports. (Thank you to Valerie Noel of Syz Private Banking; the below is from their excellent weekly summary posted to LinkedIn).

For further information, please email waltercronin@msn.com.

Other Insights That May Be of Interest…

Have the Indicators the Supply Chain Should Monitor Changed?

Brazil’s Corn Farmer Selling Picks Up, But Record Production Still Weighs on Prices